OGJ Newsletter

Deutsche Bank slashes 2008 oil demand outlook

Major investment bank Deutsche Bank has reduced its global oil demand growth forecast for this year to 840,000 b/d from 1.16 million b/d. This is lower than the latest growth estimates by the International Energy Agency, the US Energy Information Administration, and the Organization of Petroleum Exporting Countries.

Even with the demand downgrade, Deutsche Bank’s call for OPEC crude rises 200,000 b/d due to slipping forecasts for non-OPEC supply growth.

Oil is holding at over $125/bbl despite concerns of economic weakness and expectations of a strengthening US dollar.

“The forecasting tug-of-war continues between bearish analysts who believe that marginal costs near $75/bbl will dominate and those who see the need for demand destruction price levels near $150-200/bbl,” said Deutsche Bank’s Adam Sieminski. “We see increasing risk to the upside until demand shows more response to either price or income elasticities.”

The bank’s current forecast for average 2009 West Texas Intermediate and Brent crudes is $102.50/bbl, supported by a weak US dollar and funds-flow issues.

Goldman Sachs sharply raises oil price forecast

To balance worldwide economic growth with weak oil supply growth, oil prices will rise 14% in the second half of 2008, according to investment bank Goldman Sachs.

Goldman Sachs said the price surge is needed to balance global GDP growth of 3.8% against oil supply growth of just 1%. The bank’s average second-half 2008 WTI price forecast is now $141/bbl, up from a previous estimate of $107/bbl. The average WTI price in the third quarter is forecast at $135.30/bbl, rising to $145.60/bbl in the fourth quarter.

Long-dated oil prices need to rise at a rate that will force demand growth in line with supply growth. And despite expected price increases, a contango marketin which prompt-month futures prices are higher than prices in later monthsis likely to return, according to the report.

“Although we expect inventories to build in May, which will further pressure WTI term structure, ... we do not expect these softer fundamentals to translate into spot-price weakness given the strength in long-dated prices. We expect the bullish structural market to dominate the bearish cyclical weakness, dragging the market higher.”

High prices are required to achieve a needed slowdown in demand growth, as opposed to thinking about it the other way around, i.e., that weakened demand growth creates lower prices, Goldman Sachs said. “We estimate that the rise in oil prices since 2002 has already destroyed 5 million b/d of demand relative to if oil (had) stayed at $20/bbl.”

DOE suspends SPR oil purchases to year end

The US Department of Energy said May 16 that it will not sign contracts this year to continue filling the Strategic Petroleum Reserve from July through December.

The announcement came 2 days after the Senate passed the House’s version of legislation suspending SPR purchases for the rest of the year unless crude oil prices fall below $75/bbl (OGJ Online, May 14, 2008). The measure passed both chambers by large enough margins to assure that a presidential veto could be overridden.

Up to 13 million bbl of crude won’t be added to the SPR.

Willbros settles corrupt payment allegations

Willbros Group Inc. and its Willbros International Inc. subsidiary agreed to pay a $22 million criminal penalty for violating the Foreign Corrupt Practices Act, the US Department of Justice said on May 14.

DOJ had charged the oil and gas engineering and construction firm with bribing Nigerian and Ecuadorian officials to secure contracts in 2003-05.

Willbros Group also agreed to pay $10.3 million in disgorgement of all profits and prejudgment interest under a US Securities and Exchange Commission settlement. Four former employees also paid fines and settled SEC charges.

Willbros was charged with conspiring to bribe Nigerian and Ecuadorian officials, authorizing corrupt payments, falsifying books and records relating to corrupt payments, and implementing a tax fraud scheme. DOJ deferred prosecution of Willbros for 3 years, saying it would dismiss the criminal information then if Willbros abides by the agreement.

France prepares for gas trading exchange

Gaz de France, its transmission subsidiary GRTgaz, and Total SA’s transmission operator Total Infrastructure Gaz France (TIGF) have given strong support to the Powernext project to set up a gas trading exchange in France to develop a competitive market.

GDF and GRTGaz have become shareholders of Powernext through a 6.6% and 5% stake respectively. Each will have a seat on the board of directors. TIGF “will implement the appropriate operating conditions to facilitate it.”

