LNG’s role expanding as IMO 2020 compliant bunker fuel

Ken Cowell

Ramin Lakani

Muse, Stancil & Co.|

London

Ajey Chandra

Muse, Stancil & Co.

Houston

The shipping industry is likely to pursue multiple solutions to meet the regulatory requirements brought about by International Maritime Organization (IMO) 2020 sulfur regulations while maintaining its profitability, including changing to LNG as fuel. To meet IMO 2020 requirements, a large portion of ships initially have switched to very low sulfur fuel oil (VLSFO) or marine gas oil (MGO), with resultant considerable increases in their fuel bills. A small but increasing percentage have instead installed scrubbers to be able to continue to burn lower cost high-sulfur fuel oil (HSFO).

The advantage of LNG is not only that it can help operators meet sulfur content limits (as it is effectively sulfur free) but also that it could be a key part of IMO’s efforts to decarbonize the shipping industry in the long term. But to gain a larger part of the marine fuel market, it needs to overcome currently limited infrastructure and ensure it can compete with VLSFO on a cost basis.

Background

LNG has been used as a marine fuel for many years, although mostly via use of cargo boil-off gas as fuel for LNG tankers. The number of other vessels fueled by LNG has increased in recent years, despite limited LNG bunkering infrastructure and technical obstacles for the ship owners.

Incentive to use LNG as a bunker fuel increased after IMO decided to reduce the maximum sulfur content for marine bunker fuel for use outside emission control areas (ECA), such as the North Sea, to 0.5 wt % from 3.5 wt % effective Jan. 1, 2020. Since this October 2016 decision, both LNG suppliers and ship owners have sought to raise LNG’s role in the marine fuel business.

A major element of IMO’s program for the shipping industry, driven by the shift in public opinion towards greener energy solutions, is to put in place regulations to improve the environmental performance of the marine sector. In terms of flue-gas emissions from ships, IMO’s initial focus was on the progressive reduction of sulfur oxide emissions, of which the IMO 2020 regulations were the latest stage.

Growing concern regarding climate change has led IMO to now focus on decarbonization of the marine industry to reduce greenhouse gas (GHG) emissions and ultimately to reach net zero emissions. The use of LNG as a bunker fuel has considerable potential, both as a virtually zero-sulfur fuel to meet IMO 2020 and as a partial solution, and at least an interim step, in reducing carbon emissions.

Many problems, however, face LNG in the bunker fuels market and its use is still quite small; less than 0.5% of the global maritime fleet is currently running on LNG.

This article focuses on the hurdles LNG faces as a serious player in the marine fuels market and its opportunities for future growth.

IMO 2020 regulations

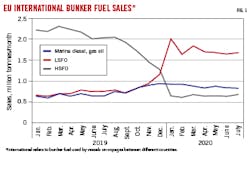

IMO 2020 regulations require the sulfur content of marine bunker fuel for use outside ECAs to be less than 0.5 wt %, except for vessels fitted with flue gas scrubbers for removal of sulfur oxide, which can continue to burn 3.5-wt % sulfur fuel oil. Fig. 1 shows data (Jan. 2019-July 2020) from the European Union’s (EU) statistics agency (Eurostat) for international marine bunker fuel consumption in EU ports, by type: low-sulfur fuel oil (LSFO), HSFO and MGO. All Eurostat-reported LSFO bunker fuel volumes are IMO 2020 compliant VLSFO.

Key points shown in Fig. 1 include:

- HSFO bunker consumption declined to an average of about 600,000 tonnes/month for the first 6 months of 2020 from more than 2 million tonnes/month in early 2019, showing the impact of IMO 2020 on high-sulfur fuels. The decline in HSFO’s use was more than 70% while global demand for all bunker fuels dropped by only 11% in the same period, indicating the additional impact of IMO 2020 on HSFO demand.

- LSFO (actually VLSFO) bunker consumption increased to a peak of more than 2 million tonnes/month in January 2020 from an average of 665,000 tonnes/month in first-quarter 2019.

- MGO consumption increased to a peak of almost 950,000 tonnes/month in December 2019. from an average of 640,000 tonnes/month in first-quarter 2019.

Total marine bunker fuel consumption in EU ports declined to 3.18 million tonnes/month in second-quarter 2020 from an average of 3.55 million tonnes/month in first-half 2019, mostly because of the effects of the global COVID-19 pandemic.

The approaching IMO 2020 deadline had a significant impact on bunker fuel purchasing choices made by ship owners and operators starting in late third-quarter 2019 and particularly in fourth-quarter 2019 and continuing into first-quarter 2020.

