Permian Basin enjoying a revival

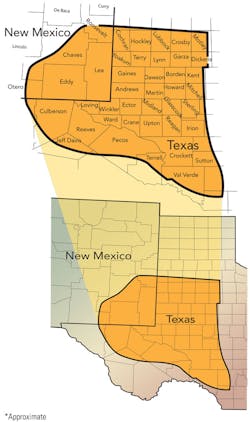

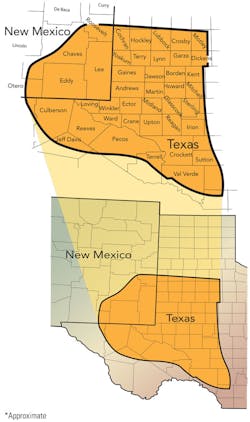

While the first Permian Basin well was drilled back in 1925, the liquids-rich area, comprised of the Midland Basin, the Delaware Basin, and the Marfa Basin, has experienced a revival of activity as the oil and gas industry's interest in unconventional resources grows along with new technologies and oil prices.

During an interview with OGFJ, Allen Howard, president and CEO of NuTech Energy Alliance, pointed to the Permian as the most exciting play on the horizon.

"From my personal perspective from the tremendous amount of work we have analyzed, there are about three or four plays in the Permian basin that are not quite there technically. When the strategies are properly understood and implemented, you will see some of the best reserves per well in the world," he said.

Drilling activity surges

There were 9,061 wells in the Permian Basin in West Texas in the last four quarters – by far the biggest number of new wells in the US.

The Permian Basin was averaging 4.89 wells per rig during the quarter, while things appear to be clipping right along in the Barnett Shale in North Texas, where there were 12.1 wells per rig. The US average was 5.2 wells per rig, according to the latest Baker Hughes well count.

Permian Rail Park construction set to begin

Construction on a 550-acre master planned industrial rail park serving the Permian Basin is set to begin shortly. The Permian Rail Park is being developed by Frontier Logistics and Kyle Kinsel, the lead developers of Mission Rail Park located south of San Antonio.

The Permian Rail Park, about six miles west of Big Spring, Texas and 30 miles east of Midland, Texas, will be located in the heart of the Wolfcamp and Cline shale plays in the Permian Basin and within 100 miles of the Delaware Basin's Bone Springs Shale, Avalon Shale, and Wolfbone play.

The park, set to be operational by the second quarter of 2014, will serve industrial tenants and users of all sizes – ranging from large distribution and manufacturing centers to small rail users. It will also serve oil field service and oil midstream companies looking to transport products to and from the Permian Basin.

The property is located within four miles of 10 major pipelines used to carry petroleum products to and from refineries.

Rosetta acquires Permian assets from Comstock

After shifting its focus to the Eagle Ford shale in 2011, Houston-based Rosetta Resources Inc. is now expanding its reach in Texas. This summer, the independent oil and gas company closed on the previously announced acquisition of Permian Basin assets from Comstock Resources Inc. On the flipside, Comstock agreed to sell all of its oil and gas properties in Reeves and Gaines counties in West Texas not only to reduce outstanding debt, but to increase activity in the Eagle Ford shale. Total consideration for the acquisition was $811 million. According to Comstock, the assets sold had proved reserves of 26.8 million barrels of oil equivalent as of Dec. 31, 2012.

Legacy obtains Permian properties for $72M

Legacy Reserves LP has acquired oil properties in the Permian Basin for $72 million from Resaca Exploitation Inc. These properties have current net production of about 668 barrels of oil equivalent (boe) per day. Legacy estimates that these properties contain 3.8 MMboe of proved reserves of which approximately 88% are oil and 84% are classified as proved developed producing. The Permian Basin remains the company's largest operating region. Last year, the Midland, TX-based company acquired oil and natural gas properties in the Permian Basin from Concho Resources Inc. for $520 million in cash.