IEA lowers demand forecasts on jet fuel downgrade

Oil demand will fall by 8.8 million b/d y-o-y in 2020, the International Energy Agency (IEA) forecast in its December Oil Market Report. The decrease is a modest 50,000 b/d downward revision from its previous report. The 2021 demand forecast was revised down by 170,000 b/d—mainly due to another downgrade for jet fuel/kerosene demand, which will account for around 80% of the overall 3.1 million b/d shortfall in consumption in 2021 versus 2019. In 2021, demand for both gasoline and diesel is projected to return to 97-99% of 2019 levels.

“The understandable euphoria around the start of vaccination programs partly explains higher prices but it will be several months before we reach a critical mass of vaccinated, economically active people and thus see an impact on oil demand. In the meantime, the end of year holiday season will soon be upon us with the risk of another surge in COVID-19 cases and the possibility of yet more confinement measures,” IEA said.

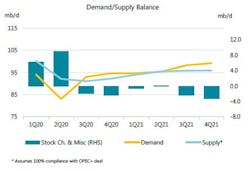

In the short term, oil demand remains weak and IEA has reduced estimate for fourth-quarter 2020 by 200,000 b/d on small data revisions in various countries. Demand has recovered from its trough in the second quarter when it was 16.3 million b/d (16.4%) below the year-earlier level, but in fourth-quarter 2020 it remains 6.2 million b/d down y-o-y, reflecting the impact of the second wave of lockdowns.

Global oil supply rose 1.5 million b/d in November to 92.7 million b/d as the US recovered from hurricane shut-ins and Libya built up production. In December, production may rise again ahead of OPEC+ increasing its quota by 500,000 b/d in January. OPEC+ dominates global output growth in the near term, with virtually all the fourth-quarter 2020 gains and 80% in first-quarter 2021. For 2021 as a whole, non-OPEC producers outside OPEC+ are expected to increase output by 400,000 b/d after a fall of 1.3 million b/d in 2020.

Global refinery throughputs fell almost 1 million b/d in October mainly due to maintenance and hurricane shutdowns. The seasonal slowdown of refined product demand in the northern hemisphere winter combined with tighter crude oil markets will result in a challenging environment for refiners in the short-term. Estimated product stock draws reached their 2020 peak in October and are expected to slow until the next leg of the demand recovery in second-quarter 2021.

OECD industry stocks fell in October by 55.3 million bbl (1.78 million b/d) to 3,129 million bbl and were 183.4 million bbl above the 5-year average. Observed global stocks fell by 4.1 million b/d. IEA’s analysis suggests that the global crude market will have a stock surplus of 625 million bbl at the start of 2021 versus December 2019. Assuming that Chinese balances are neutral in 2021, the market will absorb the 183 million bbl located elsewhere and in July it will move into deficit versus end-2019.

Oil prices have moved rapidly and smoothly from contango to backwardation, based on stronger Asian demand and effective OPEC+ supply management. ICE Brent futures rose $2.46/bbl in November to $43.98/bbl and closed at $49.97/bbl on Dec. 11. Physical crude price discounts to futures improved in late November and early December. In November, freight costs benefited from a rise of tanker activity for the first time in since May, due to stronger Asian buying.