The data indicate that most operators chose to switch fuel from 3.5%-sulfur HSFO to 0.5%-sulfur VLSFO. When the IMO 2020 changes were initially proposed, there was concern in the shipping and oil refining-fuel oil blending industries that sufficient volumes of VLSFO might not be available to meet forecast 0.5-wt % sulfur demand. It appears since, however, that efforts by oil companies and blenders to develop formulations meeting IMO 2020 requirements have been successful in the European market.

A smaller number of ship operators chose to switch to MGO. The decision to use MGO was likely driven in many cases by the convenience of not having to switch fuels when sailing into and out of ECAs (i.e., meeting the stricter 0.1-wt % sulfur specifications).

By first-half 2020, the European market for HSFO bunkers dropped to less than 30% of its level in first-half 2019. Continued HSFO bunker sales are now to the limited number of large vessels fitted with flue-gas scrubbers.

Total consumption of marine fuel oil plus MGO declined by a little more than 10% from first-half 2019 to second-quarter 2020. This reduction was due to the impact of the COVID-19 pandemic on vessel and cargo movements rather than any significant substitution of other fuels such as LNG.

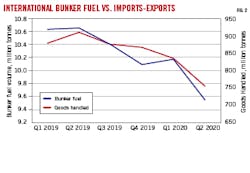

Fig. 2 compares Eurostat data for cargo movements in terms of the total tonnage of goods imported and exported through major European ports versus total marine bunkers supplied at EU ports. Bunker-fuel consumption data follow the trend of goods handled reasonably well, and by inference, the number of vessel movements in and out of major EU ports, particularly the sharp decline from first-quarter to second-quarter 2020 as the impact of COVID-19 became more severe. This trend, however, is expected to reverse by end-2021 as the impact of the pandemic on the world economy is reduced, with an expectation that by the end of 2022 global trade, and therefore bunker fuel demand, will come back to 2019 levels.

The dip in bunker fuel consumption in fourth-quarter 2019 was due to vessel operators intentionally depleting fuel stocks aboard ships in preparation for the switch from HSFO to VLSFO-MGO from Jan. 1, 2020.

LNG bunker fuel

LNG has not had a significant impact on the changes in EU marine bunker fuel supply as a result of IMO 2020 to date due to the limited number of vessels using LNG as fuel and the still relatively limited, although growing, LNG bunkering options available in European ports. The bunker fuel supply chain has shown that it can provide sufficient volumes of VLSFO to meet IMO 2020 compliance and many ship owners have either switched to VLSFO or installed scrubbers to allow them to continue to burn HSFO. Both methods have allowed operators to comply with IMO 2020 sulfur-reduction regulations.

IMO’s next environmental objective, to significantly reduce GHG emissions from the marine transport sector, however, will provide an incentive to vessel owners and operators to switch to LNG as a fuel, particularly for new-build ships. IMO’s stated targets are to reduce CO2 emissions from shipping operations by at least 40% by 2030 and 70% by 2050. The comparisons will be against 2008 emissions, with a 50% reduction in total GHG emissions by 2050.

LNG boil-off gas has been used as a fuel on LNG tankers for many years but LNG’s use by other vessels is a quite recent development. The rate of increase in LNG bunkers consumption has been constrained by shipowners being reluctant to commit due to the limited availability of LNG bunkering infrastructure, while at the same time bunker suppliers have been reluctant to invest in LNG infrastructure until sufficient LNG-fueled vessels are in operation.

Many of the vessels first built or converted to operate on LNG bunkers were ferries operating within or between Scandinavian countries on fixed routes. For these services, a secure supply of LNG at the vessel’s home ports was sufficient to support a feasible bunkering operation. This type of operation only requires a small-scale natural gas liquefaction plant supplied by the gas grid, with LNG then transported to the port by road tankers for shore-to-ship bunkering.

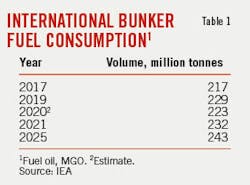

The total international bunker fuel market is greater than 200 million tonnes/year (tpy). International Energy Agency (IEA) data for 2017 and 2019, as well as IEA estimated 2020 consumption and forecasts for both 2021 and 2025 are shown in Table 1.

Domestic marine fuel adds a further 55-60 million tpy to total global marine bunker fuel consumption. As can be seen from the data for Europe (Fig. 2) and the global data (Table 1) the COVID-19 pandemic has caused less than a 5-10% reduction in fuel oil demand. This is in stark contrast to the airline industry, which has experienced a 70% drop in jet fuel (kerosine) demand in the same period.

Post-pandemic, LNG bunker fuel consumption is expected to grow significantly, as the number of LNG-fueled vessels increases and infrastructure is developed. One of the drivers of this growth is the increasing involvement of major energy companies in the supply of LNG bunkers and collaboration between energy companies and ship owners to develop the market; for example, Royal Dutch Shell and Carnival Cruise Line, as well as Total SE and container-ship operator CMA CGM.

