OGJ Newsletter

OPEC: Refinery mismatch strains crude price

Refinery construction oriented to gasoline in a market needing distillate is lifting the premium for light crude and contributing to market instability, says the Organization of Petroleum Exporting Countries.

In its May Monthly Oil Market Report, OPEC says global refinery construction during 2000-07 favored conversion capacity associated with gasoline while demand growth for the product was less than half that of distillate.

During this period, demand for distillate increased by 5.2 million b/d while that for gasoline rose by 2 million b/d and use of fuel oil declined.

At the same time, refiners added 1.2 million b/d of fluid catalytic cracking and coking capacity, associated with gasoline, but only 700,000 b/d of hydrocracking capacity, related to distillate.

Recently, demand for distillate has surged because of economic resilience in developing countries and the increased use of diesel generators, OPEC says. With insufficient distillate-oriented conversion capacity in place, refiners must rely on increased runs of light crude.

The result, OPEC says, is a widening price differential between light and heavy crude grades. The difference in price between heavy Maya crude and West Texas Intermediate, for example, has grown from about $8/bbl in June 2007 to more than $20/bbl at the beginning of May.

“The persistent mismatch between the product demand pattern and the refinery configuration has focused further upward pressure on light crude prices,” OPEC says. “Downstream constraints are continuing to contribute to the high risk premium for these grades, leaving the market increasingly sensitive to any disruption in light crude supplies.”

Aussie budget closes condensate tax loophole

Australia’s federal budget has closed a tax loophole, ending an excise exemption worth more than $500,000 on the production of condensate.

Biggest losers are the North West Shelf joint venture partners, which have been producing the gas fields off Western Australia for the past 25 years. Condensate has been a lucrative byproduct obtained with little effort.

However the new Labor Party government reported that it will remove the oil excise exemption for condensate. The move is expected to add $564 million (Aus.) to federal government revenue during the next financial year (2008-09) and about $2.5 billion over the next 4 years.

Condensate production from NWS fields and those onshore will be subject to the same excise rates as those applicable to all petroleum fields discovered since Sept. 18, 1975.

Under previous arrangements the first 30 million bbl of oil produced from a field was exempt from excise duty. Past production of condensate will now contribute to reaching that threshold.

Western Australia also is a loser as two thirds of the excise went to the state government under the old scheme. However the federal government said it will compensate the state for lost revenue, beginning with an initial $80 million this financial year and building to a total of $406 million over 4 years.

Not surprisingly, industry is unhappy with the change. Belinda Robinson, chief executive officer of the Australian Petroleum Production & Exploration Association, said industry was surprised by the government’s move and concerned at the absence of any prior consultation.

“Given the magnitude of the investments involved and the important contribution of the petroleum industry to the Australian economy, a strong partnership between industry and government is critical,” Robinson said. “Investment decisions are made on the basis of certainty that fiscal frameworks agreed with governments will underpin the long-term economic viability of projects.”

Sudan rebels vow more attacks on Khartoum

Risks to energy installations and their personnel in Sudan will increase in the next few months, particularly for Chinese oil companies operating in the southwest region of the African country, said Tahir Elfaki, head of the legislative council of Sudan’s rebel group Justice and Equality Movement.

JEM rebels attacked the nation’s capital Khartoum on May 10 and plan to continue launching new attacks on the city, aiming to destabilize the government until it falls, Elfaki said.

He also said JEM is planning operations against oil fields operated by state-owned China National Petroleum Corp. in the central province of Kordofan. Last December, JEM rebels said they attacked the Defra oil facility in south Kordofan (OGJ Online, Dec. 21, 2007).

In London, risk analyst Exclusive Analysis (EA) confirmed that additional attacks by the rebels on Khartoum as well as on energy assets in Kordofan “are likely in the next couple of months.”

Confirming the May 10 attack on Khartoum, EA said a rebel column of 50-100 vehicles left JEM’s stronghold in Jebel Moun, near the Chadian border in West Darfur, and advanced on the capital, picking up reinforcements along the way.

“After a day of heavy fighting in Omdurmana suburb across the Nile to the west of the city centerthey were repelled by the army,” it said.

The analyst also commented on JEM’s threats to increase attacks on energy and economically viable assets, especially in south Kordofan.

