OGJ Newsletter

Hydraulic fracturing foe gains clout in House

The powerful US House Committee on Energy and Commerce has a new leader who has consistently opposed operations crucial to the production of natural gas from unconventional reservoirs.

Henry A. Waxman (D-Calif.) succeeded in a bid, launched the day after the Nov. 4 general election, to unseat John Dingell (D-Mich.), chairman since 1981 and the longest-serving member of Congress.

Waxman, a supporter of aggressive environmental causes, is a persistent foe of hydraulic fracturing, a completion technique applied to wells drilled into low-permeability reservoirs such as shales and coalbeds (OGJ, Nov. 17, 2008, p. 20).

In the last session of Congress, Waxman was chairman of the House Committee on Oversight and Government Reform. In a hearing of that committee he called hydraulic fracturing “a dangerous practice.”

He has criticized a provision of the Energy Policy Act of 2005 that exempted hydraulic fracturing from federal regulation under the Safe Drinking Water Act.

The completion method, which producers have used for nearly 60 years, is regulated at the state level.

A more immediate issue before the energy committee in the next session of Congress, however, will be climate change.

A bill drafted by Dingell and Rep. Dick Boucher (D-Va.) and published in October sets reduction targets for greenhouse gas emissions in line with those espoused by President-Elect Barack Obama.

But the draft has drawn criticism from environmental groups because of accommodations it makes to the auto and coal industries, which are important to Dingell and Boucher.

France outlines new renewable energies program

France’s Environment and Energy Minister Jean-Louis Borloo offered a “national plan for renewable energies” on Nov. 17. The plan sets aside, for the time being, any assessment of the European Union’s biofuels draft directive to bring the share of biofuels in transport to 10% by 2020.

The plan aims to bring to 23% the share of renewables in the energy mix by 2020. This corresponds to 20 million tonnes of oil equivalent and involves 50 different measures to develop biomass, wind, geothermal, hydro, sea energies, and especially solar energy, which is targeted to jump to 5,400 Mw in 2020 from 13 Mw in 2007–all of which is to take place in an environmentally safe way. To help achieve these targets, a €1 billion fund will be set up during 2009-11, and the tax credits will be extended to 2012.

Jean-Louis Borloo explained that the “change of model and the change of scale” is intended to go from an essentially carbon-based model to a totally decarbonized model “where each home, each company, and each community will become its own energy producer.”

Russia, Venezuela to form ‘strategic oil alliance’

Venezuelan President Hugo Chavez plans to enter into a strategic alliance with Russia aimed at developing his country’s oil industry, according to a senior government minister.

“It will be a strategic alliance between Petroleos de Venezuela SA (PDVSA) and an oil consortium of all the Russian firms, state and private, a large industrial conglomerate not just for production, but also for the entire matter of refining and industrialization,” said Venezuela Energy Minister Rafael Ramirez.

A strategic cooperation agreement was to be signed on Nov. 26 during Russian President Dmitriy Medvedev’s visit to Caracas, Ramirez said, noting that Moscow also is pursuing a policy “of greater cooperation” with the Organization of Petroleum Exporting Countries.

In November, Rosneft Chief Executive Officer Sergei Bogdanchikov said five of Russia’s largest oil and gas firms each have taken a 20% stake in the national consortium formed to develop heavy oil fields in Venezuela’s Orinoco River basin.

The consortium was registered on Oct. 8, Bogdanchikov said. In addition to Rosneft, the Russian group is comprised of Gazprom, Lukoil, TNK-BP, and Surgutneftegaz. PDVSA will have the controlling stake in the larger consortium announced by Ramirez, and the companies will complete formalities by next spring.

Russian Deputy Prime Minister Igor Sechin explained the rationale for the consortium with Venezuela.

“The consortium derives from practical considerations: crude produced at certain Venezuelan blocs is heavy, and it is necessary to build refineries capable of making commercial oil,” Sechin said. “Such refineries are rather expensive ($6-6.5 billion), and that is too much for one company.”

