Diamondback sticks to production target in market that ‘remains volatile at best’

[Updated Nov. 5, 2024, to correct the attribution of a quote to Kaes Van't Hof.]

Diamondback Energy Inc., Midland, is sticking with its early year production forecast now that it has completed the $26 billion purchase of Endeavor Energy Resources. The operator also has agreed to an asset trade with TRP Energy that will add about 15,000 net acres to its core Midland basin holdings.

Production forecast

Diamondback wrapped its Endeavor acquisition on Sept. 10 and the two organizations’ teams have been merging operations. When the deal was announced in February, chairman and chief executive officer Travis Stice and his team expected that the combined company would produce about 810,000 boe/d next year. The company reiterated that forecast Nov. 5, saying production should be 800,000-825,000 boe/d (475,000 b/d oil) (OGJ Online, Feb. 12, 2024).

One reason for production remaining level, Stice wrote in a letter to investors, is an oil market that “remains volatile at best and tenuous at worst.” Rather than plan for notable production increases in 2025 and beyond, he and president Kaes Van’t Hof said Diamondback will focus on efficiency gains from Endeavor as well as their own operations. Committing to larger investments in production, they said, will be counterproductive in a tricky demand environment.

“The lowest-cost operator should be producing the last barrel,” Van’t Hof said. “But that spreadsheet math has gotten us in trouble in the past and it feels like we’re getting ourselves in trouble again.”

Cases in point on efficiency: The company simulfrac crews completed an average of nearly 4,000 lateral feet per day during the third quarter—30% more than forecast at the beginning of the year—and executives now expect they’ll be able to hit 2025 production target with about 18 rigs rather than the 22-24 they had expected.

Third-quarter stats, asset swap

Diamondback produced a net profit of $708 million in the third quarter, down from $993 million in the same period of 2023, as revenues rose 13% to nearly $2.65 billion. Production during the quarter averaged 571,100 boe/d (321,100 b/d of oil), which includes 3 weeks of Endeavor output. The company’s teams drilled 71 gross wells in the Midland basin and 5 in the Delaware basin during the period and turned to production 87 and 8 wells, respectively, in those areas. Completions were up from a combined 86 in the second quarter (OGJ Online, Aug. 6, 2024).

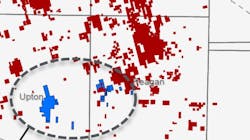

Despite being cautious about production growth, Diamondback leaders are considering deals. The operator signed an agreement to send about 33,000 net acres in the Delaware basin as well as nearly $238 million to TRP Energy, Houston, in exchange for about 15,000 acres in the Midland basin (See map above). The Delaware basin assets produce about 9,000 b/d; those Diamondback is acquiring about 11,000.

Stice said the agreement, which is expected to close next month, is an example of how a larger Diamondback can “play offense in our backyard” and improve its inventory position. The TRP acreage comes with 55 remaining undeveloped operated locations.

Shares of Diamondback (Ticker: FANG) fell about 2% to $176 and change after executives’ earnings report and conference call. They have lost a little more than 10% of their value over the past 6 months, trimming the company’s market capitalization to about $51.6 billion.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.