INDEPENDENT RESEARCH firm IHS Markit has provided OGFJ with updated production data for the OGFJ100P periodic ranking of US-based private E&P companies. The rankings are based on operated production only within the US.

Top 10

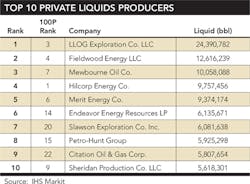

There is some movement in the Top 10 in this installment when compared to the October 2016 issue. The biggest mover is Vine Oil & Gas LP. The company has maintained an ambitious development plan in a weak natural gas price environment. The Plano, TX-based company's Haynesville drilling program has helped move the company into the Top 10 overall by BOE (at No. 10), and lift its position from No. 9 to No. 6 in top gas producers. Coming in at No. 13 by overall BOE, Indigo made its way into the Top 10 gas producers list, nudging Sheridan Production Co. LLC out. Sheridan maintains its No. 9 seat in overall BOE. As for the top liquids producers, the updated data shows Merit Energy entering the Top 10 at a healthy No. 5. The company is ranked No. 6 by overall BOE. Petro-Hunt Group dropped three spots in the liquids producers list to No. 8, and Hunt Oil Co. dropped out of that list after its No. 9 showing in October.

M&A

One large transaction in the private company space since the October installment was that by privately-held Indigo. The company, coming in at No. 13 by overall BOE in this installment, purchased a portion of Chesapeake Energy's acreage and producing properties in the Haynesville. The $450 million deal includes approximately 78,000 net acres and includes 250 wells currently producing approximately 30 MMcf/d. In an email to OGFJ following Chesapeake's announcement, Indigo chairman and CEO, Bill Pritchard, confirmed that Indigo, through affiliate Indigo Haynesville LLC, is purchasing the assets. Pritchard expects the deal to close on January 13.

In late November, Krewe Energy LLC completed an acquisition with No. 1-ranked Hilcorp Energy. Covington, LA-based Krewe purchased Hilcorp's West Little Lake Field assets located adjacent to Krewe's currently operated Little Lake Field assets in Jefferson Parish, Louisiana. The acquisition increased Krewe's lease position in the area to approximately 2,200 acres.

The buy comes on the heels of another Louisiana purchase by Krewe. In early October the company announced it had completed the acquisition of the remaining working interest in the Lapeyrouse Field in Terrebonne Parish, Louisiana. At the time of that announcement, Krewe's field study had uncovered a variety of work-over and recompletion opportunities. The company has initiated an ongoing work-over program and production in the field has increased from a rate of less than 100 barrels of oil equivalent per day (boe/d) at the date of acquisition, to the more recent rate of 500 boe/d.

Krewe was formed by Houston, TX-based Sage Road Capital together with Krewe Energy's founders, Tom De Brock and Barry Salsbury, in 2013.

In mid-October, Tulsa, OK-based Casillas Petroleum Resource Partners LLC closed on a deal involving Oklahoma assets from Continental Resources. The privately-held company, a partnership between Casillas Petroleum Corp. and Kayne Anderson Energy Funds, closed on the purchase of certain oil and gas assets in the SCOOP play for an adjusted purchase price of $294 million. The assets include net production of 550 boe/d and approximately 30,000 net acres (90% HBP) in Garvin, Grady, and McClain counties.

Greg Casillas, president and CEO of Casillas, said the bolt-on acquisition is a strategic fit for the company as it continues to build its contiguous, held-by-production, and operated position in the SCOOP where the company now holds over 42,000 net acres with development potential in the Woodford and Springer shales.

In another early fall deal, Permian players Double Eagle Lone Star LLC and Veritas Energy Partners Holdings LLC agreed to merge. The newly combined company, Double Eagle Energy Permian LLC, holds more than 63,000 core Midland Basin net acres (over 70% operated) located predominantly in Midland, Martin, Howard, and Glasscock counties.

Vinson & Elkins LLP acted as legal advisor and Jefferies LLC acted as financial advisor to Double Eagle, and Latham & Watkins LLP acted as legal advisor and Tudor, Pickering, Holt & Co. acted as financial advisor to Veritas Energy.

A short time later, in November, Magnetar Capital agreed to invest up to $450 million of equity and delayed draw unsecured debt capital to support additional Midland basin acquisition opportunities by Double Eagle Energy Permian, as well as to accelerate the company's operated drilling program.

Bankruptcy

One privately-held company, Bennu Oil & Gas, filed Chapter 7 bankruptcy in a Houston court at the end of November, noting plans to liquidate. Prior to the filing, the company held $10 million to $50 million in assets and faced $500 million to $1 billion in liabilities, according to a Wall Street Journal report dated December 1.

IPO

In mid-December, WildHorse Resource Development opened for trading on the NYSE at $15.70 after pricing 27,500,000 shares of its common stock at $15.00 per share. Net proceeds of approximately $391.7 million, along with borrowings from the company's revolving credit facility, are expected to help fund the remaining portion of the Burleson North acquisition purchase price, repay and terminate the existing revolving credit facilities of its subsidiaries, and repay in full all notes payable by one of its subsidiaries to its prior owners.

Barclays, BofA Merrill Lynch, BMO Capital Markets, Citigroup and Wells Fargo Securities are acting as book-running managers for the offering.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.