S&P Global: Oil market fundamentals outweighing Middle East war fears

Oil market fundamentals remain stable despite the uncertainty and potential for volatility arising from the Israel-Hamas war, according to the latest oil markets outlook from S&P Global Commodity Insights. Growth in non-OPEC+ supply, decelerating demand growth following China’s 2023 reopening, and sizeable OPEC spare capacity point to a well-supplied market in coming months.

“The onset of the Israel-Hamas war does fuel volatility and bring additional risks, but it has not affected underlying oil market fundamentals. Oil prices have remained below where they were in late September—a week before the Hamas attack. Strong oil market fundamentals are prevailing over any fears at the moment,” said Jim Burkhard, vice-president and head of research for oil markets, energy and mobility, S&P Global Commodity Insights.

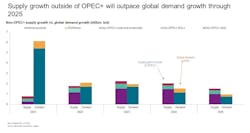

The outlook suggests that non-OPEC+ supply growth alone will be sufficient to meet global oil demand in 2023-2025. Each year, demand is anticipated to hit new records, yet the rate of increase is expected to slow down after the 2 million b/d rise this year, as the impact of mainland China’s reopening fades.

S&P Global Commodity Insights forecast that in 2024, oil supply from non-OPEC+ nations will grow by 2.3 million b/d, which is significantly more than the demand growth projected at 1.6 million b/d. For 2025, non-OPEC+ supply growth, estimated at 1.6 million b/d, is expected to exceed demand growth of just below 1 million b/d for that year.

Additionally, the considerable global crude oil production spare capacity, about 4.6 million b/d, serves as a cushion against potential supply interruptions. Supply restraint by OPEC+ will be essential for keeping oil prices over $80/bbl in 2024 and $70/bbl in 2025, according to the analysis. OPEC+ crude production in 2024 (excluding Iran, Venezuela, and Libya) is expected to be 500,000 b/d lower than it was in 2023.

“OPEC+, and particularly Saudi Arabia and Russia, are expected to produce less oil in 2024 than in 2023—and that trend could continue into 2025,” Burkhard said.

While market fundamentals do not point to an impending supply crisis, the risks of supply disruption are still higher than they were prior to the Hamas attack. How Iran and the US respond will continue to be key, the analysis said.