Part II: Oil and gas company valuation, reserves, and production

Mark J. Kaiser, Yunke Yu, Center for Energy Studies, Louisiana State University, Baton Rouge

EDITOR'S NOTE: This is Part II of a two-part article on oil and gas company valuation, reserves and production. Part I described the sample set, indicator variables, and basic statistical measures for a cross-section of publicly traded oil and gas companies for the year ending 2010. In this article, the authors establish the relationship between market capitalization, reserves and production for the companies introduced in February.

The value of an oil and gas company value is determined by its reserves, level of production, earnings, growth potential, production cost, commodity price at the time of the assessment, and a number of secondary factors. In Part 2 of this two-part article, we establish the relationship between market capitalization, reserves and production for the cross-section of oil and gas companies introduced in Part 1 for the year ending 2010.

We construct regression models for IOCs and a random sample of North American independents according to primary production, reserves volumes, technology application, and geographic diversification. Reserves and production are strong indicators of market capitalization, and for independents, production and total assets are better proxies of company value than reserves. Multinational independents are valued higher than domestic producers and companies producing primarily from conventional assets exhibit a modest price premium relative to unconventional producers.

We apply the derived models to infer effective capitalizations for private companies and National Oil Companies and compare model-predicted market caps for companies domiciled outside North America.

Model specification

Variables

The market capitalization of a publicly traded corporation is the number of shares issued and outstanding, multiplied by the per share price at a specific point in time. All resource companies are exposed to commodity price swings due to economic activity, supply and demand conditions, and related factors. By fixing the time of assessment on December 31, 2010, we eliminate the impact of oil and gas price on company valuation. Reserves life is computed as proved reserves divided by annual production and is known as the R/P ratio. A company's proved undeveloped to total proved reserves, PUD/R, indicates how much of the reserves base is currently producing. Financial risk is related to the debt equity ratio. Assets are reported at book value.

Capitalization models

Market capitalization was regressed by class and primary product against oil and gas reserves, reserves to production ratio, and debt-equity ratio using the following relations:

CAP = a + b·Rboe + c·R/P + d·D/E

CAP = a + b·Ro + c·Rg + d·R/P + e·D/E.

where CAP is the market capitalization ($); R represents the volumes of oil (bbl), gas (cf) and heat-equivalent (boe) reserves; R/P is the reserves to production ratio (yr); and D/E is the debt equity ratio.

Expectations

Proved reserves are expected to be a primary indicator of company value and to be positively correlated with market capitalization. Reserves represent the inventory of the company, and larger reserves are expected to be associated with higher valuation and longer production life. For all other things equal, high R/P ratios indicate that production and cash flows are weighted to the future, and thus, high R/P ratios should be negatively correlated with market value. Highly leveraged firms have higher fixed charges in the form of interest payments relative to discretionary outlays such as dividend payments. The higher the D/E ratio, the greater the financial risk, and the lower the expected market cap. The market cap for oil producers are expected to dominate gas producers because of the price premium of liquid hydrocarbons. Companies that are less geologically and geographically diversified with a higher reliance on unconventional production also point to greater risk and may contribute to a reduction in market cap.

International oil companies

Market capitalization for international and integrated oil companies are reasonably correlated with both reserves (Figure 1) and production (Figure 2) but significantly less correlated with assets (Figure 3). Assets are only weakly correlated because they are reported at book value and the relative amount of refining, transportation, and related assets will vary significantly with their degree of integration. Hence, we do not expect nor do we observe a strong correlation between market cap and asset value for IOCs. Reserves provide the highest correlation and the greatest predictive power followed closely by production levels. Since only seven companies comprise the sample set, the use of two or more variables in a regression will overspecify the model. Nonetheless, the results of multifactor models are reported as shown in Table 1. All the coefficients are of the expected sign but R/P and D/E are not always statistical significant.

US Independents

Large vs. small cap, oil vs. gas

Market capitalization for large independents is strongly correlated with reserves for oil producers and less so for gas producers (Figure 4), and for small-cap companies the correlations deteriorate significantly (Figure 5). Large cap independents are more uniform as a group in terms of production and financial metrics, whereas small-cap independents are more heterogeneous which reflect the low correlations.

There is a strong and significant correlation with market cap and the assets position of independents (Figure 6) because here assets are used in direct support of oil and gas production activity. This contrasts with IOCs because of the broader business segments over which IOCs operate.

Oil companies tend to have a greater market cap than gas companies for both large and small producers. This is probably the result of the price premium afforded by liquid products and may also reflect the conventional low-cost attributes of the asset class. Gas companies, especially gas companies with large positions in unconventional plays, typically have a large portion of proved undeveloped reserves on the books which may further distort the market valuation.

Proved reserves and market capitalization for independents are also more strongly correlated than IOCs (Figure 7). Reserves, production, and assets are all strongly collinear and are the primary components of market capitalization. Companies with small market capitalization tend to exhibit higher sensitivity to commodity prices as higher premiums are often paid for larger companies.

Small-cap companies are valued on a proportional basis similar to large-cap companies but as a group are priced at a premium. In Figure 4, we consolidate the small-cap oil and gas producers of our sample in terms of their reserves and market values. The small-cap gas producer group nearly coincides with the large-cap regression line, whereas the small-cap oil group is valued significantly higher relative to the large-cap producers. These differentials may be a characteristic of the producer group or result from sample bias.