“Although a large-scale attack on an oil installation would be costly to JEM in terms of loss of lives, the attack on Khartoum shows a willingness to take such losses if the operation is thought to further their strategic aims,” EA said.

It said members of JEM are “particularly well placed” to stage attacks in Kordofan, where they have experience operating and where the state presence is more limited, but they are likely to reach beyond this area as well to show their capability.

OTC: Deepwater systems offer new life in gulf

The ultradeep waters of the Gulf of Mexico will be an area of significant oil production in the future, according to Steve Thurston, vice-president of Chevron North America Exploration & Production Co.

At least four projects are expected to come on stream within the next 5 years, including Royal Dutch Shell PLC’s Perdido, Petroleo Brasileiro SA’s (Petrobras) Cascada, Chevron’s St. Malo and Jack, and BP PLC’s Kaskida. The gulf has produced about 1 million b/d from its shelf for the past 30 years, but these reserves are now in decline, Thurston noted May 8 at a luncheon during the Offshore Technology Conference in Houston.

Jack holds 3 billion bbl in place and Chevron has tested 6,000 b/d of oil. It will carry out further appraisal after gathering 350 ft of net pay. So far several companies have made 14 discoveries in the Lower Tertiary system, or a 58% success rate.

Thurston said this trend would require breakthrough technology to produce hydrocarbons in an efficient and cost effective manner. “The reservoirs are very large and spread out. We need to aggregate the fluid into one host so flow assurance is a big issue. Other challenges are long distance subsea tiebacks, life cycle water management and small fields will need to get in earlier rather than later.”

Operators are completing wells at 1,200 ft and want to reduce the cost and number of days needed. The trend is challenging as operators must overcome from top to bottom during drilling hurricanes, currents, unstable mud, thick salt layers, and high pressures and temperatures. “Other than that, it’s pretty easy,” Thurston said. Wilcox alone, in 5,000-10,000 ft of water, has a 10,000-ft salt layer.

Chevron plans to drill 13 wells on Wilcox over the coming years. It is looking at different technologies to cut investment costs, increase production rates, and reduce key uncertainties.

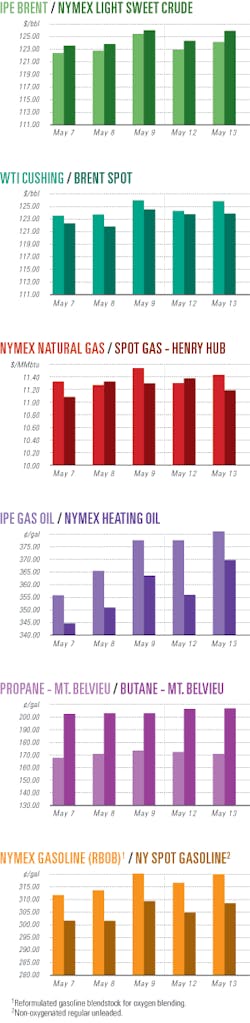

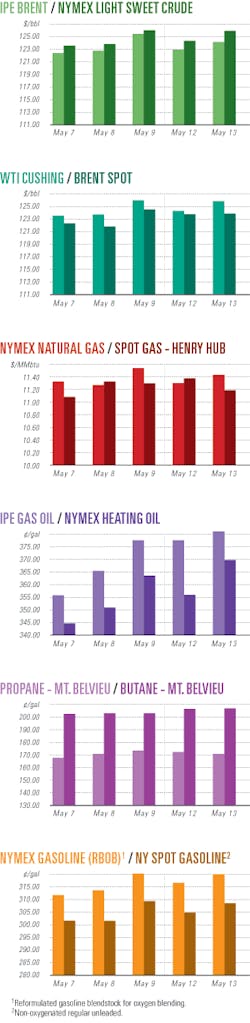

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesNine E&P permits awarded off W. Australia

Australia has awarded nine new offshore leases, receiving a total of $425 million (Aus.) in its most recent exploration acreage release. The permits cover a range of prospects, water depths, and play types. Five are in the Bonaparte basin, three in the Browse basin, and one in the Carnarvon basin.

France’s Total SA won 22% of the acreage with a substantial $94 million work program over 3 years plus $6 million in secondary work commitments for newly awarded Browse basin permit WA-408-P off northwest Western Australia.

