Tariffs, geopolitics still the focus for oil prices

Oil, fundamental analysis

Crude oil markets rode the tariff elevator up-and-down this week while demand concerns and supply increases caused prices to fall week-on-week. A slight build in crude inventory was again offset by large draws in refined product stocks. WTI’s High for the week was Wednesday’s $64.90/bbl with the Low of $61.55 also occurring on Wednesday.

Brent crude traded in an almost identical pattern although in a higher range. Its weekly High of $68.65/bbl and its Low of $65.30 also printed on Wednesday. The Brent/WTI spread has widened to ($3.85). Both grades were lower week-on-week.

Despite some public statements to the contrary, uncertainty remains over the state of tariffs from US President Donald Trump being imposed on China and retaliatory tariffs on US goods. Early week saw the Trump administration report on-going trade talks with China only to have the Chinese deny such negotiations. Later, Pres. Trump indicated he was open to lowering the tariff levels and China waived tariffs on some US imports. Equities rallied the next day, but oil prices failed to hold gains on the overall tariff uncertainty. China is the world’s No. 1 importer of crude oil.

On the supply side, OPEC+ is expected to continue its output increases in the coming months while Kazakhstan has been producing over its allotment and has indicated it will continue to do so. The Energy Information Administration (EIA)'s Weekly Petroleum Status Report indicated commercial crude oil inventories last week increased slightly while refined products again saw large draws. The Strategic Petroleum Reserve continues to be refilled while US oil production held at 13.4 million b/d vs. 13.1 last year at this time.

In geopolitics, Russia’s Foreign Minister claimed talks with the US regarding the war in Ukraine were moving in the right direction. However, those statements were overshadowed by successive Russian missile attacks on Ukraine, leaving a peace agreement in doubt. Russian oil flows to both China and India have increased thanks to a “reshuffling” of tankers being used to avoid sanctions put in place during the Biden administration. China itself has hit new record oil production of 4.6 million b/d. Venezuela is sending more crude to China after the Trump administration's ban on US companies producing oil there. Meanwhile, Iran has indicated a willingness to meet with EU officials to negotiate their nuclear program. In another note, the EU is contemplating making any imports of Russian fossil fuels illegal. The bloc still receives about 15% of its natural gas from Russia.

In economics, Pres. Trump’s comments that he wasn’t looking to fire Fed Chairman Powell were a welcome reversal from his previous statements and equity markets rose in turn mid-week. Meanwhile, the University of Michigan’s index of consumer sentiment fell to 52.2, down from March’s 57. Additionally, sales of existing homes last month declined by the largest amount in 2 years. Nonetheless, all 3 major US stock indexes have moved higher week-on-week with the Dow cresting the 40,000 mark again. And, after hitting a 3-year Low last week, the USD is slightly higher which could cap any gains made in crude prices.

Oil, technical analysis

June NYMEX WTI Futures moved above the 8- and 13-day Moving Averages but fell short of the 20-day MA. With the 13-day MA crossing over the shorter-term 8-day, it tends to indicate lower prices ahead. The 20-day MA is also trending downward. Volume is 255,000, which is lower than the recent average. The Relative Strength Indicator (RSI), a momentum indicator, is holding at 45, a neutral mark. Resistance is now pegged at $64.60, the 20-day MA with near-term Support at $62.05 (13-day MA).

Looking ahead

The same tariff and geopolitical issues as last week remain front-and-center and will continue to be the most influential factors for oil price direction in the near term. As we approach May, the low level of refined product stocks is a concern. Look to US refiners to increase utilization to meet summer driving demands and to add to inventories. Markets will also be looking for an announcement from OPEC+ as to the exact volume output increase they will put in effect on May 1.

Meanwhile, ConocoPhillips has announced layoffs and Matador Resources has reduced its 2025 drilling capital expenditures budget by $100 million as crude price remain low.

Natural gas, fundamental analysis

Shoulder month demand and declining LNG output softened natural gas prices this week. The week’s High of $3.50/MMbtu occurred Monday with the week’s Low of $3.01 set Thursday. Supply last week was down 1.0 bcfd to 111.3 bcfd vs. 112.3 the prior week. Demand was down 7.1 bcfd to 95.7 bcf vs. 102.8 bcfd the week prior, with the biggest decreases coming in residential consumption on milder weather. Exports to Mexico were 6.4 bcfd vs. 6.3 the prior week. LNG exports were 16.1 bcfd vs. 16.8 bcfd the prior week. European gas prices were most recently lower at $9.15/MMbtu equivalent. The EIA’s Weekly Natural Gas Storage Report indicated an injection of 88 bcf, above the forecasted +75 bcf and the 5-year average of +58. Total gas in storage is now 1.846 tcf, falling to 20.6% below last year and falling to 3.9% below the 5-year average.

Natural gas, technical analysis

May 2025 NYMEX Henry Hub Natural Gas futures remain below the 8-, 13-, and 20-day Moving Averages and sitting on the Lower-Bollinger Band mark, a BUY signal. Volume was 107,000 and lower than the recent average as the May contract will expire next week. The RSI is now very-oversold at 30. Support is pegged at $2.95 (Lower-Bollinger Band) with Resistance at $3.30 (8-day MA).

Looking ahead

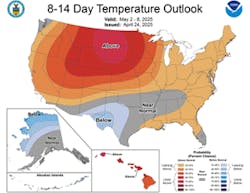

Through May 1, A/C demand for gas-fired generation looks bullish. However, the first full week of May looks mild for most of the country. The above-normal temperature areas are more sparsely populated and seasonally, that may only mean temperatures in the upper-70s/low-80s. Storage injection volumes should increase over the coming weeks. Should a triple-digit injection occur, look for prices to fall substantially.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.