EIA: 90% of 2025 oil supply growth will come from non-OPEC+ countries

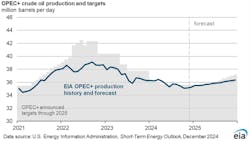

Global oil production will increase by 1.6 million b/d in 2025, and almost 90% of that growth will come from non-OPEC+ countries due to ongoing production restraint of OPEC+, the US Energy Information Administration (EIA) forecast in the December Short-Term Energy Outlook (STEO).

At its Dec. 5 meeting, OPEC+ said it would delay production increases until April 2025. Those increases had been set to begin in January 2025. At the meeting, the group also announced production targets through 2026.

“We expect global oil inventories will end 2025 near their current volume. We estimate that ongoing OPEC+ production cuts have contributed to global oil inventory withdrawals of about 400,000 b/d on average in 2024, and we expect that the extension of OPEC+ production cuts will cause inventories to fall by around 700,000 b/d the first quarter of 2025. However, we expect the subsequent ramp up in OPEC+ production and continued supply growth outside of OPEC+ will lead to an average inventory build of 100,000 b/d over the remainder of 2025,” EIA said.

Oil consumption growth in EIA’s forecast continues to be less than the pre-pandemic trend.

“We forecast that global consumption of liquid fuels will increase by 900,000 b/d in 2024 and 1.3 million b/d in 2025, which are both less than the pre-pandemic 10-year average of 1.5 million b/d of annual growth, as well as below the oil demand growth seen during the 2021–2023 pandemic recovery,” EIA said.

Non-OECD countries drive almost all global oil consumption growth, with much of this growth is in Asia, where India is now the leading source of global oil demand growth. China’s liquid fuels consumption will grow by less than 100,000 b/d in 2024 and by almost 300,000 b/d in 2025

EIA expects the Brent crude oil spot price will remain close to its current level in 2025, averaging $74/bbl for the year, as oil markets will be relatively balanced on an annual average basis.

As discussed in the November STEO, EIA continues to see at least two main sources of price uncertainty: the course of the ongoing Middle East conflict and OPEC+ members’ willingness to adhere to voluntary production cuts.

US crude oil production, net imports

US crude net imports in 2024 have remained close to 2023 volumes with increasing US crude oil production supplying an almost equivalent increase in US refinery runs.

EIA expects US crude oil production will continue increasing in 2025 even as US refiners process less crude oil than they did this year, leading to net imports of crude oil falling by more than 20% to 1.9 million b/d in 2025, which would be the least net imports of crude oil in any year since 1971.

Total US crude oil production in EIA’s forecast increases by 300,000 b/d in 2025. At the same time, EIA expects US refineries will process 200,000 b/d less crude oil in 2025, down to 16.0 million b/d.

US natural gas

Natural gas inventories in EIA’s forecast remain above the 5-year average (2019–2023) throughout the winter heating season (November—March) after ending the injection season 6% above the five-year average in mid-November.

According to EIA, natural gas inventories will total 1,920 bcf at the end of March 2025, which would be 2% more than the 5-year average.

Based on expectation that the storage surplus to the 5-year average will narrow over the winter, EIA forecasts the US benchmark Henry Hub spot price will increase from an average of just over $2.00/MMbtu in November to an average of about $3.00/MMbtu for the rest of the winter heating season.