EIA forecasts lower crude oil prices in 2025, 2026

Oil prices are expected to face downward pressures over the next 2 years due to global oil production outpacing demand, according to a report by the US Energy Information Administration.

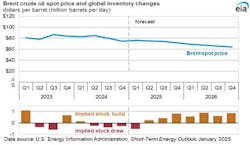

The January 2025 Short-Term Energy Outlook notes the Brent crude oil price is forecasted to average $74/bbl in 2025, which is an 8% decrease from 2024, and it is projected to drop another 11% to $66/bbl 2026.

“The unwinding of OPEC+ production cuts and strong growth in oil production outside of OPEC+ results in global oil production growing in our forecast. We expect global production of liquid fuels will increase by 1.8 million b/d in 2025 and 1.5 million b/d in 2026. Although we forecast OPEC+ will increase production, we expect the group will produce less crude oil than stated in its most recent production target in an effort to avoid significant inventory builds,” said EIA.

EIA expects growth in oil production during 2025 to be led by countries outside of OPEC+, increasing by 1.6 million b/d before slowing to growth of less than 900,000 b/d in 2026.

“We expect production in Canada to see continued growth largely because the Transmountain Expansion (TMX) project increased oil takeaway capacity for export markets, while Brazil and Guyana are expected to start new offshore production facilities in 2025. Notably, we forecast that growth in liquids production in the US will slow to 1%, or around 300,000 b/d, in 2026 as operators reduce activity in response to low WTI prices,” said EIA.

According to EIA, global inventories increase by an average of 300,000 b/d in 2025 and by 700,000 b/d in 2026. Increasing inventories put downward pressure on prices.

EIA’s forecast was completed before the US issued additional sanctions targeting Russia’s oil sector on Jan. 10, which have the potential to reduce Russia’s oil exports to the global market.

Global oil consumption

Global growth in oil consumption in EIA’s forecast continues to be slower than the pre-pandemic trend. According to the agency’s forecast, global liquid fuels consumption increases by 1.3 million b/d in 2025 and by 1.1 million b/d in 2026, compared with estimated growth of 900,000 b/d in 2024 and a pre-pandemic 10-year average (2010–2019) of 1.5 million b/d.

Non-OECD countries drive almost all global oil consumption growth in the forecast. Much of this growth is in Asia, where India is now the leading source of global oil demand growth and one of the few places growing faster than its pre-pandemic trend (OGJ Online, Nov. 1, 2024). EIA expects liquid fuels consumption in India will increase by about 300,000 b/d in both 2025 and 2026, compared with an increase of 200,000 in 2024, driven by rising demand for transportation fuels.

According to EIA’s forecast, China’s liquid fuels consumption will grow by around 200,000 b/d in both 2025 and 2026, up from an increase of less than 100,000 b/d in 2024, as economic stimulus efforts drive higher demand growth. OECD oil consumption will be relatively unchanged across 2025 and 2026.

US crude production

EIA forecasts continued increasing US crude oil production in 2025 and 2026. In 2026, production growth begins to slow as drilling and completion activity is reduced in response to sustained lower crude oil prices and producers prioritizing value per barrel over production volume.

The Permian basin region will be the largest source of US production growth in both years and the only major source of production growth in 2026. Permian production will rise nearly 300,000 b/d in both years, averaging 6.6 million b/d in 2025 and 6.9 million b/d in 2026.

Production outside of the Permian basin in the Lower 48 states will remain flat in 2025, and will decrease by about 170,000 b/d (-4%) in 2026, according to EIA.

EIA forecasts that crude oil production in the Gulf of Mexico will increase to 1.8 million b/d in 2025 and remain near that volume in 2026. Compared with onshore tight oil production, Gulf of Mexico production is characterized by projects with longer lead times, and it is driven by a few large-scale projects that are less sensitive to short-term variations in crude oil prices.