China to top onshore seismic market for the next 2 years

The purchase value of the global onshore seismic market in 2020 dropped 27% and may continue to fall in 2021 as budget cuts by operators strain the services sector, before a projected recovery in 2022, according to a Rystad Energy report. An exemption to the trend, China will lead global purchases in the next 2 years, starting with a projected 12% demand boost already in 2021.

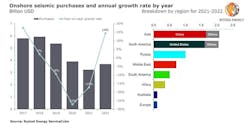

Global onshore seismic purchases are expected to fall to $3.9 billion in 2020 from almost $5.4 billion in 2019. Rystad Energy forecasts the overall decline to continue into 2021, with purchases sliding to $3.2 billion before they start a recovery to $3.7 billion in 2022 and further in following years.

Interest in onshore exploration picked up in 2019, as evident from the number of lease rounds that were held and the onshore acreage that was awarded. This year, though, onshore license awards through October dropped by two-thirds to 106,000 sq km in acreage from 316,000 sq km during the same period last year. The largest onshore acreage awarded was in India, which amounted to 30,566 sq km followed by Australia with 15,513 sq km and Oman with 10,000 sq km.

“Asia, North America and Russia will account for more than 70% of the onshore seismic purchases over the next 2 years. While Asia will begin its recovery in 2021, both North American and Russian purchases will continue to shrink,” said Binny Bagga, senior energy service analyst at Rystad Energy.

Within Asia, China is expected to account for 80% of the total purchases over the next 2 years. China, as part of its 14th 5-year economic development plan starting next year, is looking to boost its shale gas production by 50-80 billion cu m/year (bcmy) through 2025. Chinese onshore seismic demand is expected to grow by 12% in 2021, followed by 16% in 2022 as the country remains committed to increasing its domestic oil and gas production.

In fact, China will be the global leader in onshore seismic purchases in the next 2 years, with its market estimated to reach a cumulative $1.7 billion in value, followed by the US with $1.6 billion, and Russia with $1 billion in 2021–2022, according to Rystad.

BGP, a subsidiary of China National Petroleum Corp. (CNPC) and the market leader in the global land seismic market, this year conducted multiple surveys both within and outside China. The company in April commenced a large 3D seismic acquisition survey in the Jintang-Santai area in China’s Sichuan basin. The survey—by far the largest 3D in the basin in 2020—covers up to 2,263 sq km and will be of great significance to explore and develop large-scale natural gas reservoirs in southwest China, Rystad said.

BGP also concluded the world’s first large-scale 9C-3D seismic survey in Qaidam basin in western China in August. In the wider Asian region, the company conducted a walkaway VSP survey for Pertamina in Indonesia. Also, Sinopec Oilfield Service Corp. actively undertook onshore oil and gas exploration in southeast Sichuan and other regions of China.

PetroChina, China’s biggest onshore operator, continued with its optimized domestic exploration activity in 2020 and made discoveries and breakthroughs in Tarim, Sichuan, Junggar, Erdos, and other basins. Overall, Rystad estimates the number of Chinese exploration wells to climb to 2,641 in 2021 from 2,187 this year.

Among other key regions, Rystad expects activity in the US, which accounts for a major share of North American purchases, to pick up in 2022, while it will take another year for the rise of activity in Russia.