Egypt: New Directions

THIS SPONSORED SUPPLEMENT WAS PRODUCED BY FOCUS REPORTS.

Publisher: Diana Viola

Project Director: Carla Verdera Mateu

Coordinator: Karen Xi

Contributor: Jun Wakabayashi

Senior Editor: Louis Haynes

Editor: Patrick Burton

Graphic Design: Miriam León, Laura Breitfeld

Cover illustration: Miriam León

For exclusive interviews and more info, please log onto www.energyboardroom.com or write to [email protected]

Egypt enjoys a long and distinguished legacy in hydrocarbons; despite never being the largest producer in the region, it has always garnered the interest of the global industry.

In recent years, however, the country has been beset by political instability with numerous crises of leadership, fueled by the Arab Spring revolutions, setting back national development and severely disrupting economic progress. The petroleum sector, representing two-thirds of Egypt’s FDI in 2016 (BNP Paribas May 2017 report), was thus hit by the double whammy of domestic turmoil and the global oil price rout.

With Egyptian President H.E. Abdel Fattah El Sisi at the helm in the past two years, however, the country has witnessed some welcome return to normalcy, while the sector has drawn fresh energy from the 2015 Zohr supergiant gas discovery in the offshore Mediterranean. With other big-ticket initiatives like BP’s West Nile Delta and Siemens’ Egypt Megaproject coming onstream in 2017, and a wildly successfully inaugural Egypt Petroleum Show (EGYPS) in February, Egypt is certainly hoping to ride the momentum into a new era of energy prowess.

As H.E. President Sisi astutely proclaims, “Energy represents a crucial catalyst to realize sustainable development.” With the sector designated a national priority, the Minister of Petroleum and Mineral Resources, H.E. Eng. Tarek El Molla, is personally spearheading an ambitious Modernization Program to transform the entire sector with the ultimate goal of ful lling the country’s much touted potential as a regional energy hub.

Lifeblood of the Economy

Minister Molla expresses this inextricable relationship between the petroleum sector and national development thusly: "[my] fundamental mandate is, on one hand, to secure petroleum products for the Egyptian people, and on the other, to take into consideration broader societal aspects like social equality, the empowerment of Egyptian people, and the optimization of the current oil and gas infrastructure of the sector in Egypt."

The idea, he continues, is to render "our oil and gas sector like any other oil and gas sector in the world, where the Ministry is the policy-maker, the NOCs focus purely on production, optimization and their profitability, and there is an independent regulator overseeing the market. This is the set-up we expect to see in Egypt by 2021."

The upstream sector in Egypt has been notable for the activity that persisted throughout the oil price crash at a time when most major oil markets were compelled to curtail their E&P activities significantly. Nevertheless, the sector faces its own unique set of challenges, among which the most outstanding remains the significant arrears accumulated by previous governments to IOCs standing at USD 3.5 billion in March 2017, as well as the decision taken by the Egyptian government to float the Egyptian pound in November 2016 - which, while a critical and overdue measure required to boost Egypt's economy - saw the currency's value fall by 125 percent against the dollar almost overnight, hitting the local sector hard.

But as Shell VP Gasser Hanter marvels, "The market liberalization and economic reforms that have taken place … are key milestones we have all been awaiting for quite some time. The six pillars highlighted for reform clearly show that the industry has been consulted, as they directly address various issues within the Egyptian market today."

Put more simply, "The reforms the government has implemented are extremely brave. Egypt is becoming a land of opportunities ... not just for oil and gas but industry in general," excitedly assesses David Chi, VP of Apache Egypt, the largest American investor and the largest oil producer in Egypt.

Putting the E and P back into Egypt

Egypt has never been a top producer, though its openness to foreign investment, willingness to collaborate and diversity of producing basins have ensured it has always punched above its weight in E&P. Abed Ezz El Regal El Mallahy, CEO of the Ministry's main executive arm, Egyptian General Petroleum Corporation (EGPC), emphasizes that "Egypt has maintained outstanding and long-lasting relationships with our international partners for over a century. We remain open to all investors and all companies … as a trusted and supportive partner." Egyptian National Gas Holding Company (EGAS) Chairman and CEO Osama Elbakly concurs: "We have significant partners already in Egypt and we are keen to build a diversified petroleum sector, which requires the participation of a broad spectrum of international companies" … this means "focusing on maintaining win-win relationships with our partners."

