CO2 pipeline projects struggle to gain traction

A much larger pipeline network than that already used for enhanced oil recovery would be needed for carbon capture, storage, and sequestration (CCS) to meet national greenhouse gas reduction goals. Estimates published in April 2023 suggest that 30,000-96,000 miles of pipe could be required to meet net-zero goals by 2050, describing pipelines as the most cost-effective high-volume CO2 transportation option ($5-25/tonne).1 CO2 pipelines near the Gulf of Mexico and in other areas can be repurposed to deliver manufacturing-sourced emissions instead of those occurring geologically, but that will only meet part of this demand.

Meanwhile, several large CO2 pipeline projects proposed in the Midwest have encountered public opposition and regulatory headwinds, including denial of state siting permits. One project (Navigator CO2 Ventures LLC’s Heartland Greenway) has already been cancelled.

These development issues raise questions about the timely availability of pipelines for CCS and the potential federal role in CO2 pipeline expansion. States have primary siting jurisdiction for new CO2 pipelines, although federal approvals may be required for specific segments (e.g., across waterways).

CO2 pipelines in development

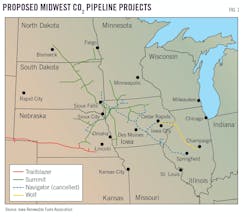

Since 2021, four large CO2 pipeline projects have been proposed in the Midwest which, collectively, would comprise more than 4,000 miles of line (Fig. 1). Three of the projects involve building new pipelines and one is a conversion.

• Summit Carbon Solutions LLC. Announced in February 2021, Summit’s 18-million tonne/year (tpy) Midwest Carbon Express pipeline would lay 2,000 miles of new CO2 pipeline across Iowa, Minnesota, Nebraska, North Dakota, and South Dakota to support CCS for regional ethanol plants.

On Aug. 4, 2023, North Dakota regulators denied Summit’s pipeline permit application (OGJ Online, Sept. 4, 2023), although on Sept. 15, they granted the developer’s petition to reconsider.

A little more than a month later (Sept. 11, 2023) South Dakota denied siting approval to Summit’s pipelines, with the developer responding by saying it intends to refile its application and remains committed to the project. Summit said it had reached voluntary easement agreements with 73% of the landowners along the project’s route at the time of South Dakota’s decision.

Some South Dakota counties passed ordinances requiring Summit to refine the pipeline’s path through the state, prompting the decision, which was accompanied by permission to reapply after routing has been adjusted. The company is in the process of doing so and now expects the system to begin operations in 2026 instead of 2024.

• Navigator CO2 Ventures LLC. Announced in March 2021, Navigator’s Heartland Greenway project planned to build 1,300 miles of new CO2 pipeline across Illinois, Iowa, Minnesota, Nebraska, and South Dakota under a similar scheme to Summit’s. South Dakota, however, denied pipeline siting approval on Sept. 6, 2023. Navigator subsequently asked regulators to suspend pipeline permit proceedings in Iowa and eventually announced cancellation of the entire project, citing “the unpredictable nature of the regulatory and government processes involved” (OGJ Online, Oct. 23, 2023).

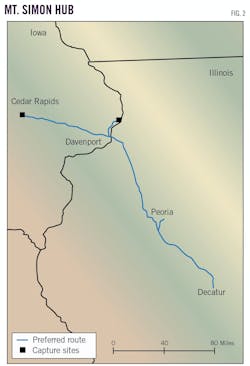

• Wolf Carbon Solutions US LLC. Announced in January 2022, Wolf Carbon Solutions’ 12-million tpy Mt. Simon Hub would use 280 miles of CO2 pipeline to provide dedicated transport of CO2 from Archer-Daniels-Midland (ADM) Co.’s ethanol and cogeneration sites in Clinton and Cedar Rapids, Iowa, to permanent underground storage at its fully permitted and already-operational sequestration site in Decatur, Ill. (Fig. 2). The pipeline would have sufficient spare capacity to also serve third-party customers. ADM has already stored more than 3.5 million tonnes at Decatur.

Wolf last month submitted a motion with the Illinois Commerce Commission (ICC) to withdraw its application. It intends to update and refile with the ICC in early 2024 (OGJ Online, Nov. 22, 2023).