Total beat three other bidders to win WA-408-P. Its program guarantees 1,300 sq km of new 3D seismic work, three exploration wells, and geotechnical studies in the first 3 permit years. The secondary program consists of further geotechnical studies.

Chinese company Sinopec won NT/P76 in the Troubador Terrace area of the Bonaparte with a guaranteed initial work program of $35.65 consisting of geotechnical studies, 500 km of 2D seismic reprocessing, 2,000 km of new 2D work, and 1,000 sq km of 3D. The company also bid $38.5 million on a secondary work program comprising one well and geotechnical studies.

Apache and Total won Bonaparte Block AC/P42, with a $18.9 million primary program and $30.2 million secondary work, and AC/P43 with a $32.95 million program and $300,000 worth of secondary work.

Finder Exploration Pty. Ltd., Perth, won AC/P44 and AC/P45 with more modest bids.

Of the other two Browse permits, a partnership of Santos, Chevron, and Inpex won WA-410-P with a low $760,000 bid for some 3D seismic and geotechnical studies followed by a secondary program of one well and geotechnical and marketing studies valued at $30.5 million.

Santos, Inpex, and Beach Petroleum combined to win WA-411-P with an initial program worth $1.46 million followed by a secondary program, including a $30.5 million program of one well and geotechnical and marketing studies.

Carnarvon basin permit WA-409-P went to Australian independent Cue Exploration and Gascorp Australia for an initial $3 million program of seismic work and a secondary $25.5 million program to drill one well and conduct geotechnical studies.

Norway invites bids for mature offshore acreage

Norway has invited operators to bid for mature acreage in the Norwegian North Sea, Norwegian Sea, and the Barents Sea under its Awards in Predefined Areas (APA) 2008 round.

This year operators can apply for all or part of 18 blocks, 11 of which are in the North Sea, 3 in the Norwegian Sea, and 4 in the Barents Sea. The APA initiative is important in attracting new and smaller companies to the Norwegian Continental Shelf.

“The area announced in APA 2008 consists mainly of returned blocks where petroleum activities have previously taken place,” the Norwegian Petroleum Ministry said. “The purpose of the APA-rounds is to enhance exploration activities in mature areas, where expectations are [for] smaller discoveries that cannot justify an independent development. It is therefore good resource management to discover and develop these resources before existing infrastructure in connection to other fields are shut down.”

The deadline for applications is midday on Oct. 3, and the Norwegian Petroleum Ministry will award the blocks by late 2008 or early 2009.

StatoilHydro finds oil, gas in Oseberg area

StatoilHydro discovered commercial quantities of oil and gas in exploration well 30/9-21 S in the Norwegian North Sea.

Oil and gas were found in the upper parts of the Brent Group of production license PL104, 7 km west of the Oseberg Sor platform. The well was drilled using the floating rig Transocean Winner and was concluded in Middle Jurassic rocks.

StatoilHydro said the discovery held an estimated 16 million recoverable bbl of oil equivalent and could be tied to the nearby Delta template within a few years. Continued exploration success in the area may trigger new development solutions, it added.

StatoilHydro also found oil in the Theta structure via its long-reach exploration well from the Oseberg C platform, targeting the Cook formation. It has designed the well to be turned into a producer within 45 days after the discovery.

Prospect mapping and well planning was a collaborative effort between the Oseberg Petech team and the North Sea exploration team, with the former unit being responsible for the drilling operation.

Drilling & Production Quick TakesEni delays Kashagan oil field production further

Kazakhstan, learning of additional delays in the development of its Kashagan oil field, may impose new fines on the Eni SPA-led consortium in charge of the project.

Eni notified the government of the delays, and officials are evaluating possible sanctions, but have not made a final decision, according to a senior official of the Kazakh oil ministry.

The consortium proposed postponing the production start to 2012-13 from 2011, according to Kazakh Energy Minister Sauat Mynbayev, who said the two sides were trying to “come to an agreement again.”

Industry analysts say the field’s development poses unusual challenges, including temperatures that range from 40° C. in the summer to40° C. in the winter.

Kashagan’s crude also has high hydrogen-sulfide content, making it potentially deadly for workers on site and raising unusually difficult environmental problems.