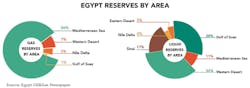

Egypt's domestic demand continues to grow voraciously so despite the low oil price, exploration still remains a top priority. Elbakly affirms, "The hydrocarbon business is a direct function of how much exploration is being done." The 2015 Zohr supergiant discovery in the Shorouk concession in offshore Mediterranean was an eye-opener for the world regarding the scale of offshore potential in Egypt, but Eng. Elbakly demurs, "the Zohr discovery is merely the first step in a much larger process. Egypt's upstream proposition is really the potential of the entire country as a complete package."

No one appreciates this better than BP, which has invested over USD 10 billion in the past few years and is running another high-profile development, the West Nile Delta (WND) project. BP's CEO, Bob Dudley, proclaimed the Nile Delta "a world-class basin" at EGPYS 2017 and was vindicated only a month later when BP made their third gas discovery in their North Damietta concession. As Regional President Hesham Mekawi enumerates, "Roughly a quarter of the group's total worldwide spend … and a third of BP's Upstream budget worldwide is in Egypt. Last year, this year and probably next year, Egypt is the highest receiver of funds within the Group."

Part of BP's staunch confidence in Egypt comes from the fact that "there is collaboration at the highest levels of management. For instance, the Minister himself chairs a steering committee that oversees the WND progress through regular meetings." This personal attention has reaped rewards: two WND fields, Taurus and Libra, came online in May under budget, almost eight months ahead of schedule and higher-than-expected rates. This is not an isolated case; in their Noorus project, BP along with their partner ENI, shot from essentially zero production in a dying field in August 2015 to 930 million cubic feet (mcf) per day today, only 1.5 years later! Hesham concludes, "BP is an excellent partner to support Egypt because we have proven ourselves to be able to deliver results efficiently and quickly." Against this backdrop of success, "we expect to be the largest gas producer in the country within the next few years."

Other IOCs are similarly bullish about investment opportunities in Egypt. As VP North Africa and Middle East Operations for Edison, Nicolas Katcharov, explains, the company has invested significantly in new, rather complex E&P projects in 2017, such as North Port Fouad, their first deepwater concession in Egypt promisingly located adjacent to the Zohr field in the Mediterranean. The hope is that by 2020, the world will see "Edison announcing a major discovery in the East Mediterranean."

Edison is making this bet despite the low Brent price due to the strategic profile of their regional assets: "There is huge potential in the Eastern Mediterranean, not just in Egypt but in neighboring countries … If we confirm a discovery in our Eastern Mediterranean concessions, we will be building new infrastructures and expanding existing ones, which could then be used to bring the hydrocarbons from all surrounding fields, whether in or out of Egypt."

This vibrancy is founded on a history of innovation. Baker Hughes country director Sameh Hussein exults, "it was our drill bit that was used to drill the first well [in Egypt] in 1910. Over the past century, we have grown our footprint significantly by tapping into the local talent pool, expanding our product lines and service portfolio here, and learning from past projects." As a result, "there is a huge role for Baker Hughes to support the mega offshore gas projects currently being undertaken in Egypt."

While offshore gas has dominated headlines in the past few years, oil producers have struck gold in the Western Desert, an area spanning two-thirds of Egypt's land mass. This is where Apache has established a veritable kingdom of 4.8 million gross acres in 23 separate concessions over the past two decades. In line with other players, Apache has increased its investment level for Egypt in 2017 with the trend expecting to continue on the basis of past solid performance. Apache's Chi boasts, "I am proud that Apache Egypt was able to deliver on all performance metrics in 2016, where we managed to exceed our production goals while managing our costs ... because we reacted faster than others and maintained capital discipline in a very challenging price environment."