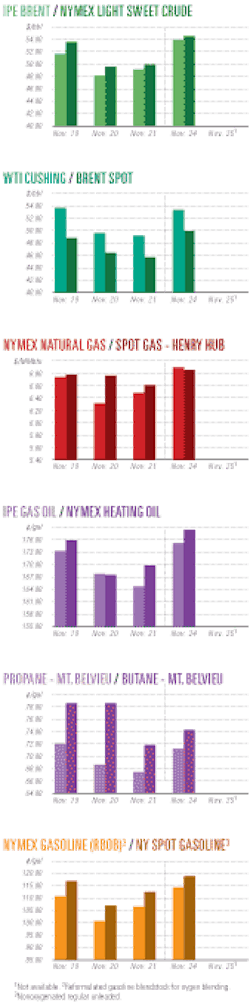

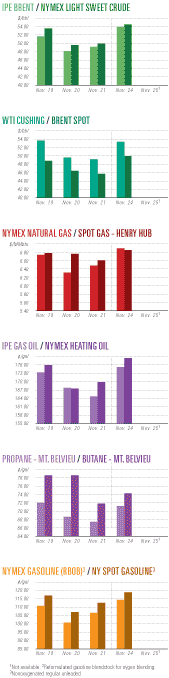

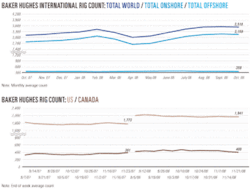

Industry ScoreboardPetrobras confirms two light oil finds

Petroleo Brasileiro SA (Petrobras) reported the completion of drilling of two wells in the presalt layer off Espirito Santo state.

The wells proved discovery of 30° gravity oil in the Parque das Baleias area.

Officials estimated the recoverable volume of the light oil reservoirs beneath the Baleia Franca, Baleia Azul, and Jubarte heavy oil fields, at 1.5-2 billion boe.

The 6-BFR-1-ESS and 6-BAZ-1DB-ESS wells were drilled 80 km offshore and 5 and 6 km, respectively, to the north and south of another discovery well 1-ESS-103A in the presalt section under the Jubarte field.

The reservoirs of the two latest wells are under a layer of salt as thick as 700 m and at 1,348-1,426 m from the water line. The reservoirs are 4,200-4,800 m subsea and have oil-bearing porous thicknesses of 190 and 300 m.

So far, six wells have been drilled in the Espirito Santo presalt layer, all successful. With these discoveries the total estimated volume of oil in the Parque das Baleias area, including reservoirs above and below the salt layer, already amounts to 3.5 billion boe.

Ecopetrol farms into Eni’s gulf assets

Colombia’s state-owned Ecopetrol will acquire a 20-25% stake in Eni SPA’s exploration portfolio in the Gulf of Mexico. It will pay more than $220 million to cover Eni’s drilling costs for five wells by Dec. 31, 2012.

Eni described the partnership as a “strategic agreement” that would help it to better manage and diversify its exploration risk.

The company has lease interests in 408 blocks within the gulf, 70% of which are in deep water. Last year it had an 80% exploration success rate and has a daily equity production of more than 100,000 boe.

Both companies also signed a memorandum of understanding to evaluate other farm-in opportunities for Ecopetrol from Eni’s exploration portfolio. Ecopetrol will also offer Eni access to opportunities in Colombia and other South American countries.

Research sought on unconventional gas

Research Partnership to Secure Energy for America (RPSEA), Sugar Land, Tex., has requested industry proposals for projects on gas shales, coalbed methane water management, and tight sands.

The full text of the RFPs is on the RPSEA web site. The proposals are due Jan. 12, 2009, for projects to start around April 2009.

The focus of the gas shales proposal is on the challenges associated with development of the shale resource from the Permian basin through the Fort Worth basin and in southern Appalachian shale gas basins.

Concepts may include characterization of parameters that differentiate high-performing wells and development of methods to assess production potential, model production results, delineate the fracture system, develop extra-extended lateral drilling techniques, develop steerable hydraulic fracs, and a host of other concepts.

Another request is for development of tools, techniques, and methods to greatly reduce the cost and environmental impact of CBM and shale gas development through more effective management of water used and produced in drilling, completion, stimulation, and production.

The tight sands solicitation seeks proposals for development of tools, techniques, and methods to increase commercial production and ultimate recovery from established tight gas sand formations and accelerate development of emerging and frontier tight gas plays. This work is to be focused on the Rocky Mountain region.

