IEA: Global oil market tightens in January on supply disruptions

Global oil market balances tightened in January despite apparent demand weakness, the International Energy Agency (IEA) said in the 2024 February issue of the Oil Market Report (OMR).

An extreme Arctic freeze affecting major oil-producing areas in the US and Canada led to substantial supply disruptions. These outages coincided with new voluntary production reductions from some OPEC+ members. Additionally, increasing geopolitical unrest in the Middle East fueled further upward pressure on the market, as oil tankers rerouting away from the Red Sea interrupted the usual supply flows to the worldwide market.

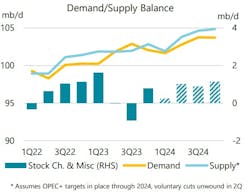

Global oil demand growth is showing signs of slowing down, dropping to 1.8 million b/d in fourth-quarter 2023 from 2.8 million b/d in third-quarter 2023. A significant reduction in China's demand contributed to an 830,000 b/d fall in global oil consumption in the final quarter of 2023. The growth rate is expected to slow further to 1.2 million b/d in 2024, down from 2.3 million b/d in 2023. “The expansive post-pandemic growth phase in global oil demand has largely run its course,” IEA said.

In January, the global oil supply experienced a significant reduction of 1.4 million b/d month-over-month, following production disruptions in North America due to severe cold weather and deeper production cuts by OPEC+. Despite this, record production levels in the US, Brazil, Guyana, and Canada are expected to contribute to a 1.6 million b/d increase in non-OPEC+ supply this year, albeit lower than the 2.4 million b/d increase seen in 2023, when total global oil supply grew by 2 million b/d to an average of 102.1 million b/d.

Refinery throughputs are set to accelerate from a seasonal low of 81.5 million b/d in February, IEA said. Activity in the Atlantic Basin is forecast to rebound from US weather-related disruptions that reduced runs by up to 1.7 million b/d, despite a pickup in planned maintenance and as new capacity comes online in the non-OECD. For the entirety of 2024, refinery crude runs are projected to increase by 1 million b/d to 83.3 million b/d, with a 330,000 b/d decrease in OECD countries partially offsetting non-OECD expansions.

Refining margins in the Atlantic Basin, led by the US Gulf Coast (USGC), have bounced back from early-January lows following the mid-month winter freeze. While Singapore margins saw a slight month-over-month improvement, a notable $4.50/bbl rise on average in USGC margins was propelled by a late-month surge in crack spreads, elevating Atlantic Basin margins to their highest since late September.

In December, global stocks rose by 21.6 million bbl as a surge in oil on water (+60.7 million bbl) more than offset draws in on-land inventories (-39 million bbl). OECD industry stocks fell by 24.1 million bbl in December, reflecting declines in all three regions. Preliminary data indicates that global observed oil inventories plummeted by around 60 million bbl in January, with on-land stocks falling to their lowest since at least 2016.

Rising tensions in the Middle East and supply disruptions in North America led to a $5/bbl increase in ICE Brent futures during January, marking their first monthly rise since September. The forward structure shifted from contango to backwardation, as diverted Red Sea tanker traffic congested Asia-Europe supply chains and delayed flows into the Atlantic Basin.