Revitalizing Egypt's Mature Fields

Large-scale greenfield developments in the offshore Mediterranean have hogged headlines but as Chairman of the Petroleum and Mining Chamber Tamer AbuBakr suggests, "Egypt's oil and gas landscape is very dynamic." The lion's share of Egypt's oil production used to come from the Gulf of Suez but it is today a mature basin with declining rates. Nevertheless, it would be unwise to disregard it as potential payoffs of implementing EOR techniques are huge, as IPR, an American-Egyptian integrated petroleum company with a stellar track record, can testify. Chairman and CEO, Dr. Mahmoud Dabbous, explains, "Our entrance into Egypt began with a big onshore field in the Gulf of Suez, Ras Gharib … which in 1981 was depleting so much that it had been marked for decommissioning within the next few years. We implemented the first EOR demonstration project in Egypt with steam injection and unconventional gas injection [and] this field is today still in production. This project has since helped recover hundreds of millions of barrels more for Egypt."

Spurred by this buoyant success, IPR is today a global exploration and production (E&P) company, producing in total over 55 million bboe in Egypt - "around 25 million of which would have been otherwise unproduceable, adding no less than USD 1 billion to the Egyptian economy", Dr. Dabbous stresses.

As maturing fields consume investment continuously, it is important to keep a tight rein on operating costs. "Adjusting to USD 50 oil was not too difficult for us as we have a history of managing low cost operations by optimizing all activities," asserts Dabbous. "Taken as a whole, Egypt offers a very attractive package that stands out within the region: profitable operations, established industry and mature leadership," he concludes.

As general manager of DEA, another veteran actor in the Gulf of Suez, Dr. Thomas Radwitz echoes these sentiments, "mature fields require continuous investment to maintain production levels and to carry out the required maintenance of the equipment and facilities." In response, DEA is "testing new well intervention techniques and installations to reduce workover cost … like new downhole sand control measures in the wells, which we have not done in Egypt before."

Unsurprisingly, all actors agree that mature basins should not be overlooked. David Thomas, CEO of PICO Cheiron, an established mature field operator, emphasizes the need for more attention to be paid to mature fields as well as the actors that work within these fields. "Egypt still has huge remaining oil and gas potential and a significant diversity in its producing regions. It benefits from having a spectrum of oil and gas companies operating in the country. As the Egyptian basins mature, it is the mid-sized and smaller companies that will continue to drive the petroleum industry as the IOCs become less motivated due to diminishing volumes."

"PICO has been expanding and diversifying its portfolio and will invest significant funds in Egypt over the next three to five years." Thomas adds, "companies like PICO can deliver real value to Egypt by combining a highly focused, cost-effective approach with local knowledge and technical know-how" while propagating "the highest international standards."

A Taste for Refinement

Petrochemicals have been identified as a national priority because the sector has the potential to bring huge value to Egypt's development, not just in terms of meeting domestic demand - and thus reducing import costs - but also as an export industry for Egypt to generate much-needed hard currency. As Mohamed Saafan, chairman and CEO of the Egyptian Petrohemicals Holding Company emphasized, "the petrochemicals sector is a value-added one that is key to Egypt's economic development."

As seen from her stunning pyramids, Egypt is a country of megaprojects, not pilots. This explains why Egyptian Ethylene and Derivatives Company (ETHYDCO) "was designed to be a world-class petrochemical facility with a project budget of USD 1.9 billion," laughs Chairman and CEO Saad Helal - with President Sisi personally inaugurating the plant in August 2016. State-of-the-art technology ensures the longevity of the facility; utility and offsite manager Hossam El-Fahmy elaborates, ETHYDCO has a permanent power generation plant generating 70 megawatt (MW) of power, operating on an n+1 principle where there is always a spare generator ready at any moment. The facility is also the first in Egypt and the first ethylene plant in the world to have implemented an award-winning zero-liquid-discharge (ZLD) waste management system."

Helal proudly points out, "One of the defining successes of ETHYDCO was that we have planned, managed and executed this USD 1.9 billion project entirely locally." Given that within the first six months of their operation alone, "we have not only paid the first installment of our loans in March 2017 but we have also achieved a profit of USD 68 million .. ETHYDCO has proven that Egypt can build a world-class petrochemical facility to compete and export globally."

Not to be outdone, sister company Sidi Kerir Petrochemicals Company (SIDPEC) is also in the process of constructing a USD 1 billion extension to their existing facilities to further increase their production capacity. As Chairman and CEO Osama Mahdy narrates, this will build on their strong track record of 17 years with long-established client relationships nationally and internationally. He reveals, clients "usually prefer to wait to receive our products rather than do business with other suppliers! It shows the trust they have in us."