Australia awards offshore E&P permits

Australia has awarded 13 offshore exploration permits in its 2007 release scheme, and the successful companies have pledged a total expenditure of $500 million (Aus.) in exploration investment over the next 6 years, despite the global economic crisis.

The permits lie off Western Australia and Northern Territory, and four of them have been designated frontier areas, which means the successful companies are entitled to a more-favorable tax rate.

Woodside Petroleum was awarded three permits (WA-415-P, WA-416-P, and WA-417-P) in the little-explored offshore Canning basin which lies inshore of the Browse basin region.

Returning independents Hunt Oil and Murphy Australia, along with local company Nexus Energy, won the four Browse basin permits on offer. Hunt received WA-413-P and WA-414-P, while Murphy secured WA-429-P and Nexus scored WA-424-P.

Small Perth-based explorer Finder Exploration won the sole permit on offer in the Carnarvon basin, WA-418-P.

Newcomer Essar Exploration & Production of India won two permits (NT/P77 and NT/P78) in the Northern Territory area of the Bonaparte basin, while Melbourne-based Albers Group companies added to its existing tally of Bonaparte permits with three more in the Western Australian area (WA-420-P, WA-421-P, and WA-422-P).

A total of 24 bids was received for the 13 permits on offer.

Drilling & Production — Quick TakesArrow to develop CSM project in China

Arrow Energy Ltd., Brisbane, has extended its operations in China by signing a heads of agreement with Bin Chang Mining Group to develop coal seam methane (CSM) in Shaanxi Province.

Arrow and Bin Chang will begin a pilot well drilling program to assess the potential surface mine degassing and CSM production in an area that covers 360 sq km within Bin Chang’s coal mining licenses.

The region has a good coal resource data base, according to Arrow, and it has been explored using closely spaced core holes that have defined a coal resource of 6,000 billion tonnes of coal. The estimated in-place CSM resource exceeds 1 tcf.

Arrow says the program will have dual benefits of gas production and improved mine safety.

Bin Chang will cover program costs, and Arrow will design and operate the work, using technology it developed in Australia. It will be Arrow’s first CSM drilling project in China and the first program to use Arrow’s surface to in-seam horizontal well technology for mine drainage.

If commercial volumes of gas are produced in the pilot program, the two parties will enter into a formal joint venture to develop CSM over the entire license area. The pilot program is expected to be completed by mid-2009.

Arrow also has been awarded a CSM business development license for its earlier joint venture with the Urumqi Geological Exploration Development Co. of the Xinjiang Geological Survey.

The license, the first of its type granted by the Xinjiang provincial government, provides access to the CSM opportunities in the coal mining areas of the province.

Nexus cancels Crux FPSO order

Nexus Energy Ltd., Melbourne, and its joint venture partner Osaka Gas Co. Ltd. of Japan have terminated a memorandum of understanding with Vanguard Oil & Gas International and Viking Shipping for the supply of a floating production, storage, and offloading vessel for the Crux liquids project in the Browse basin off Western Australia.

Nexus says the JV was unable to proceed to a final investment decision with Viking as the FPSO provider and will now negotiate an alternative offer from another provider for the project. The company said this would increase confidence that delivery of first liquids from Crux would be achieved by mid-2011. There was no indication of the problem surrounding the Viking deal which was originally signed in 2007.

Nexus (with 85% of Crux development and Osaka Gas 15%) has further incentive to complete the liquids project on time because it also has a $40 million deal to sell Crux gas to Shell Australia (OGJ, July 10, 2006, p. 27). That deal stipulated that Shell has the right to all Crux gas and any remaining liquids in the field after 2020.

Crux has an estimated 75.2 million bbl of recoverable condensate. Nexus says that even if oil falls to $40/bbl, the field is still economic.

Nevertheless the company is suffering the strain of the current world economic crisis. This was evident from comments by Chairman Michael Fowler at the Nexus annual general meeting last week when he said that the company is open to a takeover in order to maximize shareholder value.

Fowler said that during the company’s Crux asset sale process, it received expressions of interest at the corporate level, as well as some offers of strategic alliances.

“The board will evaluate any serious proposals,” he said. He said the objective is to maximize value to all shareholders, and currently the board believes this will best be achieved through an asset sale process, which underlies the value of Nexus’ asset base.

“However, it may be that the best outcome, in terms of shareholder value, proves to be a sale of the company or some other corporate-level transaction,” Fowler added.

