US MTBE restrictions seem likely

California's decision to ban methyl tertiary butyl ether (MTBE) as of Jan. 1, 2002, appears to be proceeding as planned.

A number of other states and the EPA have announced their intentions to restrict or eliminate the future use of MTBE, increasing the uncertainty regarding the continued use of MTBE in US gasoline.

Although the rest of the world looks upon US decisions regarding MTBE with interest, it has not moved against MTBE in the same degree as the US because MTBE is a valuable gasoline component.

These are observations by energy consultants Purvin & Gertz Inc. and petrochemical consultants Chemical Market Associates Inc. (CMAI), both in Houston, in their joint-study analysis on possible implications of future MTBE regulations.

The companies examined three potential scenarios (refer to graph, OGJ, Sept. 25, 2000, p. 7). One scenario is a phaseout scenario that assumes a complete MTBE ban by 2005 throughout the US and the end of the federal oxygen mandate.

An intermediate scenario, the blue ribbon scenario, assumes a ban in California by the end of 2002, a phase down in the rest of the US to a 1 wt % MTBE cap by 2005, and a repeal of the federal oxygen mandate.

The third scenario, called status quo, assumes that the ban applies only in California, and there is no change in federal regulations regarding MTBE or oxygenate use in the US.

Phaseout effects

According to Blake Eskew, senior principal with Purvin & Gertz, the US refining industry on the eastern and western coasts of the US has developed a substantial reliance on MTBE.

If MTBE use is eliminated, these refiners will have to compensate for their octane, volume, and other property losses via the expansion of refining facilities and higher-cost processing operations.

US MTBE consumption is about 300,000 b/d, less than 4% of total US gasoline production. MTBE makes up 8% of the gasoline in Petroleum Administration for Defense District I (PADD I) in the East Coast and PADD V on the West Coast, however.

Fig. 1 shows the contribution of MTBE to each PADD in the US.

The removal of MTBE from the gasoline stream will strain the refining industry's octane capacity because it will occur simultaneously with the federal Tier II gasoline-sulfur reduction program, which will also reduce octane capacity.

The combined effects of MTBE phaseout and sulfur reduction will require significant refining investment. Increases in refining costs and the tighter gasoline supply and demand balance will impact gasoline prices and octane values in the US market, with further effects in other world markets.

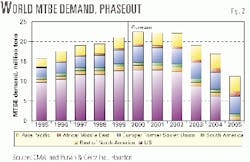

Chris Geisler, CMAI project manager, proprietary services, expects reduced demand will significantly impact world trade. North American MTBE and methanol producers will be hard hit.

If a complete phaseout occurs in the US, MTBE production will either convert to alternate products or shut down.

Isobutylene-production units based on raffinate from butadiene extraction processes or based on tertiary butyl alcohol (TBA) as a by-product from propylene oxide production will either need to convert to produce an alternative gasoline blending product or sell or use butylenes to produce conventional alkylate.

Fig. 2 shows an estimate of worldwide MTBE demand should a complete phaseout of MTBE occur.

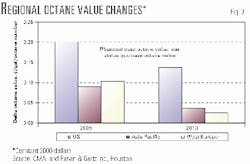

Fig. 3 shows the difference in the value of octane between the phaseout case and the status quo case. Increased octane values will drive the prices of propylene, butylene, and aromatics prices higher.

Aromatics prices will mainly increase as a result of increases in their blend values. Propylene and butylene values will increase with the value of alkylate.

An MTBE phaseout will more severely impact the US than Asia Pacific and West Europe. Therefore, the impact on aromatics prices is also less in Asia Pacific and West Europe. Regional differences in octane values could affect the US petrochemical producers' competitiveness in world markets.