Non-OECD demand climbed by 220,000 b/d month-on-month (m-o-m) in September to 53.9 million b/d (+720,000 b/d y-o-y), as strong Chinese deliveries outweighed lackluster consumption in other regions. However, growth is expected to reverse during fourth-quarter 2022, with oil use falling by 100,000 b/d y-o-y, as the deteriorating macro-economic climate weighs on demand. This will be followed by a return to gains in second-quarter 2023 as China’s economy extends its recovery and due to strong baseline effects versus second-quarter 2022. For 2023 as a whole IEA forecasts non-OECD demand to grow by 1.3 million b/d year-on-year, to reach 55 million b/d, compared to 820,000 b/d in 2022, when demand will average 53.7 million b/d.

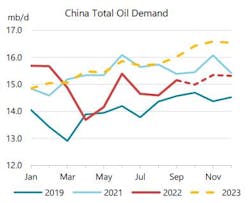

China’s apparent demand rose by 570,000 b/d m-o-m in September, 360,000 b/d above IEA’s forecast in October. The recovery reflected stronger refinery output, which rose by 5.9% m-o-m to its highest level since March, according to China’s National Bureau of Statistics. The robustness of the latest data extended across the products range, with petrochemicals (LPG/ethane +380,000 b/d m-o-m; naphtha +10,000 b/d m-o-m) and road fuels (gasoline +100,000 b/d m-o-m; gasoil +400,000 b/d m-o-m) showing solid advances. Conversely, jet/kerosene (-240,000 b/d m-o-m) was the main bearish outlier.

Year-to-date, China’s refinery outputs were also revised higher, resulting in an upward adjustment to 2022 demand of an average of 140,000 b/d, concentrated in naphtha and gasoil. Firm LPG/ethane and naphtha demand (the latter’s consumption exceeded 2 million b/d for the first time in September) correlates with the resilience of the Chinese petrochemical sector to narrow margins as well as the ongoing capacity additions. The revival in gasoline and diesel demand appears more tentative, as economic data remain poor. China’s economy expanded by 3.9% y-o-y in the third quarter, bringing average growth for the first 9 months to 3%, far below 2022’s official 5.5% target. Other data releases pointed to rising unemployment, lackluster retail sales and a worsening property slump. Total exports were unable to counterbalance the domestic economic malaise, slowing further in September as recession fears weighed on global demand and trade.

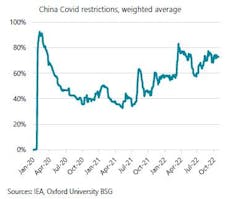

China’s unbending zero-tolerance COVID-19 policy was evident in fresh lockdowns being imposed in districts in Wuhan, Zhuzhou, and Guangzhou. Daily new infections climbed to above 10, 000 in early November, their highest since the spring Omicron-related outbreak that sent Shanghai into full lockdown. A weighted average of provincial restrictions from Oxford University’s Blavatnik School of Government (BSG) was little changed m-o-m in October, hovering only marginally below March/April curtailment levels.

“The long-awaited Communist Party 20th National Congress dashed hopes of a launch of any pro-growth policy initiatives to combat the overall weakness of the economy, nor did it indicate a departure from the country’s rigid pandemic approach. Instead, President Xi, having secured a historic third 5-year term, emphasized the priority of self-sufficiency and national security over economic reforms,” IEA said.

“The shift in focus, combined with the soft economic data, convinced investors that China is entering a new phase of structurally lower growth: Hong Kong’s benchmark Hang Seng stock index slumped almost 10% post-Congress, to its lowest level in more than 13 years. The sharp weakening of the yuan – trading near a 15-year low against the US dollar – is another testament to investor unease with the direction of China’s economy.”

Jet/kerosene demand collapsed in September, falling more or less in line with flight tracking data from Radar box, which showed a 31% m-o-m decline in average daily flights. October traffic then fell by a further 20% m-o-m to 5,600, its third consecutive monthly decline and heralding ongoing weakness in jet fuel deliveries.

“Air traffic is now down to about half of to its July peak. Attesting to the disconnect between China and the rest of the world, the country’s jet/kerosene consumption remains around 60% below its pre-pandemic level - the lowest of any major economy by a large margin. Owing to this persistent downturn, we have reduced our estimate for jet fuel demand for 2022 and 2023, by 50,000 b/d and 30,000 b/d, respectively. Due to the exceptionally strong September figures, China’s total oil consumption came close to moving back into y-o-y growth in September (-1.5% y-o-y, to 15.2 million b/d). However, we expect this revival to be transitory, as China’s economic outlook remains unremittingly negative, and we do not foresee a return to y-o-y growth until March 2023 and even then, only as a result of strong baseline effects in 2022. We have slightly increased our forecasts for 2022 and 2023, by 140,000 b/d to 15 million b/d and 100,000 b/d to 15.7 million b/d, respectively, largely on account of ongoing strength in the petrochemical sector,” IEA said.