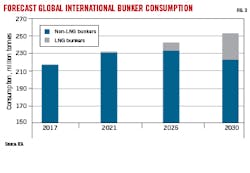

The IEA data for LNG use as marine fuel in 2017 recorded only 130,000 tonnes, split roughly evenly between international and domestic bunkers. The consensus view of industry participants is that consumption will increase to about 1 million tpy globally in 2021, then to 9-10 million tpy in 2025 and close to 30 million tpy in 2030. This growth will be driven by increasing numbers of new-build vessels designed as LNG- or dual-fueled. Estimates of the current number of LNG-fueled vessels vary but are typically around 200, with an expectation that this number will increase by a factor of 5-10 by the end of the decade. Fig. 3, however, shows that the forecast LNG bunker volume would still be only about 10-12% of forecast marine bunker fuel consumption by 2030 at current growth rates.

The forecast increase in LNG bunkering will require a substantial addition to the LNG bunkering vessel fleet. The number of LNG bunkering vessels in operation globally has grown from only 6 in early 2019 to 15 by the end-2020, with an estimated 25 under construction or on order for delivery by 2022.

Key drivers

The IMO 2020 regulations, reducing the maximum sulfur content in marine bunker fuel to 0.5 wt %, were applied globally from Jan. 1 2020 (while inside ECAs this limit was already reduced to 0.1 wt %) and were the key driver for change in the bunker fuels market.

In general, ship owners had three main options to meet the requirements of IMO 2020 bunker fuel sulfur emission regulations, and the choice of fuel continues to dominate investment decisions. These choices are:

- Fit flue-gas scrubbers to remove sulfur oxides, while continuing to burn HSFO.

- Buy 0.5%-VLSFO or MGO distillate fuel.

- Switch to using LNG as a marine fuel.

Shipping industry experts estimate that about one-third of the global fleet could be fitted with scrubbers by 2030. The number of vessels with scrubbers by January 2020 was relatively small, estimated by some shipping experts at 2,000 to 3,000 (i.e., around 5% of the global maritime fleet), limiting the size of the market for HSFO bunkers to a small proportion of the current marine bunker fuel volume (Fig. 1).

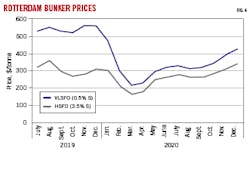

In January 2020, with IMO restrictions coming into force, the ocean shipping industry was mostly focused on fuel oil issues, both in terms of sufficient supply of compliant low-sulfur fuel and in terms of its price. Prices spiked from third-quarter 2019. The COVID-19 pandemic, however, led to a significant drop in the price of crude oil and as a result both outright marine fuel prices and the price differentials between HSFO and VLSFO collapsed. Fig. 4 shows the change in fuel oil prices and differentials between VLSFO and HSFO marine bunkers in Rotterdam from mid-2019 (when market quotations for VLSFO became readily available) to December 2020.

The very large price spread between VLSFO and HSFO bunkers for the second half of 2019, averaging more than $200/tonne, was clearly driven by the scramble by bunker blenders and shipowners to buy VLSFO to turnover tank inventory and have only IMO 2020-compliant fuel in-tank as of Jan. 1, 2020.

The differential had already started to narrow in January-February 2020 as the bunker market stabilized, before the pandemic had its full impact on the world economy. The subsequent fall in absolute crude oil and fuel oil prices and decline in bunker fuel demand due to COVID-19 closed that spread further to around $50/tonne during second- and third-quarter 2020. The tentative economic recovery at the end of 2020, with increasing crude prices, product prices, and bunker consumption, increased the VLSFO-HSFO bunker price differential to more than $80/tonne in December 2020.

Crude prices have been steadily rising as global oil demand begins to recover and supply continues to be managed by the Organization of Petroleum Exporting Countries and 10 other countries, including Russia (OPEC+). As a result, the price of marine fuel and the price spread between VLSFO and HSFO fuels have increased and scrubbers are becoming more economically attractive again.

Factors influencing the decision by a shipowner on whether or not to fit scrubbers include:

- Strength of the VLSFO-HSFO differential, which must remain sufficient over the long-term to provide an economic justification.

- Engineering to handle the required revamps and new-build scrubbers in a timely manner and at reasonable cost.

- Cost of having the ship out of service and in dry dock for installation of a scrubber.

- Vessel suitability for scrubber installation and its impact on cargo capacity and operating costs.

