IEA revises down 2020 oil demand forecast on high COVID-19 cases

In its August Oil Market Report, the International Energy Agency (IEA) reduces its 2020 oil demand forecast by 140,000 b/d to 91.9 million b/d, the first downgrade in several months. The downgrade reflects the stalling of mobility as the number of Covid-19 cases remains high, and weakness in the aviation sector.

Moreover, IEA has revised down its 2021 global demand estimate by 240,000 b/d to 97.1 million b/d, mainly due to aviation sector weakness.

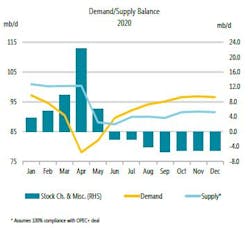

“Our balances show that in June demand exceeded supply, and for the rest of the year there is an implied stock draw. However, ongoing uncertainty around demand caused by COVID-19 and the possibility of higher output means that the oil market’s re-balancing remains delicate,” IEA said.

After steadily rising since late May, new confirmed COVID-19 cases appear to be stabilizing around 280,000 daily, the highest rate since the early days of the pandemic. Easing of the first wave of confinement measures was bound to lead to a resurgence of cases as normal activity resumed. In many countries, social distancing measures are being re-introduced along with some localized lockdowns.

“It remains to be seen if the increase in cases heralds a second wave or it is merely a regular fluctuation that we will see over time,” IEA said.

Global oil demand

The virus continues to impact road transport as people avoid non-essential trips and working from home remains the norm in much of the West. Mobility data for July imply that fuel demand remains below seasonal norms in Europe and North America. Regions where the virus is continuing to spread fast – e.g. Latin America and India – show much worse figures for mobility.

For diesel, there is evidence that the recovery in business and industrial activity combined with ongoing growth in e-commerce are supporting trucking activity as more goods are delivered to customers.

Jet fuel demand remains the major source of weakness. In this report, revised data show that in April the number of aviation kilometers travelled was nearly 80% down on last year and in July the deficit was still 67%. With few signs that the picture will improve significantly soon, IEA has downgraded its estimate for global jet fuel and kerosene demand.

According to IEA’s latest forecast, jet fuel demand in 2020 will be 4.8 million b/d or 39%, below the 2019 level, and in 2021 the year-on-year recovery will be just below 1 million b/d. These are the main components of a revision to the total 2020 oil demand picture from a decline of 7.9 million b/d seen in the last report to 8.1 million b/d in this edition. For 2021, IEA has reduced the expected rebound in growth to 5.2 million b/d from 5.3 million b/d seen previously.

In China, oil demand in June rose 200,000 b/d m-o-m and 750,000 b/d y-o-y. It was the largest annual rate of growth registered since the pandemic started. The largest increases were seen in transport fuels such as gasoil/diesel and gasoline, but LPG and ethane also grew strongly. However, jet fuel deliveries were around 180,000 b/d below last year’s level as international flights remained constrained by the pandemic.

India saw deliveries rise by 510,000 b/d from May to June. However, in July Indian deliveries fell once again, both m-o-m and y-o-y, as the virus spread further and due to extensive floods that curbed movement.

OECD oil demand fell 9.4 million b/d y-o-y in May, a slight recovery from April’s 12.2 million b/d fall. In volumetric terms, the largest decline was for gasoline, followed by jet/kerosene and gasoil/diesel. In particular, demand in Canada, Japan, Mexico, UK, and US significantly underperformed. Data for June point to a smaller decline of 6.3 million b/d y-o-y with jet/kerosene demand contributing the most in volume terms.

For 2020 as a whole, IEA forecast OECD consumption to average 43.1 million b/d, down 4.55 million b/d (-10%) from 2019 and the lowest annual total since the early 1990’s. In 2021, consumption should recover to 45.75 million b/d, but will remain around 1.9 million b/d below the 2019 level due to the continuing impact of Covid-19 on economic activity and particularly on the aviation sector.

Global oil supply

World oil supply rose from a nine-year low in June to reach 90 million b/d in July after Saudi Arabia ended its voluntary supply cut, the UAE pumped far above its OPEC+ target and the US began to reverse steep declines. Although production increased by 2.5 million b/d m-o-m, it was down 10.1 million b/d y-o-y after record OPEC+ cuts and massive economically driven shut-ins in the US and Canada led to a 13 million b/d decline from April to June.

In May, US crude output fell by nearly 2 million b/d from April’s level and, at 10 million b/d, it was 2.9 million b/d below the all-time high seen in November. However, WTI prices have averaged around $40/bbl since mid-June with little volatility, and US production is starting to rise again. For now, IEA expects US crude oil output to oscillate around 11 million b/d for the remainder of the year and into 2021, resulting in average declines of 900,000 b/d in 2020 and a further 500,000 b/d in 2021.

Canada is also seeing production rising and in June output was nearly 5 million b/d, although still about 900,000 b/d below the peak seen at the end of 2019. While Canadian refinery demand remained depressed, increased demand from US supported heavy crude grades.

After four consecutive months of falling or flat production, Brazilian oil supplies rose by 260,000 b/d in June to more than 3.1 million b/d, thanks to strong pre-salt. Production likely rose further in July, supported by the ramp up of Atapu field that saw first oil at the end of June. Record flows from Buzios field also boosted supply. In its latest investor update, Petrobras said the four FPSOs installed at the field reached a new output record of 674,000 b/d during July, well above the 600,000 b/d nameplate capacity.

Recovery in the two North American giants, with Brazil also growing, comes as the OPEC+ countries ease their output cuts.

In July, Saudi Arabia withdrew its voluntary 1 million b/d cut and changes in production elsewhere saw OPEC+ output increase by a net 1.3 million b/d. In August, output could rise again as the 9.6 million b/d of cuts implemented in May ease to 7.7 million b/d.

However, if countries that have not hitherto complied with their quotas cut back by enough to bring them into compliance, global oil supply would not necessarily increase significantly, IEA noted.

Prices

Crude prices remained in a narrow $3.0/bbl range in July, averaging $40.77/bbl for NYMEX WTI and $43.22/bbl for ICE Brent. The forward price curve contango deepened again in July after flattening in June, as forward prices (anticipating a tighter market) rose faster than prompt prices. Middle distillate and naphtha cracks made modest gains. Freight rates fell to levels not seen in months or even years.

OECD stocks, refining

OECD industry stocks rose by 16.2 million bbl (540,000 b/d) to 3,235 million bbl in June, and in the first half of 2020 they increased at an average rate of 1.78 million b/d. In the US, preliminary data for July show that commercial crude stocks fell by 18.2 million bbl. In Europe, they rose by 3.6 million bbl while falling in Japan by 1.6 million bbl. As the market rebalances and the forward price curve flattens, floating storage of crude oil fell by 35.7 million bbl from its all-time high in June, to 184.8 million bbl in July.

Global refinery intake is recovering, but the pace will lag behind the demand rebound as product inventory levels are very high. In July, crude runs are estimated at 3.7 million b/d above the low point in May, with another 5.6 million b/d ramp-up expected by end-2020.

In 2020, runs will decline by 6.9 million b/d but in 2021 they will rebound by only 4.5 million b/d. Runs in 2021 will be 2.7 million bd below the historical peak seen in 2018.