Leveraging Egypt's Best Resource: People

Despite Egypt's petroleum wealth, the best - non-depletable - resource she can count on -is her people. Egypt draws on a huge pool of industry knowledge and personnel, supporting not only Egypt's local development but the region's oil and gas industry; according to Minister of Manpower H.E. Mohamed Saafan, some seven million Egyptians work overseas. He exults, "the full height of Egyptian talent can be seen in the proliferation of Egyptians working abroad, in every sector and in every country, which highlights their ability to work well anywhere." To further complement this, "we have signed a number of cooperation protocols with major petroleum companies to provide training for Egyptian job seekers," Saafan elucidates.

Local company Saad Eldin Group is a perfect example of the heights that Egyptians can achieve. As Chairman and CEO Dr. Mohamed Saad Eldin charts, at a time when the LPG distribution sector in Egypt was entirely public, "I started the company in 1985 as the first private factory for the filling of LPG gas cylinders." This provided so successful that the company increased production "by more than 20 times in the first year alone." Three decades later, Saad Eldin is an "extremely diversified holding group with over 1,800 employees, with investments and operations in various industries, from oil and gas to power generation to solar energy to salt mining."

Explaining the strategy behind his successful growth, he says, "Fundamentally, when you have a clear vision and a clear direction, you will inspire people … We look at the potential in the country and we set out a strategy to follow" integrating all necessary components. This is how they were able to diversify into other sectors that were initially unfamiliar. He emphasizes patriotically that the local sector should play a very significant role in the country's development.

Powering Egypt's National Development

60 percent of Egypt's natural gas consumption goes to the power sector. With Egypt's petroleum and power generation fortunes inextricably linked, it is little wonder that diversified energy companies are seeing Egypt as a treasure trove of opportunities. Edison, an Italian E&P company now owned by the French utility giant, EDF, sees ample opportunities to link their E&P and power generation portfolios. One of the innovative ideas they are bringing to the Egyptian market is an integrated gas-to-power project linked to their Abu Qir concession. VP North Africa and Middle East Nicolas Katcharov argues that power generation is a long-term game in Egypt because of the time it would take to deregulate the market. "Long-term players in Egypt are the ones already established in E&P here." In Edison's case, "this is complemented by the fact that for over 110 years, Edison has operated in the power generation sector and developed a deep understanding of the power market. This makes us the perfect company to develop Egypt's own energy sector."

Another spectacular endeavor is the Egypt Megaproject, a trio of high-efficiency power plants constructed by Siemens with two Egyptian partners, Orascom Construction and Elsewedy Electric. Inaugurated by German Chancellor Angela Merkel and Egyptian President H.E. President Abdel Fattah El Sisi in March 2017, the project will increase Egypt's power generation capacity by 45 percent while building the country's industrial capacity through the establishment of a multipurpose service and training center for both the power generation and petroleum sectors. Emad Ghaly expresses, "having expertise and experience throughout the value chain of the energy sector have allowed us to deliver a comprehensive package of solutions, which has been critical to our success. This is something very few companies are able to do." Ghaly is also deeply pleased that this project will act as a flagship project globally. "We benefited from full support from the Egyptian government ... what Siemens has built in this country will stand as a showcase project for many years to come."

Staking Out A Claim As A Regional Energy Hub

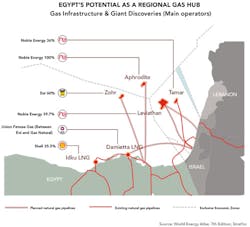

The raison d'être of the Modernization Program is to realize Egypt's dormant potential as an energy hub drawing in the surrounding Eastern Mediterranean countries. Despite questions about whether the new Zohr and West Nile Delta developments will be sufficient to satiate Egypt's domestic appetite, Minister El Molla is adamant on the feasibility of this goal. "It is not just about exporting our products. The hub would be a means of trading and integration with our neighboring countries," he clarifies.

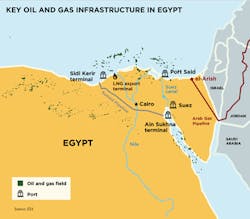

Khaled AbuBakr, chairman of the Egyptian Gas Association, concurs. "Becoming a gas hub does not necessarily mean we have to own all the gas ... We are able to cultivate this positioning as a hub because we have the necessary infrastructure and the means to seamlessly facilitate trade between Eastern and Western markets." There is certainly ample gas in the region. What is more critical, he highlights, are the resources Egypt can offer: gas processing facilities, LNG trains, pipeline networks, a national grid and transport links like the Suez Canal, which was expanded in a massive USD 8 billion project opened by President Sisi in 2015.