When faced with these factors, most ship owners have decided to avoid scrubber installation and instead have switched to burning VLSFO or MGO to remain compliant with IMO 2020 sulfur regulations for the time being. The main uncertainty in pursuing this tack is the price differential between VLSFO-HSFO, which has changed significantly over the short period of time in which VLSFO has been available (Fig. 4).

Additional uncertainty for future marine fuel quality and consumption centers around IMO’s Apr. 13, 2018, announcement that the shipping industry will be committed to a 70% reduction in CO2 emissions and 50% reduction in total GHG emissions by 2050, with policy being developed in the early 2020s. Before the impact of changes in the bunker-fuel sulfur specification have had a chance to be fully understood by the market, an additional change will have to be addressed, highlighting the continuous environmental pressures faced by the shipping and energy industries.

Selecting LNG as a marine fuel allows vessels to comply with IMO 2020 sulfur regulations (as LNG is effectively sulfur-free) while also reducing CO2 emissions compared with marine fuel oil and MGO, moving in the direction of compliance with expected future IMO restrictions. A ship owner either investing in a new vessel or in refurbishing an existing vessel must think about a 20-year window, as ships stay in service for long periods.

LNG, however, is not the only alternative fuel that could meet these requirements. Other fuels being considered have even greater potential to reduce CO2 emissions. These alternatives include methanol, hydrogen, ammonia, LPG, and HVO (hydrogenated vegetable oil or biodiesel). However, most of these alternative marine fuels are either at an experimental stage, lack the required supply volumes, or are in demand in other sectors (e.g. LPG is a key petrochemical feedstock and is used in home heating and cooking).

LNG as a marine fuel has distinct advantages. Global availability has been increasing steadily over the past decade with the addition of new suppliers such as the US and Mozambique and expansion of projects from traditional producers such as Russia. As a result, the price of LNG is quite competitive compared with LSFO (Table 2). Note that these are LNG and fuel oil cargo prices and do not include the cost of delivering either fuel to the ship.

LNG’s heating value on a weight basis is much higher than HSFO-VLSFO-MGO: 50-55 MMbtu/tonne versus 39-42 MMbtu/tonne. On the other hand, one of the advantages of liquid fuel oil is its volumetric energy density, which is 75% higher than LNG. This means that, as an energy medium for combustion engines, LNG is much lighter than fuel oil but also takes up more space. This is one of the main problems facing LNG as a ship fuel, affecting the infrastructure requirements of the whole LNG value chain (i.e. storage onshore at the ports as well as on the ships).

These are the key factors complicating LNG’s use in the bunker fuels market:

- Supply side infrastructure. Ability to provide LNG to ports in manageable parcels as most ports cannot store the contents of an entire traditional LNG carrier. LNG suppliers are building LNG bunkering vessels so that smaller parcels of LNG can be supplied to different ports.

- Cost of localized liquefaction. Make mini-LNG projects competitive such that pipeline gas could be used to provide LNG at key ports (already the method used for LNG supply to several ferry services in Scandinavia).

- LNG storage at ports. LNG’s low temperature requires expensive metallurgy for LNG storage tanks.

- Ship conversion. Converting existing vessels to store and burn LNG is complex and not many ships have been converted.

- New ships with LNG as fuel. The cost of cryogenic storage on these ships needs to be reduced to encourage a switch to LNG.

- Gas leakage. Methane is a more damaging GHG than CO2. Methane leakage from LNG-powered ships requires close scrutiny.

The authors

Ken Cowell ([email protected]) is managing director, Europe, at Muse, Stancil & Co. He has a BS in chemical engineering and 40 years of experience in the oil industry. Before joining Muse he worked for BP and Mobil for more than 20 years in a wide range of refinery operations, technical, supply, distribution, and trading positions. Since joining Muse in 1996 he has completed technical and valuation assignments for various midstream and downstream assets in Europe, the Former Soviet Union, Africa, the Middle East, and the Asia Pacific.

Ramin Lakani (rlakani@musestancil) is a partner at Muse, Stancil & Co. based in London with 30-years experience as a consultant in upstream, midstream, and downstream projects. He has previously worked for Esso Petroleum, Premier Oil, BG, Shell, Schlumberger, PetroCanada, GCA, Halliburton, and HARPS Marine. A chartered engineer, he holds a B.Eng in chemical engineering from University College London, an M.Sc. in petroleum engineering from Imperial College London and an executive leadership degree from Texas A&M Mays Business School.

Ajey Chandra ([email protected]) is a director of Muse, Stancil & Co. in the Houston office. Chandra joined Muse in 2014 after 28 years of experience in various facets of the midstream industry, including operations, engineering, business development, management, and consulting. His operating, consulting, and management experience includes working at Amoco, Purvin & Gertz, Hess, and NextEra Energy Resources. Chandra has a BS in chemical engineering from Texas A&M University and an MBA from the University of Houston.