EIA: US gasoline prices to average $1/gal less in 2015 vs. 2014

US regular gasoline retail prices are expected to average $2.33/gal in 2015, down from $3.36/gal in 2014, according to the Energy Information Administration’s (EIA) latest Short Term Energy Outlook (STEO).

As a result, the average household is now expected to spend about $750 less for gasoline in 2015 compared with last year, EIA says. The projected regular gasoline retail price increases to an average of $2.73/gal in 2016.

Driven largely by falling crude oil prices, US weekly regular gasoline retail prices averaged $2.04/gal on Jan. 26, the lowest since Apr. 6, 2009, before increasing to $2.19/gal on Feb. 9.

Brent, WTI prices unchanged

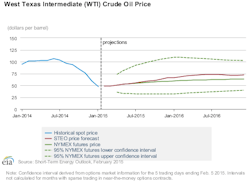

EIA’s price outlook is unchanged from last month’s forecast (OGJ Online, Jan. 13, 2015). The administration expects Brent crude prices will average $58/bbl in 2015 and $75/bbl in 2016, with 2015 and 2016 annual average West Texas Intermediate prices expected to average below Brent by $3/bbl and $4/bbl, respectively.

The current values of futures and options contracts continue to suggest very high uncertainty in the price outlook, EIA notes.

WTI futures contracts for May delivery, traded during the 5-day period ending Feb. 5, averaged $52/bbl while implied volatility averaged 52%, establishing the lower and upper limits of the 95% confidence interval for the market's expectations of monthly average WTI prices in May 2015 at $33/bbl and $81/bbl, respectively.

The 95% confidence interval for market expectations widens over time, with lower and upper limits of $32/bbl and $108/bbl for prices in December.

January was the seventh consecutive month in which monthly average North Sea Brent crude oil prices decreased, reaching $48/bbl, the lowest since March 2009. The price decline reflects continued growth in US tight oil production and strong global supply, amid weaker global oil demand growth, which contributed to rising global oil inventories.

Estimated Organization for Economic Cooperation and Development total commercial oil inventories in January reached their highest level since August 2010.

Impact on crude output

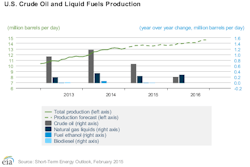

Total crude oil production is expected to average 9.3 million b/d in 2015 after averaging an estimated 9.2 million b/d in January.

With WTI crude prices expected to average $50/bbl in this year’s first half, EIA expects 2015 drilling activity to decline because of unattractive economic returns in some areas of both emerging and mature oil production regions.

Many companies have begun redirecting investment away from marginal exploration and research drilling and focusing on core areas of major tight oil plays. Projected 2015 oil prices remain high enough to support some development drilling activity in the Bakken, Eagle Ford, Niobrara, and Permian basin, albeit at lower levels than previously forecast.

Companies that have lower drilling and debt costs and have acreage in the sweet spots of these regions will continue to drill highly productive wells in 2015.

With projected WTI crude prices rising in this year’s second half, drilling activity is expected to increase again as companies take advantage of lower costs for both leasing acreage and drilling services, resulting in growing production despite the relatively low WTI price.

Given EIA’s price forecast, crude production is anticipated to average 9.5 million b/d in 2016, close to the highest annual average level of production in US history of 9.6 million b/d in 1970.

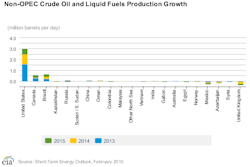

After increasing by 2.1 million b/d in 2014, non-OPEC supply is expected to grow more slowly, by 800,000 b/d annually in both 2015 and 2016, in part because of lower projected oil prices.

The slower growth in non-OPEC supply over the forecast period is largely attributable to slower production growth in the US, Canada, and South America. Additionally, production in Europe and Eurasia is projected to decline. The US remains the leading contributor to non-OPEC supply in the forecast.

EIA expects OPEC crude production to fall 100,000 b/d in 2015 from the previous year, and 400,000 b/d in 2016. Iraq is the largest contributor to OPEC production growth over the forecast period, but its growth is expected to be offset by production declines from other Persian Gulf producers.

However, the threat of the Islamic State of Iraq and the Levant (ISIL) on northern Iraqi production and exports still looms, and as a result, Iraq is a major wild card in the world oil production forecast.

US natural gas prices down

Natural gas working inventories on Jan. 30 totaled 2.428 tcf, 468 bcf above the level at the same time in 2014 and 29 bcf below the previous 5-year average during 2010-14.

EIA expects the Henry Hub natural gas spot price to average $3.34/MMbtu this winter, compared with $4.53/MMbtu last winter, reflecting both lower-than-expected space heating demand and higher natural gas production this winter.

EIA expects the Henry Hub natural gas spot price, which averaged $4.39/MMbtu in 2014, to average $3.05/MMbtu in 2015 and $3.47/MMbtu in 2016, $0.39/MMbtu lower for both years than in last month’s STEO.