Expand executives earmark $300 million to add capacity for 2026

The leaders of Expand Energy Corp., Oklahoma City, have slightly increased their 2025 natural gas production forecast to roughly 7.1 billion cu ft equivalent per day (bcfed) and are earmarking $300 million in additional spending to set additional production in 2026 should market conditions be favorable.

In an early 2025 preview 3 months ago, president and chief executive officer Nick Dell’Osso and his team said the company planned 2025 production from assets in Haynesville and Appalachia basins to be about 7 bcfed. Updated guidance calls for output in the current quarter of 6.75 bcfed—up from 6.4 bcfed in the last 3 months of 2024—and to steadily climb as teams turn in line “substantially all” of the wells they prepared last year while gas prices were depressed.

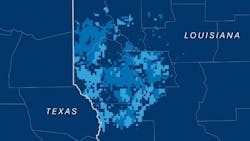

The majority of that growth will come from the Haynesville where production is projected to rise to an average of 2.9 bcfed this year from a little more than 2.3 bcfed in the fourth quarter. Expand’s Haynesville operations will receive a little more than half of the roughly $2.2 billion in drilling and completion capital executives plan to spend in 2025.

On a Feb. 27 conference call with analysts and investors, Dell’Osso reiterated his view that Expand is best served by only gradually ramping up production while also preparing future capacity as longer-term demand drivers such as LNG export plants and data center development take shape.

Hence the $300 million capex addendum penciled in for the second half of this year: That will grow Expand’s rig count from about 12 in first-half 2025 to up to 15 late in the year and give executives the option to boost 2026 production up to 7.5 bcfed from the baseline forecast of 7.2 bcfed.

“The market’s been volatile,” Dell’Osso said on the conference call. “We are better prepared for that volatility, we think, than just about anybody else out there.”

Formed last year via the $7.4 billion union of Chesapeake Energy and Southwestern Energy (OGJ Online, Feb. 13, 2024), Expand in the fourth quarter posted a net loss of $399 million on total revenues of $2.0 billion; in late 2023, those numbers had been a profit of $569 million and $1.95 billion, respectively.

Adjusted for merger costs, taxes, and big swings in derivates gains/losses, net income was $131 million in the quarter, down from $185 million in the same quarter of 2023.

Shares of Expand (Ticker: EXE) fell on the earnings report and management’s commentary: In midday trading, they were down 3% to about $99.20. Over the past 6 months, however, they have risen more than 35%, a surge that has grown Expand’s market capitalization to $23 billion.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.