The exchange, Powernext officials said, “will promote the emergence of an efficient liquid and transparent market as requested by France’s Energy Regulatory Commission and the European Commission. There will be a matching of supply and demand in transparent and nondiscriminatory conditions and the setting up of a price reference for the French market.”

Powernext Chief Executive Officer Jean-Francois Cornil-Lacoste said a preliminary market model will soon be provided to expert market players, who will finalize specifications of the products and services offered.

A spot market is expected to be launched by yearend on all of France’s balancing zones (which will be reduced to three on Jan. 1, 2009) and a futures market with physical delivery in the North zone.

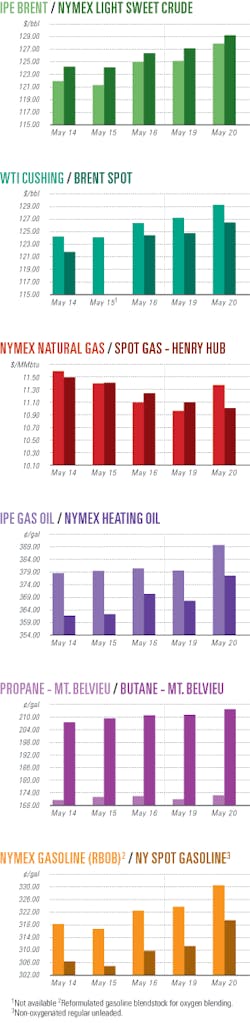

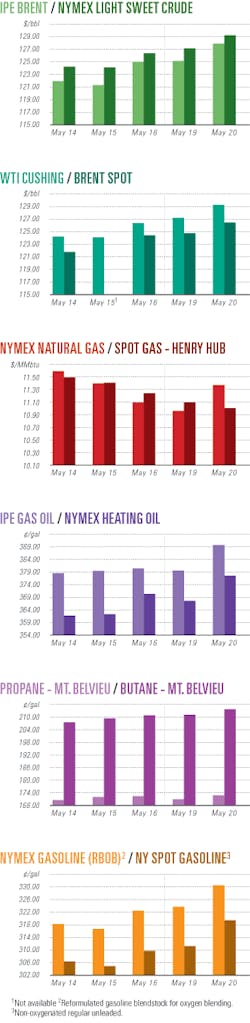

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesBG Norge finds oil, gas in Norwegian North Sea

BG Norge AS has found oil and gas with exploration well 15/12-19 on Production License 292 (PL 292) in the Norwegian North Sea. The well, combined with the nearby 6/3-1 discovery, could hold as much as 3-5 million cu m of oil equivalent.

The well, south of Varg field, tested 750 cu m/day from Jurassic and Triassic reservoirs, the Norwegian Petroleum Directorate said. BG gathered data from the well and is carrying out field development studies.

The Maersk Guardian jack up rig drilled the well in 86 m of water to 3,169 m TVD subsea. The well will be plugged and abandoned.

BG has 60% interest in the license, and its partner Lundin 40%.

Trinidad and Tobago offers five blocks for bid

Trinidad and Tobago said bids will be welcomed in the third quarter for five new exploration blocks in its 2008 bid round. They include:

- Block 4(b) in 400-800 m of water off Trinidad and Tobago’s east coast. It lies just east of BG Group’s prolific Dolphin field, which holds more than 5 tcf of gas.

- Block 5(d), also off the east coast, is north of the Manikin gas discovery in 450-800 m of water.

- NCMA (3), (4), and (5)all off the northern coastare believed to be gas-prone. They lie in more-shallow water (100-550 m).

The minister said he is hopeful bids will be awarded by January 2009.

He also said three 2006 ultradeep water bid parcels will be rebid in 2009.

EBRD loan, stake advance Siberian development

Irkutsk Oil, under concession rights granted by Russia, is developing oil fields in Siberia that could facilitate the extension of Russia’s planned East Siberia Pacific Ocean oil pipeline from Skovorodino, near Russia’s border with China, to the Sea of Japan.

A joint venture set up by Irkutsk Oil and government-affiliated Japan Oil, Gas, & Metals National Corp., is scheduled to start test-drilling for oil in the region as early as this winter.

