The global COVID-19 vaccine roll-out is putting oil fundamentals on a stronger trajectory for the year, with both supply and demand shifting back into growth mode following 2020’s collapse, according to the International Energy Agency’s January 2021 monthly oil market report.

A price rally is gathering pace. Brent rose to $57/bbl and WTI to $53/bbl, reflecting a boost in demand on a cold snap in Europe and Asia and OPEC+ supply cuts that look set to keep markets in deficit.

Nevertheless, as recently renewed lockdowns in a number of countries weigh on fuel sales, IEA revised down its global demand forecast by 600, 000 b/d for first-quarter 2021 and by 300,000 b/d for 2021 as a whole.

World oil demand is now expected to rise by 5.5 million b/d this year following 2020’s 8.8 million b/d contraction. This recovery mainly reflects the impact of fiscal and monetary support packages as well as the effectiveness of steps to resolve the pandemic.

Anticipating weaker demand, the Organization of the Petroleum Exporting Countries, and its non-OPEC partner countries (OPEC+) decided in January to delay a further easing of cuts and Saudi Arabia surprised with an additional 1 million b/d supply reduction in February and March.

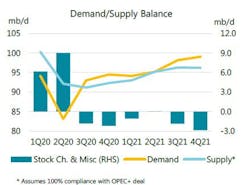

“The group’s more proactive production restraint looks set to hasten a drawdown in the global stock surplus that got underway in earnest during 2020 third quarter. Assuming OPEC+ achieves 100% compliance with the latest agreement, global oil stocks could draw by 1.1 million b/d, or 100 million bbl, in 2021 first quarter, with the potential for much steeper declines during the second half of the year as demand strengthens,” IEA said.

Higher demand of 2021 will allow supply to start rising this year. World oil supply is now expected to increase by 1.2 million b/d in 2021 following a record decline of 6.6 million b/d last year.

“Much more oil is likely to be required, given our forecast for a substantial improvement in demand in the second half of the year. Our balances assume that during 2021 second half, OPEC+ will still withhold 5.8 million b/d of oil from the market as per the group’s April 2020 agreement. However, OPEC+ has taken a more flexible approach to market management and will meet monthly to decide on output levels,” IEA said.

Higher crude prices could also provide an incentive to increase production by the US shale industry, which saw the biggest fall in output last year. For now, companies seem committed to pledges made to keep production flat and instead use any price gain to pay down debt or to boost investor returns. US crude oil production is now expected to decline by 200,000 b/d compared with a fall of nearly 1 million b/d on average during 2020. “If they stick to those plans, OPEC+ may start to reclaim the market share it has steadily lost to the US and others since 2016,” IEA noted.

Global refinery throughput is expected to rebound by 4.5 million b/d in 2021, after a 7.2 million b/d drop in 2020. Runs rose by 2.6 million b/d in November, the largest monthly gain in 7 years, as refiners returned from peak maintenance. A cold snap in Europe and Asia boosted diesel and kerosene, but higher crude oil prices led fuel oil cracks lower, with an overall negative impact on refinery margins.

Observed global oil stocks fell by 2.58 million b/d in fourth-quarter 2020 after preliminary data showed hefty draw downs towards yearend. In November, OECD industry stocks fell for a fourth consecutive month. A monthly decline of 23.6 million bbl (790,000 b/d) left inventories at 3,108 million bbl, 166.7 million bbl above their 5-year average. Products led the fall, with OECD industry crude stocks only 48.9 million bbl below a May peak.

Oil’s rally accelerated, with Brent reaching $57/bbl on Jan. 12, a level not seen since February 2020. Despite rising COVID-19 cases, crude prices are well supported by financial, economic, and market fundamentals. Crude prices flipped into backwardation in December.