Owing to the challenges, in January Eni set a new date of 2011 for first production of Kashagan oil, following two earlier delays. At the time, the consortium agreed to compensate the Kazakh government for the cost overruns and production delays occasioned by 6 months of talks.

The government claimed that the delays in the Kashagan project were undermining the nation’s financial plans and preventing it from implementing other developments in the country.

Under the agreement reached in January, Eni will no longer be sole operator once production begins but will share that role with partners ExxonMobil Corp., Royal Dutch Shell PLC, and Total SA (OGJ Online, Feb. 3, 2008).

Also in January, the partners agreed to sell part of their Kashagan stakes to KazMunaiGas, giving the Kazakh state oil company a 16.81% stake in the project and to make additional payments to the Kazakh government based on the price of oil.

At the end of April, Eni Chief Executive Officer Paolo Scaroni said the consortium was talking with the Kazakh government about an updated plan for Kashagan, and it had hoped to reach an agreement by then. Scarloni said discussion had focused on the need to agree to a date specifying when field production would begin.

Eni expects Kashagan’s output to reach 370,000 b/d when it eventually comes online and to reach peak production of 1.5 million b/d by 2019.

Shell starts gas production from Shamrock

Shell UK Ltd. reported production start-up May 12 from Shamrock field in the North Sea, the third new Shell-operated North Sea field to begin production this year. Shell operates the field and holds 100% interest.

Shamrock field was developed using Shell’s proprietary Monotower platform powered by wind and solar energy, which costs much less to build than a traditional offshore platform. John Gallagher, technical vice-president for Shell Exploration & Production, Europe, said Shamrock was brought on stream shortly after Starling and Caravel fields earlier this year. “Our ability to use latest generation technology has enabled Shell to develop a field that would once have been uneconomic,” Gallagher said.

Starling, a subsea tieback to the Shearwater platform in the Central North Sea, came on stream in January, and Caravelalso a Monotower platform developmentproduced initial gas Apr. 30.

Production capacity through the Shamrock monotower will average 120 MMscfd, Shell said. Gas is transported by pipeline to the Shell-operated Bacton gas plant about 120 km to the southwest.

Shell UK operates fields in the UK sector of the North Sea on behalf of itself, Esso, and other partners.

Shell, Repsol drop Iranian development plans

Royal Dutch Shell PLC and Repsol-YPF SA have suspended plans to develop Phase 13 of South Pars gas field in Iran as relations between the US and Iran deteriorate and development costs rise.

US sanctions against Iran have made it increasingly difficult for foreign investors to develop the proposed $10 billion LNG export plant, but the companies have signalled an intention to look at other types of involvement in Iran at a later date. The US Congress is worried about Iran’s nuclear program.

A Shell spokesperson said that the company agreed to swap the development for “alternative suitable phases.”

According to media reports, a Repsol-YPF source was quoted saying that the companies want to exchange their participation in Block 13 for a role in Blocks 20 or 21 due to rising development costs.

Other replacement candidates for the partners could be OAO Gazprom and certain Asian companies. As Iran has huge gas potential holding the second largest proven natural gas reserves in the world, the majors have been reluctant to shun it completely despite pressure from Iran to commit to a development date. The country has published proven natural gas in-place of more than 27.57 trillion cu m.

Respol-YPF and Shell had planned to develop Persian LNG on Tombak Island in partnership with National Iranian Oil Co. to export 16 million tonnes/year of LNG to Europe, Asia, and the Far East. The plant was to use two 8-million tonne/year trains and start operations in 2007 and then 2011 (OGJ Online, June 1, 2007). Other products included 1.5 million tonnes/year of LPG, 4.5 million bbl/year of condensate, and 200,000 tonnes/year of sulfur, using 2.8 bcfd of natural gas.

Processing Quick TakesConstruction begins on Nghi Son refinery in Vietnam

Construction has begun on Vietnam’s $6 billion Nghi Son refinery and petrochemical project in Thanh Hoa province, following directives issued by the country’s prime minister Nguyen Tan Dung.

At groundbreaking, Nguyen said the Nghi Son complex and the Dung Quat refinery, also under construction, will jointly meet some 60% of the country’s demand for petroleum products.

