BP energy outlook sees 41% rise in worldwide energy use to 2035

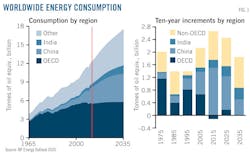

BP PLC's Energy Outlook 2035, released Jan. 15, forecasts that world energy consumption will increase 41% between 2012 and 2035. Countries outside of the Organization for Economic Cooperation and Development, especially China and India, are believed to contribute to virtually all of this growth.

Global energy intensity in 2035 is forecast to be 36% lower than what it was in 2012, while energy per capita use will increase by 14%.

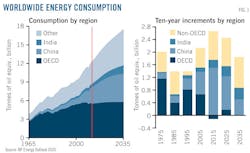

According to the outlook, all fuels experience growth, with the fastest in renewables (6.4%/year). By 2035, 14% of world electricity is from renewable sources, up from just 5% in 2012. Among fossil fuels, natural gas is fastest (1.9%/year), followed by coal (1.1%/year) and oil (0.8%/year).

Out to 2035, more than a third of global liquids will be supplied by the US, Russia, and Saudi Arabia. Natural gas supplies will reach nearly 500 bcfd by 2035, of which 20% will be from the US.

US production

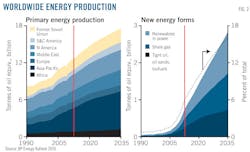

BP projects that, between 2012 and 2035, US energy production will rise 24%, significantly outpacing consumption growth of just 3%. By 2035, US will be energy self-sufficient by producing 101% of its energy needs, up from 69% in 2005.

Over the forecast period, consumption growth in natural gas (21%) and renewables in power generation (277%) offsets large decline in oil (–18%), coal (–12%) and nuclear (–17%) demand.

According to the outlook, natural gas will hold a 35% share of the US energy mix in 2035, replacing oil as the leading fuel in US energy consumption. Oil's share will fall from 36% to 29%. Fossil fuels still account for 80% of US energy demand in 2035, down from today's 85%. Renewables in power generation will increase to 8% from 2%.

Rising US production of oil (37%) and natural gas (45%) will outpace declines in coal (–20%). Tight oil output will triple to 4.5 million b/d in 2035. Shale gas production should more than double to 65 bcfd, reaching nearly 70% of the total.

European outlook

BP's projections on European energy markets are out to 2030. The region's energy demand is expected to rise just 5% by 2030, according to the outlook. And the region's energy intensity is expected to decline 29%.

Demand for fossil fuels declines 7% with losses in oil (–15%) and coal (–33%) overwhelming gains in gas (26%). Renewable demand expands 180%, rising to 13% of market share by 2030 from 5% in 2011.

European energy production is expected to drop 1%, according to BP's projection. Production of all fossil fuels will drop, led by oil (–50%), coal (–29%), and gas (–21%). Despite a 4% decline, nuclear power is forecast to overtake gas as the dominant domestic energy source for the region.

Import dependence increases from 46% today to 49% by 2030 and Europe will remain the largest net importer of natural gas in the world.

Chinese outlook

During 2012 to 2035, China's energy production is expected to rise 61% while consumption grows 71%, BP projects. The country's energy production as a share of consumption is expected to fall to 80% by 2035 from its current 85%, driving import dependence to 20% from 15%. BP expects that China's share in global demand will rise to 27% by 2035, and China will become the world's largest energy importer, exceeding Europe.

Among China's energy mix, coal's dominance is forecast to decline to 52% in 2035 from 69% today and natural gas is forecast to rise to 12%, while oil's share is expected to remain unchanged at 18%.

According to the outlook, China will overtake the US as the world's largest oil consumer by 2027. The country's oil and gas import dependences will be 76% and 41% in 2035, respectively, up from 57% and 25% in 2012.

Other BRIC countries

By 2035, India's energy demand growth of 132% will outpace each of the BRIC (Brazil, Russia, India, and China) countries, BP forecasts. India's demand for all fossil fuels will rise, led by gas (183%), oil (121%), and coal (108%).

India is expected to become increasingly import-dependent despite its gains in nonfossil fuel production. The country's oil imports are expected to rise 169%, accounting for more than 60% of the net increase in imports.

Brazil's energy production as a share of consumption is forecast to rise to 106% by 2035 from 92% today, transforming the country from an energy importer to an exporter. Fossil fuels will account for 54% of Brazilian energy consumption in 2035, compared with a global average of 81%.

Russia will remain the largest net exporter of energy, satisfying 4% of global energy demand by 2035. The outlook forecasts that tight oil production will commence post-2020 and gradually climb to 7% of the country's total by 2035.

Middle East outlook

The Middle East will remain the world's largest oil producing region, and its share of global supplies will expand to 34% in 2035 from 32% today, BP forecasts.

By 2035, oil production from the Middle East is expected to expand by 22%. The region will maintain its leading role as the world's top oil exporter, but the capacity to export is expected to decline, with 55% growth in domestic use through 2035. Its share of interregional exports will remain about 50%.