Incoming Devon CEO steps back acquisition activity to focus on value ‘underfoot'

Devon Energy Corp., Oklahoma City, is prioritizing organic growth over acquisitions, incoming chief executive officer Clay Gaspar said Feb. 19, adding that his team’s main focus “is just making Devon a heck-of-a-lot-better Devon.”

In prepared remarks and during a question-and-answer session with analysts after Devon reported fourth-quarter results, Gaspar—who will soon take over from Rick Muncrief—said he is excited about the opportunities Devon has to improve its operations and financial efficiency across its assets in the Delaware, Eagle Ford, and Anadarko basins as well as the Rockies. Many of those efforts, he noted, will be small in scale and “never make the earnings presentations” but will add up over time.

“I just see real tremendous value-creation kind of underfoot the portfolio we have today,” Gaspar said. “Flattening the base decline on our business is a massive opportunity […] The teams that are working on things like artificial lift and really applying kind of real-time diagnostics to those opportunities […] have the biggest value-creation opportunities as we think about the coming decade and beyond.”

Gaspar made his comments about 5 months after Devon about $5 billion in cash and stock to buy the Williston Basin assets of Grayson Mill, a move that made the Rockies region—Devon also has operations in North Dakota—the second-largest in the company’s portfolio behind its core Delaware business (OGJ Online, July 15, 2024).

Gaspar’s comments also came days after Diamondback Energy Inc. announced a $4.1-billion purchase of parts of Double Eagle IV Midco LLC and on the same day Occidental Petroleum Corp. leaders said they had signed deals worth $1.2 billion to divest some assets in the Permian basin and the Rockies (OGJ Online, Feb. 18, 2025; Feb. 19, 2025).

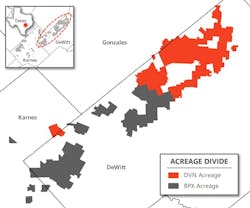

Devon will still consider acquisitions if they meet certain criteria, Gaspar added, but another initiative suggests the bar to make a deal is set pretty high. Alongside Devon’s earnings, executives said the company and peers at BPX agreed to dissolve a long-running partnership in the Eagle Ford, mostly in DeWitt County.

After that transaction is finalized in about 5 weeks, Devon will hold about 46,000 acres with a more than 95% working interest and oversee drilling and completion of wells there, something BPX had been handling under the JV’s terms. Having that control, executives said, is set to save Devon more than $2 million per well.

“We’ve already got our hands on the wheel. We’re seeing that improvement come through and we feel very, very confident in being able to achieve” the cost savings, Gaspar said. “In addition to that, the amount of control that we’ll have—our ability to dial up [or] dial down activity as we need to—I think is a huge value creator as well.”

Fourth-quarter numbers, outlook

Devon reported a fourth-quarter profit of $639 million on revenues of a little more than $4.4 billion. Those numbers were down from $1.15 billion and up from $4.15 billion, respectively, in the last 3 months of 2023. Higher marketing and midstream costs as well as great depreciation, depletion, and amortization hurt income year over year.

Devon’s total production in the fourth quarter came in at 848,000 boe/d, which included 117,000 boe/d from the acquired Grayson Mill assets. Oil production was a record 398,000 b/d, with 63,000 b/d coming from Grayson Mill. During the quarter, the company averaged 24 operated rigs and six completion crews and placed online 128 gross operated wells.

Looking to 2025, Devon expects total production of 805,000-825,000 boe/d, a drop of nearly 4% from the fourth quarter, but 2% higher than executives’ forecast of 3 months ago. Capital spending, which was $3.65 billion in 2024, is expected between $3.8 billion to $4.0 billion, which is $200 million lower than leaders’ preliminary forecast.

Of the $3.65 billion allocated to upstream capex, $2.0 billion is earmarked for the Delaware basin and $1.0 is allocated to operations in the Rockies. Assets in the Eagle Ford and the Anadarko will get about $500 million and $150 million, respectively.

Other items of note from Devon’s report and conference call:

- Executives agreed to extend a joint venture with Dow Inc. in Oklahoma and Devon will in second-quarter 2025 begin development work in Blaine County.

- The Trump administration’s new tariffs on steel and aluminum products from several countries will not have a big impact on Devon’s capex budget, chief financial officer Jeff Ritenour said. After running rough but “pretty aggressive” calculations, Ritenour said the overall impact of the tariffs will be less than 2% of Devon’s overall spending of nearly $4 billion.

Shares of Devon (Ticker: DVN) popped nearly 8% Feb. 19 to $37.57 and added another 2.4% in after-hours trading. They are, however, still down about 15% over the past 6 months, a decline that has trimmed Devon’s market capitalization to about $25 billion.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.