Central Petroleum, AGIG advance Amadeus-Moomba pipeline plan

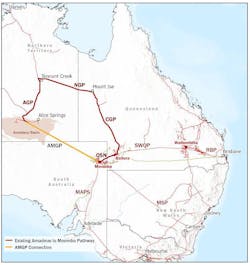

Central Petroleum Ltd., Brisbane, signed a memorandum of understanding with Australian Gas Infrastructure Group (AGIG) and Macquarie Mereenie Pty Ltd. to move towards a final investment decision for construction of the proposed Amadeus basin to Moomba gas pipeline.

The MoU provides for progression to FID and includes a foundation gas transportation agreement with an initial proposed gas transportation tariff structure, provision of gas storage services on the pipeline and other foundation shipper entitlements.

Central Petroleum currently supplies gas from its three Northern Territory fields (Mereenie, Palm Valley, and Dingo) to customers in the Northern Territory and to Mt Isa in Queensland.

A pipeline direct from the Amadeus to Moomba is less than half that distance which would mean lower gas transport costs.

Currently, the company must transport gas 2,200 km via Mt Isa to the Moomba hub in South Australia to sell its gas into the Australian east coast market.

The Amadeus to Moomba gas pipeline (AMGP) is planned to be 950 km long and up to 16 inches in diameter with a free-flow capacity of 124 terajoules/day (45 petajoules/year). The capacity would be greater if compression is installed.

The project has completed front-end engineering and design phase as the subject of a firm offer by AGIG under the North East Gas Interconnect process conducted in 2015. A final investment decision is expected in second-half 2021 which would enable AGIG to begin construction in 2022 and bring the project on stream in early 2024.

Central Petroleum says its Amadeus fields have about 200 petajoules of uncontracted conventional gas reserves which can be sent to Moomba via the new pipeline.

In addition there is third party uncontracted gas reserves that could also provide foundation volumes to supply the east coast market.

Central plans to increase production capacity from its Amadeus basin fields to 80 terajoules/day for delivery to the proposed pipeline. This production capacity can be increased by accelerating the drilling of development wells and debottlenecking or expanding existing production facilities at the three fields.

The company also plans to drill three exploration and two appraisal wells in 2021 aiming to mature 100 petajoules of 2C resources and 590 petajoules of prospective gas resources.

AGIG is owned by the Hong Kong-based CKI Group.