Output from the Nghi Son refinery complex is expected to reach 200,000 b/d, with products to include gasoline A92, A95, A98, diesel, kerosine, fuel for reaction engines, and paraxylene.

The Dung Quat refinery, the first of its kind in Vietnam, is slated to begin operating in February 2009, according to Truong Van Tuyen, head of the refinery’s management board.

Authorities plan to begin trial runs at the Dung Quat refinery later this month, with all tests due to be completed by August, according to a report in the Saigon Liberation newspaper.

Venezuela, Ecuador to seek bids for refinery

Venezuelan and Ecuadoran state-owned oil and gas companies Petroleos de Venezuela SA and Petroecuador plan to form a joint venture company to build and operate a 300,000 b/d refinery on Ecuador’s Pacific Coast.

Petroecuador said the planned Pacific Refinery-CEM, to be owned 51% by Ecuador and 49% by Venezuela, will ask foreign companies to bid on constructing the refinery, requiring them to finance 70% of its construction.

Petroecuador, which did not set a date for bidding to start, said the winner would be compensated after construction, possibly with a fee-for-service payment or a temporary share of the refinery’s earnings.

Last year, Ecuadorean President Rafael Correa said the proposed Pacific refinery, to be built in the coastal province of Manabi, would cost around $5 billion, increasing to $10 billion if the partners decided to add a petrochemical plant on the site.

Transportation Quick TakesOdessa-Brody oil line reversal nears completion

The Odessa-Brody oil pipeline will start carrying light crude oil in its originally-planned direction from the Caspian Sea toward Europe this summer, according to a senior Ukrainian official.

Oleh Dubyna, chairman of state oil and gas company Naftohaz Ukrayiny, expects the pipeline to carry Caspian crude by July, saying that state oil pipeline operator Ukrtransnafta already is purchasing 485,000 tonnes of light oil to facilitate the pipeline’s reversal.

The Odessa-Brody pipeline was originally built to transport light Caspian crude oil to Europe, but it has never operated as planned. Instead, it has worked in the reverse direction, carrying Russian oil to Odessa.

The planned reversal is part of a larger project aimed at extending the Odessa-Brody pipeline and using it to supply Europe with oil from the Caspian Sea region.

Last October, five former members of the Russia-dominated former Union of Soviet Socialist RepublicsAzerbaijan, Georgia, Lithuania, Poland, and Ukraineagreed to set up the so-called “Samartia” consortium (OGJ Online, Oct. 12, 2007).

Its goal is to enable transportation of oil from the Caspian Sea region, particularly Azerbaijan and possibly Kazakhstan, through Poland to markets in western Europe.

The countries in the Samartia consortium want to diversify Europe’s sources of oil. Most European countries rely heavily on supplies from Russia, but they fear that Russia could leverage its near-monopoly status for political advantage.

In April, oil company officials from Ukraine and Poland signed an agreement authorizing a feasibility study for a new oil network that would extend the Odessa-Brody pipeline from Ukraine to Poland.

The plan calls for the extension of the pipeline to the central Polish city of Plock, site of the country’s largest refinery, allowing new supplies to be shipped onward to Poland’s Baltic Sea port of Gdansk.

OTC: US must pay more to attract gas storage

US natural gas markets will have to compete in price in global gas markets if they expect to attract sufficient supplies into storage before the country’s gas withdrawal season traditionally begins on Nov. 1.

That was the main message of David Thames, president of Cheniere Marketing, as he spoke to a luncheon audience May 8, the final day of the Offshore Technology Conference in Houston. And he believes historically high prices for this time of the year suggest US markets will respond.

Arguing the primacy of LNG as the fuel most likely to fill the import demand, Thames cited the flat growth in domestic natural gas production despite rising gas rig counts and prospects for falling gas imports from Canada. The result, he said, will be a 5-8 bcfd deficit the US will face.

New shale plays will not be as productive as the Barnett has been, Thames said. Many are requiring years to reach modest levels of a few hundred million cubic feet/day.

LNG, on the other hand, as exemplified by Cheniere’s newly opened Sabine Pass terminal stands ready to send out large amounts of gas into storage or electric power market. Again, price is the key, Thames said.

Recent US prices have hit more than $11/Mcf, compared with contracts in Asia-Pacific nearing $20/MMbtu, as US markets respond to growing demand for gas.