API: September US petroleum demand eased less-than-historical average

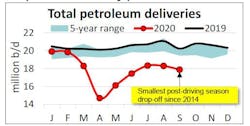

US petroleum demand, as measured by total domestic petroleum deliveries, was 17.9 million b/d in September, which marked the end of the 2020 summer driving season with a decrease of 2.3% month-on-month (m/m).

Over the past 5 years, petroleum demand in September averaged 3.7% less than that of August, and the 2.3% decrease in September was the smallest drop-off for the month since 2014. With less seasonality, the year-on-year (y/y) difference in September total petroleum deliveries narrowed to 11.7% y/y (2.4 million b/d) in September from 13.6% y/y (2.9 million b/d) in August.

Consumer gasoline demand, measured by motor gasoline deliveries, was 8.6 million b/d in September. This was a seasonal decrease of 2.9% (0.2 million b/d) from August and 7.0% (0.6 million b/d) below the level in September 2019.

In September, distillate deliveries of 3.7 million b/d were virtually unchanged from August but down by 5.8% y/y (200,000 b/d)–the lowest y/y decrease among major refined products. This was consistent with DAT iQ industry trendlines showing increased spot trucking loads.

Jet fuel deliveries of 900,000 b/d decreased in September by 5.8% m/m and 45.4% compared with September 2019–by far the deepest impact due to the COVID-19 pandemic. The decrease in jet fuel deliveries was consistent with weak reported flight activity and passenger demand per Flightradar24 and TSA, plus the end of summer travel season.

Deliveries of liquid feedstocks, such as naphtha and gasoil (other oils) used in refining and petrochemical manufacturing, were 4.5 million b/d in September. This was a 1.2% m/m decrease, apparently due to Gulf Coast petrochemical activity having slowed with the hurricane season. While these deliveries were down 10.8% y/y, they rose to 25.1% of total US petroleum demand.

Oil supply

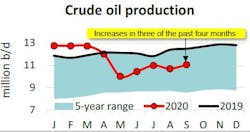

In September, US crude oil production was 11.1 million b/d, an increase of 3.3% (400,000 b/d) from revised August data on increased drilling activity. Oil-directed drilling activity (181 rigs in September) picked up from lows over the summer and EIA’s drilling productivity report indicated record high productivity among most basins.

US NGL production set a September record at 5.1 million b/d, up by 2.2% m/m (200,000 b/d) from revised August values.

International trade

The US was a petroleum net exporter for the third consecutive month in September. The US imported 7.6 million b/d of crude oil and petroleum products in September. This was a 2% m/m (100,000 b/d) increase from August, with EIA data suggesting that imports from OPEC nations picked up slightly from multi-decade lows.

By contrast, US exports of crude oil and refined products held steady at 7.8 million b/d, implying US petroleum net exports of 200,000 b/d in September. Within the exports, 4.9 million b/d was refined products, which increased by 0.5% m/m, and the remaining 3.0 million b/d was crude oil that rose by 0.4% m/m to the second highest September value on record.

Refining, stocks

Refinery throughput fell by 5.2% m/m while capacity utilization declined by 4.1 percentage points. As refinery activity resumed in the wake of Hurricane Laura, additional disruptions arose due to Hurricanes Marco, Alpha, and Beta. Approximately 15% of US refining capacity was temporarily shut-in during September.

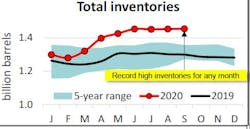

US total petroleum inventories, including crude oil and refined products but excluding the Strategic Petroleum Reserve, were 1.45 billion bbl in September. This was the highest inventory on record for any month since 1956, increasing 13% since the onset of COVID-19 in March. Within the total, crude oil stocks of 495.3 million fell by 1.5% m/m and stood 6.9% below the high of this year’s June crude supply glut.