Nexus began a global sales process for its Crux AC/P23 exploration permit in October after Mitsui E7P Australia withdrew from an earlier intention of buying a 25% stake because of poor global market conditions.

Saskatchewan THAI demonstration test slated

Petrobank Energy & Resources Ltd. and True Energy Trust, both of Calgary, announced plans to demonstrate the effectiveness of toe-to-heel air injection (THAI) to recover conventional heavy oil from a +10-m thick Mannville channel reservoir in Kerrobert field, Saskatchewan. The initial test will involve two wells.

THAI is an in situ combustion process, patented by Petrobank, that combines a horizontal producing well with a vertical air-injection well placed at the toe.

Since 2006, Petrobank in its Whitesands project has been testing the THAI process in the Athabasca oil sands of Alberta under a variety of operating conditions.

Processing — Quick TakesTotal, Aramco delay Jubail refinery project

Total SA said the award of construction tenders for its $10 billion Jubail refinery joint venture with Saudi Aramco has been delayed because of uncertainties in global financial markets.

The partners, Aramco 62.5% and Total 37.5%, previously said tenders to build the 400,000 b/d facility would be awarded in first-quarter 2009. The French firm said the award of construction contracts would be set back by at least 3 months.

Recently, in a related development, Aramco said it cancelled a contract awarded in July to Saipem subsidiary Snamprogetti for development of Manifa oil field offshore (OGJ Online, Nov. 19, 2008).

Oil from Manifa was intended for the Jubail refinery, according to Jean-Jacques Mosconi, Total’s senior vice-president for strategy and development.

In June, Mosconi told the European Fuels Conference that the Jubail refinery would process Arab Heavy and a new grade from Manifa oil field, which was scheduled to begin production in 2011.

“About 70-80% of Manifa will go to Jubail,” Mosconi told the conference delegates, adding that distillate products produced at the complex refinery would be exported, mostly to Europe, while some would be shipped to Asia.

The decision to delay the Jubail refinery follows an earlier announcement by Aramco and ConocoPhillips to delay the bidding process for construction of a similar 400,000 b/d refinery at Yanbu (OGJ, Nov. 17, 2008, p. 29).

China, Costa Rica develop joint refinery plans

Costa Rica’s Refinadora Costarricense de Petroleo (Recope) and China National Petroleum Corp. (CNPC) are jointly considering plans for the construction of a refinery in the Central American country.

CNPC and Recope will conduct a feasibility study for the facility, which would be able to process 200,000 b/d, or about eight times the capacity of Costa Rica’s existing facility at Puerto Moin on the Caribbean.

The announcement followed an earlier one by Recope Pres. Jose Leon Desanti, who said CNPC would help Costa Rica boost the capacity of its existing Puerto Moin refinery to 60,000 b/d from 25,000 b/d by 2013.

The two announcements build on earlier initiatives agreed by the two countries.

In November 2007, Costa Rican President Oscar Arias, returning from a state visit to China, said CNPC was analyzing the possibility of establishing a refinery in Costa Rica in order to sell fuel to Central America and the Caribbean.

According to Arias, the $6 billion refinery project is independent of another one the Chinese had to revamp the Moin facility to enable it to process fuels required for domestic needs.

As part of the Moin development, Recope announced plans in February to expand its storage capacity by 550,000 bbl to 3.95 million bbl by 2011.

Recope said the $15 million project will see installation of two 25,000 bbl tanks at the Moin refinery, as well as a 200,000 bbl light crude tank and a 100,000 bbl diesel tank.

The project also covers work on two 50,000 bbl diesel tanks for the state refiner’s Barranco distribution facility, while a 100,000 bbl diesel tank will be built for the El Alto de Ochomogo distribution plant.

Plans also call for existing tanks at the La Garita site to be converted to hold jet fuel instead of gasoline.

Oil Search eyeing PNG petrochemicals

Papua New Guinea company Oil Search Ltd., Sydney, has signed a memorandum of understanding with the Papua New Guinea government and Japanese entities Itochu Corp. and Mitsubishi Gas Chemical Co. to carry out a feasibility study into development of a petrochemical project in Papua New Guinea.

Under the agreement Oil Search and the two Japanese companies will work together and coordinate with the government to investigate the development of a petrochemical industry and its associated benefits to all concerned based on current economic conditions.

