Permian pipeline operators staying ahead of capacity constraints

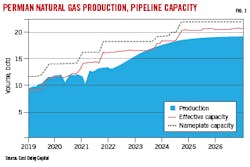

Both natural gas and crude oil production in the Permian basin have returned to nearly pre-pandemic levels and are expected to continue to grow. Despite this expansion, however, transmission pipeline constraints out of the region are not expected until 2027 and 2025, for gas and crude respectively.

Permian basin marketed natural gas production reached a new high of 16.7 bcfd in 2021 and the US Energy Information Administration (EIA) forecasts an additional 2.1 bcfd in 2022 and 1.7 bcfd in 2023. Most Permian production is associated gas produced from oil wells, with operators basing rig deployment and other capital expenditure decisions on crude oil markets as opposed to gas. Given this, capacity constraints have become a worry.

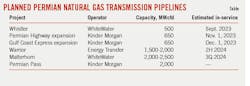

Three new pipeline projects brought online in 2021—Kinder Morgan Energy Partners LP’s Permian Highway pipeline, WhiteWater Midstream LLC’s Whistler pipeline, and Summit Midstream Partners’ Double E Pipeline—added 5.5 bcfd of capacity from the region, bringing the total takeaway (including local consumption) to 17.5-18 bcfd. A combination of expansions to these systems and additional newbuild projects will add more than 5 bcfd of capacity by end-2024 (see Table), pushing constraints beyond 2027 (Fig. 1).

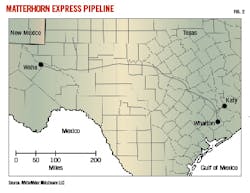

Two of the more recent project announcements were for EnLink Midstream LLC’s 2.5-bcfd Matterhorn Express pipeline, scheduled to be complete by fourth-quarter 2024, and a 600-MMcfd expansion of Kinder Morgan’s Gulf Coast Express pipeline, set for end-2023 completion.

Matterhorn

WhiteWater, EnLink, Devon Energy Corp., and MPLX LP reached final investment decision on Matterhorn Express earlier this year after having secured sufficient firm transportation agreements with shippers (OGJ Online, May 19, 2022). The pipeline will use 490 miles of 42-in. OD pipe running from Waha, Tex., to the Katy area near Houston (Fig. 2).

Supply for Matterhorn Express will come from multiple upstream connections in the Permian basin, including direct connections to gas plants in Midland basin through a 75-mile lateral and connection to the 3.2-bcfd Agua Blanca pipeline, a joint venture between WhiteWater and MPLX.

WhiteWater expects Matterhorn to enter service in third-quarter 2024, pending regulatory approvals.

Kinder Morgan

Kinder Morgan’s proposed 2-bcfd Permian Pass pipeline project, also delivering to interconnections near Katy, Tex., seems to have been deemphasized by the company for the time being in favor of expansions to its Permian Highway and Gulf Coast Express systems. In its first-quarter 2022 earnings conference call, however, Kinder Morgan noted that the expansions would fill up quickly and that greenfield capacity would be needed in 2026, targeting an early-2023 final investment decision (FID) for Permian Pass.

Even before the earnings call, in April 2022, Kinder Morgan had launched a binding open season to solicit commitments for a 650-MMcfd Permian Highway expansion, supported by a foundation shipper for half of that capacity. The project will involve compression expansions to increase gas deliveries from the Waha area to multiple mainline connections, Katy, and various US Gulf Coast destinations. A positive final investment decision to proceed was made after the JV secured binding firm transportation agreements for all available capacity. In a June 29 release, Kinder Morgan said the expansion will increase PHP’s capacity by about 550 MMcfd. Pending the timely receipt of required approvals, the target in-service date is Nov. 1, 2023.

Permian Highway is jointly owned by subsidiaries of Kinder Morgan Inc., Kinetik Holdings Inc., and ExxonMobil Corp., with interests of 26.7%, 53.3%, and 20%, respectively.

The next month, Kinder Morgan held an open season to solicit commitments for a 570-MMcfd expansion of Gulf Coast Express. The project, like Permian Highway, will involve primarily compression expansions, but in Gulf Coast Express’ case Permian gas will be delivered to South Texas destinations. Kinder Morgan has targeted an in-service date of Dec. 1, 2023, pending customer commitments.

The pipeline is jointly owned by subsidiaries of Kinder Morgan (34%), DCP Midstream LP (25%), an affiliate of ArcLight Capital Partners LLC (25%), and Kinetik Holdings (16%). Kinder Morgan Texas Pipeline operates both Permian Highway and Gulf Coast Express.

Warrior

Energy Transfer LP’s 260-mile Warrior pipeline (1.5-2 bcfd) would carry gas along a more northerly route towards interconnects southwest of Ft. Worth, Tex., with its own infrastructure for continued transport to the Gulf Coast, perhaps eventually including its planned 15.3-million tonne/year Lake Charles LNG plant in Louisiana via the Carthage hub. Lake Charles LNG is expected to begin deliveries as early as 2026.

Plans for Warrior include a combination of repurposing underutilized pipe and building loops within existing right-of-way. The company noted in its first-quarter 2022 earnings presentation that, given the proposed route and its ability to use existing assets, it could complete construction within 2 years of reaching FID.

Whistler

Whitewater announced in May 2022 that it would be expanding its Whistler pipeline by 500-MMcfd, installing three new compressor stations to boost capacity to 2.5 bcfd. The expansion is scheduled to be in service by September 2023.

Whistler runs 450 miles from the Waha header to Agua Dulce hub, providing access to South Texas end-users and LNG infrastructure. It’s owned by a consortium that includes MPLX and a joint venture of Stonepeak Infrastructure Partners LP and West Texas Gas Inc.

Crude

Volumes are also rising on crude oil transmission pipelines out of the Permian basin. Enterprise Products Partners first-quarter 2022 crude pipeline volumes rose to 2.2 million b/d, up 16% year-on-year. The company made particular note in its first-quarter 2022 earnings of increased volumes on its more than 1.3-million b/d Midland-to-ECHO system, connecting Permian production to its Enterprise Crude Houston (ECHO) storage terminal.

Flows on EPIC Midstream LLC’s crude pipeline between the Permian and Corpus Christi, Tex., have also grown since mid-2021, reaching more than 550,000 b/d, a roughly 200,000-b/d increase.1

Magellan Midstream Partners, meanwhile, is reconsidering plans it floated late-2021 to convert its 275,000-b/d Longhorn crude pipeline to either natural gas or refined products service. Longhorn runs from Crane, Tex., in the Permian basin to crude oil terminals near Houston.

Total oil output from the Permian, both conventional and unconventional, is forecast to grow by almost 1 million b/d in 2022, according to Rystad Energy, jumping to 5.6 million b/d from 4.7 million b/d, before climbing further to around 6.5 million b/d in 2023.2

Even with rising production and pipeline utilization, however, constraints on crude oil transmission out of the Permian are not expected before 2025.

References

- Ferguson, J., “Runnin’ Down a Dream – EPIC Crude Pipeline Nears Full Utilization,” RBN Energy LLC, June 1, 2022.

- Erlingsen, E., “Permian to the rescue: Core US basin’s oil production growth to outpace rivals this year and next,” Rystad Energy, May 31, 2022.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.