API: US petroleum demand fell year-over-year for 6 consecutive months by May

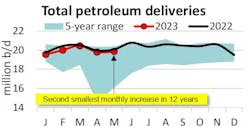

US petroleum demand, as measured by total domestic petroleum deliveries, rose 65,000 b/d month-on-month (m/m) to 19.9 million b/d, according to the latest monthly statistical report from the American Petroleum Institute (API).

The month-over-month increase recorded for May was the second smallest for the month in 12 years. Compared with May 2022, petroleum demand in May 2023 fell 1.1% (200,000 b/d), making this the 6th consecutive month with year-over-year (y/y) declines averaging -1.8%.

Consumer motor gasoline demand, measured by motor gasoline deliveries, rose 264,000 b/d m/m in May to 9.2 million b/d and rose 67,000 b/d y/y from May 2022. The month-over-month increase of 3%, compared with an average increase of 4.4% for the April to May period for the past decade, reflects a stronger demand to start off the summer driving season.

Distillate deliveries of 3.9 million b/d in May rose by 2.6% m/m and 0.7% y/y compared with May 2022 marking the first month of year-over-year increase since October 2022. The increase in May was higher than experienced in past years and runs counter to the trend of a weakening in distillate demand, API said.

DAT industry trendlines showed that the quantity of spot trucks and spot load posts decreased by 8.6% m/m and by 29.4% m/m, respectively. Notably, spot load posts for the month also fell almost 61.2% y/y, reflecting building slack capacity, because of declining US freight activity, which is being reflected in failing consumption of diesel and other distillate fuel oils

Kerosene-type jet fuel deliveries of 1.6 million b/d in May rose by 0.9% m/m from April and 2.2% from May 2022. Jet fuel demand for May is the highest for the month since 2019 and has had 26 consecutive months of year-over-year growth. This is consistent with high-frequency data from Flightradar24 and TSA showed that the total numbers of flights and air passengers increased by 11.1% y/y and 10.2% y/y, respectively. Reports by the Airlines Reporting Corp. (ARC) shows domestic air passenger traffic in April fully recovering to pre-pandemic seasonality trends for the first time. However, North American air cargo markets showed a continued decline against the previous year’s demand. Declines were from reduced activities in key trade lanes such as the North America- Europe (-13.5%) and North America-Asia (-9.3%), per the International Air Transport Association (IATA).

Residual fuel oil, which is used as a marine fuel, and in electric power production, space heating, and industrial applications saw demand of 200,000 b/d in May, a decrease of 35.1% m/m from April to its second lowest volume for the month of May on record since 1936. Excluding the month of February, demand for residual fuel decreased y/y from January to May. The year-on-year decrease was consistent with reports on a sustained slow-down in US industrial activities, which also reduces the demand for electricity, API said.

Macroeconomy

In May, the manufacturing Purchasing Managers Index (PMI) from the Institute for Supply Management recorded a reading of 46.9, which was lower by 0.2 percentage points compared with April. This marked the 7th consecutive month in which the manufacturing PMI below 50, following a 30-month period of expansion.

The University of Michigan’s consumer sentiment index showed consumer confidence falling to a 10-month low in May. The final reading for May was 59.2 - down from 63.5 in April. The May change, reflected concerns about current economic conditions, amidst rising tension from delayed implementation regarding debt ceiling plan.

According to the Bureau of Labor Statistics (BLS), non-farm payrolls rose to a preliminary estimate of 339,000 m/m, which is in line with the average monthly gain of 341,000 over the prior 12 months, per BLS.

Oil production

US crude oil production of 12.4 million b/d in May fell by 180,000 b/d from April. It was also the largest volume on record for May. Compared with May 2022, crude oil production was up by 800,000 b/d y/y. May volumes were 12.2% above the 5-year average.

A day-weighted average of active oil-directed rigs from Baker Hughes reflected 575 rigs in May, a 0.9% m/m (5 rigs) decrease from April.

NGL production of 6.1 million b/d in May reached its highest for the month on record since 1973, rising by 87,000 b/d m/m and by 174,000 b/d y/y.

Refining, inventories

In May, US refinery throughput, measured by gross inputs into crude distillation units, soared to 16.6 million b/d by processing an extra 200,000 bbl daily m/m. This implied a capacity utilization rate of 92.1%.

US crude oil inventories of 461.2 million bbl in May rose by 0.1% m/m (352,000 bbl) from April and rose by 11.3% y/y (46.9 million bbl) from 414.3 million bbl in May 2022. This was the largest y/y increase for May since 2016. US Strategic Petroleum Reserve (SPR) inventories remained stable in May at 352.3 million bbl, their lowest since August 1983.

US distillate inventories of 110.9 million bbl in May rose 800,000 bbl but remained below their historical 5-year average by 17.3% and additionally, up 0.7% from April. In terms of days of supply, distillate inventories ended May with about 26 days, compared with a 5-year average of roughly 33 days of supply for May, per EIA.