This is no new dream for Egypt, which has sat at the crossroads of global trade links for millennia - and there are few industries more global than oil and gas. As a case in point, ExxonMobil Egypt has already seen strong growth from using Egypt as an export hub for its lubricants. As Hesham El Amroussy, chairman and managing director, details, "we operate two state-of-the-art lubricant manufacturing plants, one in Alexandria and another in Cairo, and we use these plants not only to support the local market but to export all over the world to over 45 countries [because]we have world-class technology here in Egypt and we are geographically positioned well to supply Africa, Europe as well as the Far East." To his mind, "Egypt is naturally positioned to become an energy hub, a much larger manufacturing and trading center with a regional outreach." This is why ExxonMobil has been operating in Egypt since 1902 without interruption.

Egypt needs to look no further than home to witness an example of successful regional cooperation. The Suez-Mediterranean (SUMED) pipelines, 50 percent owned by EGPC with the rest shared among the NOCs of Saudi Arabia, Kuwait, Abu Dhabi and Qatar, transports 120 million tonnes of crude yearly. Chairman Mohamed Abdel Hafez boasts, "SUMED is one of the most important pieces of infrastructure as we are a vital route for the transport of Gulf crude to Europe and beyond" while being "a success story showcasing the economic success that cooperation with our neighbors has brought". He hopes that "foreign companies can look at SUMED as an example of the potential success that investing in Egyptian companies can bring."

Total stakeholder collaboration is critical if this regional energy hub is to materialize. Shell's VP Hanter outlines the role that Shell, the second-largest oil and gas company in the world, could play in supporting this herculean endeavor. "We are in an advantaged position to help not just due to our size, positioning or acreage but also our experience and global involvement with a number of similar projects. Shell is one of the biggest players on the LNG front globally ... our Egyptian LNG plant at Idku ... remains one of the most strategic infrastructure piece in the Mediterranean. We are also part of the Aphrodite discovery in Cyprus so we are very keen to explore the potential of bringing in regional gas, which would help meet the country's energy requirements as well as turn Egypt into an energy hub."

He concludes, "I believe Shell does have a role to play when it comes to offering credible commercial and technical solutions. We can bring in a strong commercial case, show different parties the economic value, and help structure a win-win arrangement that delivers value for all stakeholders. This could go a long way in supporting Egypt's transformation into a regional energy hub, especially given our 100 plus years of partnership with the government of Egypt."

In this vein, the modernization of Egypt's petroleum sector proffers a solution not only to its domestic challenges, but also to those of the entire region.

A Sweeping Reform Agenda Underway

Against a challenging backdrop of low global oil prices and domestic fluctuations, Egypt's Ministry of Petroleum has set out an ambitious Modernization Program for the oil and gas sector in Egypt through stakeholder engagement with international partners and funding institutions, under the close personal leadership of H.E. Minister of Petroleum Tarek El Molla.

By re-affirming the sector's core values of safety, innovation, ethics, transparency and efficiency, Modernization will unlock the sector's full value chain potential.

To further promote efficiency and transparency, digitization of key business processes will also be mainstreamed across the sector.

By achieving financial sufficiency as an engine of sustainable growth and development for the country, the sector strives to become a leading regional energy model - thus acting as a role model for the future of modernized Egypt.

An Ode to Investing in Egypt

With gas discoveries being announced seemingly every other week, a reformed regulatory framework and the government rolling out the red carpet for investors, how can companies exploit opportunities here?

Paul Dixon, regional director and general manager of ODE North Africa (ODENA) offers some firsthand advice on how foreign companies can succeed in Egypt, as they are themselves in the process of developing their existing office to an engineering hub for the wider MENA region as well as a high-value engineering center for ODE and their parent company, DORIS Group.

Firstly, companies should prepare themselves for the long haul. "Oil and gas is fundamentally a long-term business and Egypt is a long-term game", Dixon explains. "ODE is all about long-term commitment to the region and the investment we have continued to make in this country reinforces this."