• Tallgrass Energy LP. Announced in May 2022, the 10-million tpy Trailblazer Conversion Project would switch 392 miles of the existing Trailblazer natural gas pipeline to carry CO2 captured from ethanol production sites in Nebraska—including ADM’s corn-processing complex in Columbus—through Colorado to Tallgrass’ Eastern Wyoming Sequestration Hub.

Currently an interstate natural gas pipeline, Trailblazer is under the jurisdiction of the US Federal Energy Regulatory Commission (FERC). On Oct. 23, 2023, FERC issued an order approving the “abandonment” of Trailblazer for the purpose of conversion to CO2 service. FERC will no longer have regulatory authority over the pipeline after abandonment is completed.

CO2 pipeline opposition

In states where CO2 pipeline projects have been proposed, some parties favor their development, citing job creation, support of ethanol producers, and other economic factors. Other local groups, however, have opposed CO2 pipelines.

The North Dakota Public Service Commission summarized several reasons for opposition in its Summit permit denial: “Those testifying expressed broad concerns regarding eminent domain, safety, the policy of permanent CO2 sequestration and storage, setback distances, irreparable harm to underground [drainage] systems, impacts on property values, and the ability to obtain liability insurance.”

Other groups object to CO2 pipelines because they believe CCS perpetuates the use of fossil fuels, which they oppose, or because they believe federal funding for CCS would be better spent on other technologies, such as renewable energy.

CO2 pipeline safety is a particular concern. The Pipelines and Hazardous Materials Safety Administration (PHMSA) has long regulated the safe construction, operation, and maintenance of CO2 pipelines. But a 2020 CO2 pipeline rupture near Satartia, Miss., which required a local evacuation and caused 45 people to be hospitalized, prompted criticism from pipeline safety advocates about PHMSA’s existing regulations.

In May 2022, PHMSA announced a rulemaking to update its CO2 pipeline safety standards. It plans to publish a Notice of Proposed Rulemaking in June 2024, but has not set a date for a final rule.

On Oct. 3, 2023, 13 Members of Congress wrote to President Biden asking for “a moratorium on any federal permitting of new carbon pipelines and related infrastructure until PHMSA’s safety regulations are finalized.” The letter reasoned that since portions of the rule wouldn’t retroactively apply, a moratorium was needed to prevent pipelines from operating under outdated safety standards.

Meanwhile, cancellation of the Navigator project has heightened concerns about developing sufficient CO2 pipeline capacity, particularly considering the Biden administration’s recent announcements of financial support for regional hydrogen hubs and direct-air capture hubs, both of which would likely require CO2 pipelines. The Environmental Protection Agency’s proposed carbon pollution standards for fossil fuel-fired power plants also include CCS as a compliance option. Some analysts assert that the current siting regime “will be a significant problem if more interstate CO2 pipelines are built.”2

Given the siting difficulties projects have faced at the state level, proposals have been made to federalize interstate CO2 pipeline siting. In May 2023, the Biden administration urged Congress to “address the siting of...carbon dioxide pipelines and storage infrastructure and provide federal siting authority for such infrastructure.”3

The Energy Policy Act of 2005 governs the designation of energy corridors on federal lands and covers oil, gas, and hydrogen pipelines, and electric transmission lines. “Such corridors are also suitable for carbon dioxide pipelines and need to be expanded in legislation to cover both prospectively designated and previously designated corridors,” the administration added.

Some, however, may object to federalization of CO2-pipeline siting authority contending that pipeline development for CCS is relatively new and that steps can be taken—such as finalizing new safety regulations—to facilitate pipeline development without federal preemption.

References

- US Department of Energy, “Pathways to Commercial Liftoff: Carbon Management,” April 2023.

- Energy Futures Initiative, “Turning CCS projects in heavy industry & power into blue chip financial investments,” February 2023.

- The White House, “FACE SHEET: Biden-Harris Administration Outlines Priorities for Building America’s Energy Infrastructure Faster, Safer, and Cleaner,” May 10, 2023.

Adapted and expanded from Paul W. Parfomak, “Siting Challenges for Carbon Dioxide (CO2) Pipelines,” Congressional Research Service, Oct. 27, 2023.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.