Oil Search’s managing director said the companies want to better understand the commercialization options that exist for gas in Papua New Guinea, and that includes further LNG trains, petrochemicals, and other gas-based domestic and export industries.

“This new study will satisfy a core initiative announced last July following the signing of the domestic gas MOU with the Papua New Guinea government,” he added.

Oil Search has a 34.1% interest in the ExxonMobil-operated, two-train, 6.3-million-tonne/year PNG LNG project that will source gas from fields in which Oil Search has a stake.

The new MOU covers gas from the company’s non-Papua New Guinea LNG gas resources.

Transportation — Quick TakesFirst Tangguh LNG exports to be on schedule

Indonesian officials, quickly reversing earlier statements, said the first LNG exports from the BP PLC-led Tangguh project will be shipped in February 2009 as scheduled.

Raden Priyono, head of the upstream oil and gas regulatory body BPMigas, said the project is being completed on schedule and denied earlier reports that the shipment would be delayed from first-quarter 2009.

Previously, a BPMigas official said the $5 billion Tangguh LNG project would be delayed until second-quarter 2009.

“It will come on stream in the second quarter of next year,” BPMigas deputy chief Djoko Harsono told reporters on the sidelines of the Gasex conference, without giving a reason for the delay.

Earlier reports indicated that Indonesia would not delay shipments of Tangguh LNG to CNOOC’s Fujian terminal in China, despite an ongoing price renegotiation with Beijing. The shipments are scheduled to begin in first-quarter 2009.

“We must respect the contract,” said Energy and Mineral Resources Minister Purnomo Yusgiantoro. “We are continuing negotiations, but as the negotiation has yet to reach an agreement, we must follow the contract,” he said (OGJ Online, Oct. 30, 2008).

Dolphin Energy begins supplying gas to Oman

Abu Dhabi’s Dolphin Energy, as part of a 25-year gas sales agreement (GSA) signed in 2005, has begun supplying Qatari natural gas to Oman via pipeline.

“This is a historic moment for Dolphin Energy; it is equally significant for three nations [which] have embraced and supported the Dolphin Gas Project from the very beginning,” said Dolphin Chief Executive Ahmed Ali Al Sayegh, referring to Qatar, the UAE, and Oman.

The gas is produced from Dolphin’s production wells off Qatar, processed at the Ras Laffan gas plant, and shipped through a 48-in., 3.2 bcfd capacity pipeline to the UAE emirate of Abu Dhabi.

From Abu Dhabi, the gas is shipped along Dolphin’s Eastern Gas Distribution System to Al Ain in Fujairah, where the line connects to a new Omani pipeline at the Oman border. Oman will be receiving 200 MMscfd of gas under the terms of its GSA with Dolphin.

In addition to Oman, other long-term customers for Dolphin gas from Qatar include Abu Dhabi Water & Electricity Authority, Union Water & Electricity Authority, and Dubai Supply Authority. Each has signed a 25-year gas supply agreement with Dolphin Energy.

Mubadala Development Co., run by the government of Abu Dhabi, owns 51% of Dolphin, while Total SA and Occidental Petroleum share equally in the remaining 49%.

BGTT lets pre-FEED contracts for marine facilities

BG Trinidad & Tobago (BGTT) has let two contracts valued at $1.2 million to KBR consulting subsidiary Granherne certain pre-FEED (front-end engineering and design) studies.

Under the first pre-FEED study, Granherne will undertake study work for provision of compression to BGTT North Coast Marine Area facilities that deliver gas to Atlantic LNG. The concept phase will examine both offshore and onshore solutions and a final solution will be selected during the pre-FEED phase.

The second study includes reviews of the facilities at BGTT’s East Coast Marine Area onshore gas plant at Beachfield, including a review of the arriving offshore pipeline and onshore reception facilities. The study includes design for operational upgrades as well as enhancements to the facility that will help BGTT meet future demand. Work is expected to begin immediately.

In September, BG Group said it intended to obtain initial gas output from its Poinsettia platform in Trinidad and Tobago’s North Coast Marine Area by yearend.

The Poinsettia field is anticipated to boost its gas output by 9.91 million cu m/day. In 2007, BG produced 23 million boe of gas in the country.