Secondly, companies need to adapt their offerings to the country. Dixon gives an example: "In the North Sea, the norm was to automate as much as possible, whereas in other parts of the world, local employment is extremely important. Maximal use of technology may not always be the most appropriate strategy for projects when you look at the whole economic lifecycle".

Finally, companies need to manage their cost base. ODE's solution is to have "the company staffed predominantly by Egyptian nationals", Dixon says, which means that, "as an Egyptian company with international backing, we have a focus on quality and schedule while - critically - being able to leverage on cost."

Red Sea Bonanza?

To many, the Red Sea may simply be a sun-soaked holiday destination, but for Dr. Sherif Sousa, chairman and CEO at the Ganoub El-Wadi Petroleum Holding Company (GANOPE), the Red Sea represents the future of Upper Egypt. As Dr. Sousa explains, "Upper Egypt has traditionally been rather underdeveloped and so priority needs to be placed on exploration … in the Red Sea, in the desert and in the south of the Gulf of Suez."

To encourage more investment, GANOPE launched a very innovative multi-client seismic survey project in February 2017, attracting bids from three international consortia worth nearly USD 1 billion in value. Contractors will be able to sell the seismic data packages to interested clients for a stipulated period before GANOPE opens a new bid round. Dr. Sousa emphasizes, "The focus here will be to provide the best quality of seismic data for Upper Egypt, especially the Red Sea."

He adds, "the real challenge is to keep the wheel moving - which means more exploration needs to be done. This requires investments and a good partner ... In Upper Egypt, GANOPE is here to be a good and innovative partner."

Big-Ticket Construction: Building the Egypt of Tomorrow

As Egypt looks to build its industry base and readies itself to be an export hub, EPC companies should be looked to as a model as Egyptian companies, both public and private, have enjoyed significant domestic and international success.

Q: How do you account for your success today?

Mohamed Hathout, chairman and CEO, Engineering for the Petroleum and Process Industries (ENPPI)

"We are trusted to offer the largest possible range of services by a single contractor able to manage all aspects of a major project as per our business obligations … we have a robust business portfolio [delivering] engineering, procurement, construction management, electrical and instrumentations installations, project and interface management.

But our main asset is people ... through more than 15 offices and branches all over the world. Egypt delivers the biggest skilled workforce base in the MENA region with competitive man-hour rates. The strategic location of Egypt and the advantage of multicultural skills have given ENPPI a massive advantage in operations in many countries in the Middle East."

Salah Ismail, chairman and CEO, Petroleum Projects and Technical Consultations Company (PETROJET)

PETROJET is today a recognized regional EPC contractor capable of delivering end-to-end services across the whole petroleum value chain. What differentiates PETROJET from other EPC players is definitely the one-stop-shop solution we provide to our clients, and the diversity of resources the company owns both inside and outside Egypt. Over the past six years, we have faced very difficult challenges, but we have managed to overcome this difficult period while also tripling our revenues. This shows that PETROJET is a company that can be relied on."

Osama Bishai, CEO, Orascom Construction

"The first aspect is having a strong financial team that manages our affairs in a very professional manner. It also goes without saying that we need to have a profitable business. The second is project selection. We are extremely careful of the type and nature of projects we pursue. We also always ensure that all projects are well-funded.

In the past two years, we have also established many internal capabilities to compete head to head with international contractors, such as tunneling work, EPC in the power sector and the ability to do complex petrochemical projects as turnkey projects.

Another area where we provide value is our ability to self-perform. We like to self-perform certain projects because it means we can control our destiny."

Ahmed Hamdan, CEO, Onspec Tawakol Engineering & Contracting (OTEC)

"15 years ago, the industry in Egypt was dominated by huge, state-owned EPC companies. While they were doing a great job, I observed that there was a market need for a smaller locally-based engineering or EPC player. Smaller companies are more economical for smaller projects in Egypt. Over the past few years, I have witnessed many [engineering/EPC] companies entering and leaving Egypt in response to industry fluctuations. On the contrary, OTEC has never left Egypt. We are an Egyptian company and we are very much here to stay, so our clients can trust in our dependency and commitment.We provide engineering services for both upstream and downstream sectors. OTEC has proved to be extremely adaptable and I am very proud that we have consistently managed to achieve around 22 to 25 percent growth year-on-year since our founding in 2003 by managing market developments and seizing opportunities."