Irkutsk Oil will invest more than $500 million on operations over the next 7 years. The European Bank for Reconstruction and Development will provide partial financing and will acquire an 8% stake in the project.

Taitai discovery extends Uganda prospectivity

The Taitai-1 oil discovery at Taitai in the Butiaba area of Uganda’s Block 2 cut 5 m of net gas pay and at least 8 m of net oil pay, said Tullow Oil PLC. A thick section of oil-stained basement was also encountered and provides upside potential at this location and elsewhere in the basin, the company said (see map, OGJ, Feb. 11, 2008, p. 36). The well was drilled to a TD of 1,006 m and was successfully logged. Downhole pressure testing and sampling confirmed the presence of movable 30° gravity oil and a potential oil column as thick as 80 m in sands above the basement play.

“The uppermost oil sand exhibited high permeability; however pressure sampling of underlying oil sands was inconclusive....[So] the well is being sidetracked and the oil-bearing zones cored to collect further reservoir and fluid information,” said Tullow.

Taitai-1 well is the first of a nine-well exploration campaign in the Butiaba area.

Deeper gas proved in Norwegian Sea’s Alve field

Exploration extension drilling in Alve field in the Norwegian Sea confirmed natural gas and condensate in a reservoir deeper in mid-Jurassic sandstone than was previously known. Operator StatoilHydro said a thin oil zone also was proved below the gas.

Well 6507/3-5S was drilled to 3,834 m subsea in 368 m of water. Based on a preliminary estimate, the discovery includes 3-5 billion cu m of gas, StatoilHydro said.

The well will be temporarily plugged.

Alve field was proved in 1990 in Production License 159B (Jan. 19, 2007, Newsletter).

Drilling & Production Quick TakesCERA: upstream costs up 6% over 6 months

Constructing upstream oil and gas facilities has increased by 6% over the past 6 months and have doubled since 2005, according to the most recent IHS Inc.-Cambridge Energy Research Associates (CERA) Upstream Capital Costs Index (UCCI).

The UCCI is a proprietary measure of project cost inflation similar in concept to the Consumer Price Index. It provides a benchmark for comparing costs around the world and draws upon proprietary IHS and CERA databases and analytical tools.

Areas with a high level of projects under way in the Middle East, West Africa, South America, and Australia have seen higher than average cost increases, compared with areas of moderate escalation in North America and Europe.

“Rising costs have become one of the ‘new fundamentals’ driving the price of oil,” said Daniel Yergin, chairman of CERA.

Increased demand for raw materials and transportation is driving costs, which are contributing to delays and postponements of many projects, said Pritesh Patel, director for the Capital Costs Analysis Forum for Upstream, a CERA Industry Forum. “Exchange rate fluctuations and the weakening US dollar also contribute.” Because the dollar is the reporting currency of choice, this weakness has a dramatic effect on final construction costs for projects in regions such as Europe and West Africa, Patel said.

The biggest leap on CERA’s UCCI was for deepwater subsea equipment, particularly umbilicals and control systems. These costs have jumped by 12% over the past 6 months due to manufacturing constraints and higher costs for materials and labor.

The costs of vessels used to install platforms, lay pipe, and support offshore development also are on the rise after briefly leveling off in 2007. Their rates have increased 2% in the past 6 months.

Gazprom winter gas production beats previous year’s

OAO Gazprom increased natural gas production in the first 4 months of 2008. Despite a relatively mild 2007-08 winter between January and April, Gazprom produced 199.4 billion cu m (bcm) of gas (about 7 tcf), 4.2 bcm more than for the same period in 2007.

Current forecasts call for Gazprom’s production to hit about 570 bcm for 2010, growing to 610-615 bcm/year by 2015 and 650-670 bcm/year by 2020. By that time, new fields will account for nearly a half of all gas produced.

Gazprom spokesman Sergei Kupriyanov said growth of the company’s gas reserves has considerably surpassed its production for the third year running. “According to preliminary estimates, in 2007 our success in exploration led to an increase in discovered reserves” to 585 [bcm], while production was 548.5 [bcm].

In 2006, he said, exploration increased reserves by 590.9 bcm, while production totaled 556 bcm. In 2005, the figures were 583.4 bcm and 555 bcm, respectively.

