EIA revises up second-half 2023 oil price forecasts

In its August Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) forecasts the Brent crude oil price to average $86/bbl in second-half 2023, up about $7/bbl from its July STEO forecast for the same period.

Crude oil prices have increased since June, primarily because of extended voluntary cuts to Saudi Arabia’s crude oil production and growing global demand. EIA expects these factors will continue to reduce global oil inventories and put upward pressure on oil prices in the coming months.

Global oil demand, supply

According to EIA’s latest forecast, global liquid fuels consumption will increase by 1.8 million b/d in 2023 and by 1.6 million b/d in 2024. Most of the expected liquid fuels demand growth is in non-OECD Asia, led by China and India. EIA expects China’s liquid fuels consumption will rise by 800,000 b/d in 2023 and by 400,000 b/d in 2024.

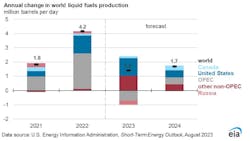

EIA forecasts global liquid fuels production to increase by 1.4 million b/d in 2023 because of strong growth from non-OPEC producers and despite decreases in production from OPEC and Russia. This forecast reflects Saudi Arabia’s announcement on Aug. 3 that it would extend its voluntary 1 million b/d product cut through September. EIA expects Russia’s production will decline 200,000-300,000 b/d on average this year compared with 2022 and remain unchanged in 2024.

Global liquid fuels production in the forecast rises by 1.7 million b/d in 2024, which is over 200,000 b/d more than EIA forecasted last month. Despite ongoing production cuts extending through 2024, EIA expects that OPEC's crude oil production will likely rise by an average of 600,000 b/d in 2024. This increase is attributed to higher production targets set by the UAE, along with rising production from Iran and Venezuela.

Thanks to improved well-level productivity and higher crude oil prices, EIA expects US crude oil production to average 12.8 million b/d in 2023 and 13.1 million b/d in 2024, setting new annual records.

Inventory trends

EIA estimates global oil inventories will transition from a period of inventory builds in first-half 2023 to inventory draws through the end of the year, placing upward pressure on global oil prices. Global oil inventories increased by an average of 600,000 b/d in first-half 2023, and EIA forecasts they will decrease by an average of 400,000 b/d in second-half 2023. EIA expects slight inventory builds in 2024, which puts some downward pressure on oil prices in the forecast for next year.