Q. What are some flagship projects for your company?

Mohamed Hathout, Chairman and CEO, Engineering for the Petroleum and Process Industries (ENPPI)

"Since 1978, we have worked on a multitude of flagship projects in the oil and gas, petrochemicals and process industries, like the Assuit refinery project, the first oil refinery in Upper Egypt and the USD 1.9 billion ETHYDCO petrochemical plant. Today we are naturally involved in both of the most critical mega developments in Egypt's oil and gas sector: the Zohr Onshore Development Project, producing a 2.7 bcf/d gas production from a single plant located at Port Said through eight integrated production trains, and the West Nile Delta Onshore Gas Development Project."

Salah Ismail, Chairman and CEO, Petroleum Projects and Technical Consultations Company (PETROJET)

"PETROJET enjoys an impressive track record of successfully completed large-scale projects … PETROJET has participated in almost all the projects within the entire Egyptian Petroleum infrastructure sector since 1975. For instance, PETROJET built almost the whole of the Egyptian pipeline grid for Oil, Gas and Products, in addition to numerous pipeline projects across the Middle East and North Africa, reaching up to 30,000 kilometers.

Osama Bishai, CEO, Orascom Construction

"We have been a key player in the power generation story of Egypt. As you know, Egypt was facing a domestic electricity shortage in 2014 and we were a key player that worked to bridge this gap in 2015 and 2016 through the Siemens Egypt Megaproject. These are projects that are not built anywhere else in the world so we are delivering record performance not achieved anywhere else. It is a great success story that showcases the capabilities and expertise that Orascom Construction can export anywhere else in the world."

Ahmed Hamdan, CEO, Onspec Tawakol Engineering & Contracting (OTEC)

"At the height of the political instability in 2011, I decided to use our backlog for the year to increase our engineering capacity at a time when companies were laying off staff. This was rewarded only half a year later, where we won what was then our largest project ever in Egypt, an extended FEED for an international E&P company, in large part because we could begin work immediately. They were so impressed with our work that they awarded us the rest of the detailed engineering, construction supervision, commissioning and start-up. The project ended up producing between 150 to 240 million cubic feet (mcf) of gas.

Crisis Breeds Opportunity

Said Riad, CEO of SAPESCO Africa, a successful local oil field service company with regional operations, details how despite 2016 being a year of survival for the company, SAPESCO managed to turn crisis into opportunity by maintaining their market share and offering new solutions.

He outlines, "One of our biggest challenges in 2016 became one of our greatest successes of the year! Shell was facing a significant scaling problem in their pipes and no service company - globally - could manage to find a solution." After six months of hard work, "SAPESCO's chemical engineering solutions division managed to devise a solution that works with a 100 percent success rate".

As a result, this was considered by Shell as "one of the top five best operations for 2016 global operations. This new solution was accredited by Texas A&M University and will be published officially at the SPE International Conference on Oilfield Chemistry in Texas, USA, wnere SAPESCO will be announced as a chemical solutions provider for the oil and gas sector globally".

To Riad, this shows that "SAPESCO - with our experience and our team work and our capabilities - can support anyone anywhere!"

The 'Apache' Way

Over the past twenty years, Apache has established themselves as a stalwart of the Egyptian petroleum sector. David Chi, VP and general manager, states, "Apache is seen as a company that gets things done and moves the fastest. This stems from our mentality of doing the right things and doing things right", adding that this is why our first company value is 'fire in the belly'. Another is 'best answers win', which means "we also challenge our employees to challenge us," laughs Chi. "Company culture is critical in how we compete ... this is absolutely what differentiates Apache."

Possibly the clearest example of this is Apache's '2x Program'. In 2005, from an already strong production base of around 160,000 boepd - larger than most of the major players' production in Egypt today - Apache set the target to double our production in five years. Many people were very skeptical, Chi admits, but as he explains, "we realized there were opportunities to improve efficiency and cooperate with the host government in a more seamless way we promised the government that if they allowed us to do things in a more efficient way, for instance, in terms of importing the equipment and bringing expertise we required", this could be done." In less than five years, Apache more than doubled production to over 330,000 boepd. For Chi, "this [was] a resounding testament to our efforts and gave us a lot of credibility with the government."