Gazprom’s strategy is that by 2010, three new gas production centers will be operating: the Arctic shelf, Yamal Peninsula, and East Siberia-Far East, which are “expected to develop into major production hubs over time,” it said.

In the near future, Shtokman and Bovanenkovo, two fields in the Arctic shelf and Yamal, will be put into operation.

Parker plans two newbuild arctic land rigs

A BP PLC subsidiary signed a letter of intent with a Parker Drilling Co. subsidiary for a drilling contract in Alaska requiring two newbuild land rigs.

A 5-year drilling contract, with a 5-year option, is expected to be executed by May 30, Parker said. Operations are anticipated to commence during the second half of 2010.

The arctic-class land rigs will feature safety-engineered equipment to reduce vibration, noise, and personnel hazards; technology to decrease well times and increase the number of wells drilled each year; onboard command center centralizing decision-making processes; and fully enclosed rig modules for operation in arctic conditions down to 50° F.

Oilexco lets UK North Sea subsea work to Technip

Oilexco North Sea Ltd. has signed an agreement with Technip SA for engineering, project management, and construction services for subsea developments at Shelley oil field and other fields in the UK North Sea.

Using the Ocean Guardian, Oilexco drilled 22 well bores in Shelley field to define the limits of the oil accumulation.

The company expects the contracted Sevan Voyageur FPSO to begin production in the fourth quarter.

Technip will provide diving support, trenching support, and umbilical installation vessels, inspection, repair, and maintenance. It will execute the engineering, installation, and commissioning of pipelines, a control umbilical and jumpers, flexible risers, a subsea manifold, and attendant flowlines.

Norway cuts 2008 oil production forecast

Norway has revised its oil production forecast for 2008 to 2.4 million b/ddown from the previous projection of 2.5 million b/din its revised budget for this year. The estimate includes natural gas liquids and condensate.

The Norwegian energy ministry said it expected oil production to continue falling because of maturing Norwegian continental shelf fields.

However, gas production will increase, with gas sales at 100 billion cu m in 2008, estimated to be 10% higher than in 2007. In 2009 gas sales are expected to increase to about 110 billion cu m.

Operators have planned 125 billion kroner investment in 2008, including exploration, which also is 10% higher than 2007.

The country has produced about a third of the expected recoverable petroleum resources, with more oil coming on stream than gas. The ministry said about half of the total expected oil resources have been produced.

The government expects to receive 356 billion kroner net cash flow from the petroleum industry in 2008 because of high oil prices.

Processing Quick TakesNavajo refinery FCC unit down for repair

The Navajo Refinery in Artesia, NM, is operating at reduced rates because the FCC unit has been shut down for repairs. Owner Holly Corp. said crude charge of the 85,000-b/d refinery has been cut by 55,000 b/d while repairs are under way.

An instrument control malfunction required shutdown of the FCC unit May 7. Catalyst circulation problems during restart forced another shutdown May 16. Holly says repairs to take several days.

The unit has reported capacity of 18,500 b/cd (OGJ, Dec. 24, 2007, p. 50).

Holly expects average output for all of May to be down by 13,000-18,000 b/d of gasoline and 3,000-5,000 b/d of diesel.

CNPC takes stake in Nippon Oil Takaishi refinery

Nippon Oil Corp. and China National Petroleum Corp. have agreed to jointly manage the existing 115,000-b/d Takaishi refinery in Osaka province and to export its products to China and other regional markets. Nippon will have a 51% stake in the venture and CNPC the remaining interest.

The Takaishi facility, the sixth-largest among Nippon Oil’s seven domestic refineries, has seen its capacity utilization fall sharply due to slumping demand in Japan for such refined products as gasoline, gas oil, and fuel oil.

Demand for these products has been surging in China, however, on the back of strong economic growth. Refineries there are having difficulty meeting the demand.

Tesoro R&M agrees to civil penalty for air violations

Tesoro Refining & Marketing Co., San Antonio, has agreed to pay a $1.5 million civil penalty to settle air-quality violations at its 166,000-b/d Golden Eagle refinery at Martinez, Calif. The refinery is the company’s largest facility and the second-largest refinery in Northern California.

