Is $3/gal US gasoline in prospect?

Are gasoline pump prices headed for $3/gal in the US this year?

Don't start topping off your sport utility vehicle just yet.

While there has been much speculation that higher crude oil prices in tandem with refiners' infrastructure, inventory, and fuel reformulation concerns will spike pump prices this year, it is unrealistic to expect a nearly 100% leap in average US pump prices that some market-watchers are suggesting.

Merrill Lynch analyst Michael Rothman voices skepticism over such a scenario, noting that a $3/gal average US pump price would require the "crack spread"or raw margin between gasoline prices and crude oil pricesto rise another $53/bbl from current levels. The crack spread currently averages about $10.75/bbl, based on next-month futures contracts on the New York Mercantile Exchange.

"While we've been discussing prospects for a tight US gasoline balance these past 5 months owing to the MTBE (methyl tertiary butyl ether) ban in selected states and new sulfur reduction limits that affect [gasoline] imports, our sense is that average US retail prices have no more than 10¢/gal upside risk from current levels," Rothman said in a recent research report. "To be extremely conservative, that 10¢/gal figure goes so far as to assume no change from current high crude prices, which, frankly, we view as being at an unsustainably high level." (It should be noted here that crude oil prices already had fallen $2/bbl as of this writing from the levels they were when the Merrill Lynch report appeared.)

Noting the general improvement in recent weeks in US crude and gasoline stocks, Rothman contends the market is in fact tilted towards an even larger than seasonally normal build in crude stocks, based on the historically high price spreads showing up between US and foreign crudes.

Inventory worries easing

Meanwhile, inventory levels looked less bullish in March, as the exceptionally strong refining margins of late had been attracting increased supplies. At the same time, demand has been slipping due to the seasonal dip in heating oil consumption as the heating season draws to a close.

Jacques Rousseau, analyst with Arlington, Va.-based Friedman, Billings, Ramsey & Co. Inc., notes that average US refining margins have fallen 15% since Mar. 1.

"These trends should turn more bearish as we enter the 'shoulder' months of April and May, when demand continues to decline and supply rises further," Rousseau said in a Mar. 25 research report.

The end of refinery turnaround season also will mean increased throughput at refineries and greater stockpiling of gasoline ahead of the summer driving season. As stocks expand amid weakening demand, refining margins will tighten, helping to rein in crude demand.

However, gasoline stocks in late March still were more than 8 million bbl below their 5-year average level in the US. Meanwhile, Asian marketsespecially Chinaare competing more intensively for the same marginal product barrels (notably from Europe).

And the jury is still out on how much the new sulfur specs and MTBE bans will affect refiners' efforts to rebuild stocks. Those logistical concerns could be exacerbated by a few ill-timed refinery or pipeline outages. That in turn could result in spot gasoline prices in boutique-fuel areas such as the West Coast and Upper Midwest rocketing briefly to as much as $3/gal.

But sustaining a price level like that for long would squelch gasoline demand growth. The problem contains the seed of its own undoing. Even when anomalous gasoline price spikes occurred in some regions in recent years, the overall average nationwide price increase was limited to a few cents per gallon.

Still, a US average gasoline price approaching $1.90/gal sustained for even part of the summer driving season is certain to trigger yet another round of congressional hearings in an already contentious presidential election year. And if crude oil prices remain near $30/bbl for NYMEX next-month futures, consumers could come to accept $1.50/gal as a new price floor for regular self-serve gasoline across the US. Coupled with unabated demand for SUVs and their lower gasoline mileage, demand could remain as robust as it is today.

An interesting side note is the recent announcement by Citgo Petroleum Corp. that it plans to increase capacity at its Lake Charles, La., refinery by 105,000 b/d. It would be the first major grassroots expansion of capacity at a big US refinery in years. If persistently high refining margins encourage more of the same, that tight market balance might start to show signs of loosening.

(Author's e-mail: [email protected])

OGJ HOTLINE MARKET PULSE

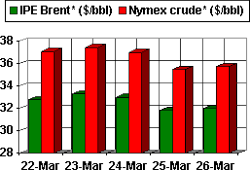

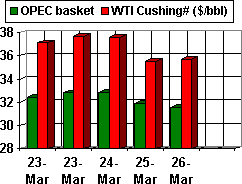

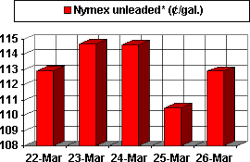

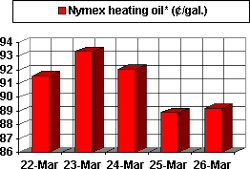

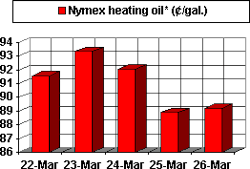

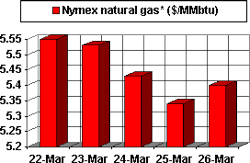

Latest Prices as of Mar. 29, 2004

null

null

null

null

null

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.