EIA: Market forecasts remain subject to high COVID-19 uncertainty

While the increase in economic activity and easing of COVID-19-related restrictions have contributed to rising energy use, the US Energy Information Administration’s May Short-Term Energy Outlook (STEO) remains subject to heightened levels of uncertainty because responses to COVID-19 continue to evolve.

EIA’s forecast assumes continuing economic growth and increasing mobility with easing COVID-19-related restrictions, and any developments that would cause deviations from these assumptions would likely cause energy consumption and prices to deviate from the forecast.

US gross domestic product (GDP) declined by 3.5% in 2020 from 2019 levels. The May STEO assumes US GDP will grow by 6.2% in 2021 and by 4.3% in 2022.

Global oil market

Brent crude oil spot prices averaged $65/bbl in April, unchanged from the average in March. Brent prices were steady in April as market participants considered diverging trends in global COVID-19 cases.

In some regions, notably the US, oil demand is rising as both COVID-19 vaccination rates and economic activity increase. In other regions, notably India, oil demand is declining because of a sharp rise in COVID-19 cases. EIA forecasts that Brent prices will average $65/bbl in second-quarter 2021, $61/bbl during second-half 2021, and $61/bbl in 2022.

“News of rising COVID-19 cases in India offset some of the expectation of rising demand globally, but India’s increase in cases has not prevented crude oil prices from rising; they climbed to their monthly highs of $68.56/bbl for Brent and $65.01/bbl for WTI as of April 29,” EIA said.

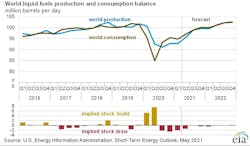

According to EIA estimates, the world consumed 96.2 million b/d of petroleum and liquid fuels in April, an increase of 15.8 million b/d from April 2020 but 4.0 million b/d less than April 2019 levels.

EIA forecasts that global consumption of petroleum and liquid fuels will average 97.7 million b/d for all of 2021, which is a 5.4 million b/d increase from 2020. Consumption of petroleum and liquid fuels will increase by 3.7 million b/d in 2022 to average 101.4 million b/d.

On the supply side, “oil market developments during the past month occurred against a backdrop of continuing production restraint from OPEC+, which likely contributed to some upward price pressure,” EIA said.

However, OPEC+ is expected to begin increasing production in May, which is consistent with the production targets announced at its early April meeting. OPEC+ plans to revisit its production targets at the next meeting, scheduled for June 1.

In particular, EIA forecasts OPEC crude oil production will average 26.9 million b/d in 2021 and 28.5 million b/d in 2022, which are 200,000 b/d and 400,000 b/d higher, respectively, than last month's STEO. The higher forecast OPEC production mainly reflects EIA’s expectation that crude oil production in Iran will continue to increase, continuing the rising output trend that started in November 2020. Even though sanctions that target Iran’s crude oil exports remain in place, crude oil exports from Iran have been rising since end 2020, driving up crude oil production

Overall, EIA expects global oil production to continue to increase in the second half of the year to keep pace with rising demand. Increased production puts downward pressure on crude oil prices: the Brent price falls to $63/bbl in third-quarter 2021 and $60/bbl in fourth-quarter 2021.

US oil market

EIA expects that gasoline consumption in the US will average almost 9.0 million b/d this summer (April–September), which is 1.2 million b/d more than last summer but almost 600,000 b/d less than summer 2019. EIA increased its summer gasoline consumption forecast by 100,000 b/d from last month based on weekly data that suggested more gasoline consumption than it had previously forecast. The increase also reflects IHS Markit’s increased employment forecast. For all of 2021, EIA forecasts that US gasoline consumption will average 8.7 million b/d, which is up from 2020 (8.0 million b/d) but down from 2019 (9.3 million b/d).

According to EIA’s most recent data, US crude oil production averaged 9.9 million b/d in February 2021, which was down by 1.2 million b/d from January. In February, cold temperatures caused significant declines in crude oil production in Texas, as well as smaller declines in other states.

EIA estimates that production outages were generally limited to February and that US crude oil production rose to 10.9 million b/d in March and to almost 11.0 million b/d in April. Because the average price of WTI crude oil remains above $55/bbl in EIA’s forecast, producers are expected to drill and complete enough wells in the coming months to offset declines at existing wells. In addition, new projects in the Federal Offshore Gulf of Mexico contribute to rising production in the forecast. US crude oil production in the forecast averages 11.3 million b/d in fourth-quarter 2021 and then rises to average 11.8 million b/d in 2022.

Also, EIA completed modeling and analysis for this report before the temporary closure of the Colonial Pipeline on May 7 as a result of a cyberattack. Although effects of the outage are not reflected in this report, EIA is closely following supply and price developments related to the outage.