Multinational vs. Domestic

Multinational independents have a higher valuation than domestic producers which may be due to the profitability and size of fields, favorable contractual arrangements, and the premium afforded by geographic diversification (Figure 8). Multinational independents are the largest independents and exhibit higher premiums. Market premiums reflect the market expectation that the company might make new discoveries, increase their production and reserves base, or have an advantageous position in acreage or technology application.

Conventional vs. Unconventional

Producers with mostly conventional assets exhibit a modest premium relative to unconventional producers (Figure 9). In our classification, we inferred production position from annual reports and operating basins/regions in a non-quantitative manner. We observe that the correlative relations are similar and the slope of the relation for companies with primarily conventional production is modestly greater than the unconventional group.

Production and reserves

Production and reserves are strongly correlated for independents (Figure 10) and production is a better indicator of market cap than reserves. IOCs and independents are often considered to value reserves over production, but the empirical evidence suggests that production is more closely correlated with the market value of independents.

Regression models

In Table 2, regression results for independents are depicted. Oil and gas volume models are superior to heat-equivalent reserves, and as expected, large-cap producers yield stronger correlations than small-cap producers. Reserves are the most significant explanatory variable, and while the R/P and D/E coefficients are of the expected sign, they are not statistically significant.

Private companies

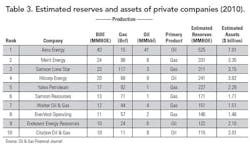

Public corporations have broadly dispersed ownership while companies with concentrated ownership are privately owned. Using the oil and gas production levels for private companies reported in the OGFJ100P, we estimate reserves and assets using the independent regression models as shown in Table 3. Aera Energy, for example, produced 43 MMboe in 2010, and using our regression models we would expect that their reserves position to be 525 MMboe based on $7.9 billion in assets.

National Oil Companies of OPEC

OPEC governments created NOCs in the 1970s when they broke away from the majors influence. OPEC NOCs are entirely owned and operated by state government. If these NOCs were privatized and listed on a stock-exchange, what market capitalizations would we expect? Assuming oil and gas reserves volumes are accurate as shown in Table 4, effective market capitalizations are computed using IOC relations. Saudi Aramco would have the largest market capitalization at $6.7 trillion, about four times the combined market cap of the seven majors. National Iranian Oil Company would be worth $4.9 trillion. NOCs in UAE, Venezuela, Iraq and Kuwait would each have market caps greater than $2 trillion. In total, the 12 NOCs of OPEC would have a combined market cap of $28 trillion in 2010.

GSEs and other international companies

In Table 5, the market cap for a sample of companies headquartered in Australia (Woodside), Brazil (Petrobras), China (PetroChina, CNOOC), and the UK (BG Group) are depicted. All of these companies are listed on the US Stock Exchange and are subject to SEC reserves disclosures.

PetroChina and Petrobras are partially state-owned and each has more than 10 Bboe reserves and would be ranked among the top four IOCs if they were privatized. CNOOC, BG Group, and Woodside hold reserves volumes similar to large-cap US independents.

Using only reserves as an indicator of market capitalization, PetroChina, BG Group and Woodside all fall above the IOCs market cap relation, whereas CNOOC and Petrobras fall well above the line (Figure 11), indicating a premium relative to reserves volumes.

Using information on company R/P and D/E data, the model-estimated capitalizations diverge from the market data. PetroChina is estimated to have a market cap of $506 billion relative to its actual cap of $303 billion, while Petrobras is valued at $124 billion relative to its cap of $229 billion. Interestingly, it appears that the market is valuing PetroChina and Petrobras as if they were large-cap independents, while for CNOOC, BG Group and Woodside, the opposite is occurring and the market is valuing these companies as if they were similar to majors. This is perhaps not surprising considering the state ownership in PetroChina and Petrobras.

Estimation challenges

Constructing robust market capitalization models of oil and gas companies are subject to a number of estimation issues. In this analysis, we fixed the time of assessment to coincide with the release of reserves and production data, and it is clear that the model results will change over time and are only valid on a relative basis. A large number of factors may impact capitalization of a company, including the cost of production, earnings, management quality, exploration potential, etc. Some of these factors can be quantified, but many cannot. Factors which are not reported or disclosed will limit the use of regression models. It is easy to extend the analysis over time to obtain more descriptive and robust models.

The influence of cost and commodity price may be significant since these are primary determinants of profitability. Each oil and gas deposit has its own extraction, processing, and transportation cost. Extraction cost depends on the size of deposit, reservoir continuity, location, fluid flow characteristics, and other factors. Processing cost depend on the type and mixture of oil and gas, while transportation cost is usually a small part of the total cost. Costs data are generally reported at an aggregate level, and only average composite selling prices are reported, which limits the ability to infer revenue and profitability. The average selling price of oil and gas indicate product value, and because cash flows are determined by production and price, may correlate with company value, however, because aggregate values are generally nondistinct we did not include price in the analysis.

All of the major oil and gas companies in North America were enumerated and a large portion of independents were sampled which significantly reduces sample selection bias, and because all of the measured factors are reported according to US GAPP, the data sources are believed to be reasonably consistent and accurate. Sample size was small for IOCs and several coefficients of interest were not individually statistically significant. As long as the coefficients are jointly significant, however, the estimating equation can be utilized with benefit. The purpose of the regression model is to estimate market value and is not necessarily concerned about the direct significance of each control variable.

About the authors

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com