San Francisco’s Bay Area Air Quality Management District (AQMD) said the settlement covers violations that occurred over 3 years, including “failure to inspect tanks and equipment, air pollution releases that resulted from equipment malfunctions, and administrative and reporting violations.”

Tesoro will undertake capital improvement projects and equipment upgrades. It will replace several outdated systems with equipment incorporating the best available pollution control technology. AQMD also said Tesoro also agreed to retrofit heavy-duty diesel vehicles in and around the refinery with particulate traps to reduce particulate pollution.

Transportation Quick TakesAnother Northeast offshore LNG terminal proposed

Excalibur Energy (USA) Inc., a 50-50 joint venture of Canadian Superior Energy Inc. and Global LNG Inc., New York, reported plans to build a 2.4-bcfd LNG terminal off New Jersey and subsea pipelines to shore.

The proposed $550 million Liberty natural gas transmission line will consist of a “fully submerged, offshore gas importation turret anchored to the seafloor” in 100 ft of water 15 miles off New Jersey; 50 miles of 36-in. OD subsea pipeline; a directionally drilled underground shoreline approach near South Amboy, NJ; and 11 miles of 36-in. onshore pipeline to interconnections in Linden, NJ.

Gas transmission capacity in the Linden area totals more than 4 bcfd. Excalibur will submit US permit applications early next year and targets late 2011 for start up.

Excalibur said the project is not associated with Houston-based Excelerate Energy, which has pioneered offshore LNG terminals off Texas and the UK and operates several regasification carriers.

Excalibur, while declining to identify the specific offloading system planned, said the regas vessels will “temporarily connect to permanently anchored turrets.” Roger Whelan, Excalibur’s president and CEO, told OGJ the company has narrowed its choices of technology and expects to announce that within the next 3 weeks.

No LNG supply contracts have been signed, but Whelan said Atlantic Basin suppliers, especially Trinidad and Tobago’s Atlantic LNG Train X, currently under design, are logical sources.

He said the US Energy Information Administration has projected that the US Northeast’s growing population will “need an additional 30% more energy in the coming decades relative to the current demand, with energy shortfalls beginning as soon as 2012.”

The project has been developed over the last 2 years, he said, and “included an independent survey of 1,000 New York and New Jersey residents and discussions with several key stakeholders in the area.

Northeast Gateway LNG port starts operation

Houston-based Excelerate Energy LLC’s Northeast Gateway (NEG) Deepwater LNG Port in Massachusetts Bay, 18 miles east of Boston, has begun commercial operations. The company’s Excellence regasification vessel off-loaded its natural gas cargo into the HubLine pipeline system, operated by Spectra Energy, Houston.

With the inaugural delivery, Excellence will offload 1 bcf of gas to test all of the port and pipeline systems. The system will be able to handle peak deliveries of 800 MMcfd of gas through two turret buoys and under normal operations will deliver about 500 MMcfd (OGJ Online, May 19, 2008).

Italy streamlines permitting for LNG, regas plants

Last October, Italy’s Council of Ministers approved plans to simplify and accelerate the permitting process for new LNG terminals to ease planning restrictions, which had prevented several LNG terminal developers from securing final planning approvals for their facilities.

The new plans no longer require operators to consult the public works council Consiglio superiore dei lavori pubblici. Instead, Italy’s Environment Ministry will conduct and complete an environmental impact assessment for final authorization by the Ministry of Economic Development, the Ministry of Environment, and the Ministry of Infrastructure.

ERG SPA Chief Executive Officer Alessandro Garrone said the 8 billion cu m/year regasification terminal his firm plans to build with Royal Dutch Shell PLC at Priolo, Sicily, has received environmental clearance after a 3-year wait.

In February, Italy’s Il Sole 24 Ore said the project had already cost 15 million euros.

Construction can now begin in 2010, and the facility will be operational in 2013. The plant’s capacity can later be expanded to 12 billion cu m/year.

Earlier this month, Italy’s environment ministry also approved plans by Compagnie Industriali Riunite SPA’s energy unit Sorgenia SPA and northwest utility Iride SPA for construction of an LNG terminal at Gioia Tauro in Calabria (OGJ Online, May 2, 2008).