ConocoPhillips plans year-over-year production increase, $12.9-billion capex

ConocoPhillips’s earnings were down year-over-year, but increased production. For 2025, the company expects production to grow even more on capital expenditures of about $12.9 billion.

The operator expects to produce 2.34-2.38 MMboe/d in 2025, which includes impacts of 20,000 boe/d from planned turnarounds. First-quarter 2025 production is expected to be 2.34-2.38 MMboe/d.

The operator had fourth-quarter 2024 earnings of $2.3 billion, compared with fourth-quarter 2023 earnings of $3.0 billion. Excluding special items, fourth-quarter 2024 adjusted earnings were $2.4 billion, compared with fourth-quarter 2023 adjusted earnings of $2.9 billion.

Special items for the current quarter were primarily due to transaction and integration expenses largely offset by a tax benefit, both resulting from the acquisition of Marathon Oil, and debt transaction-related expenses.

Full-year 2024 earnings were $9.2 billion, compared with full-year 2023 earnings of $11.0 billion. Excluding special items, full-year 2024 adjusted earnings were $9.2 billion, compared with full-year 2023 adjusted earnings of $10.6 billion.

Fourth-quarter review

Production for fourth-quarter 2024 was 2.1 MMboe/d, an increase of 281,000 boe/d from the same period a year ago. After adjusting for impacts from closed acquisitions and dispositions, fourth-quarter 2024 production increased 139,000 boe/d or 6% from the same period a year ago.

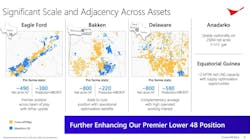

Lower 48 delivered production of 1.3 MMboe/d, including 833,000 boe/d from the Permian basin, 296,000 boe/d from the Eagle Ford, and 151,000 boe/d from the Bakken.

Earnings decreased from fourth-quarter 2023 as higher volumes were more than offset by nonrecurring acquisition-related transaction and integration expenses, lower prices and higher depreciation, depletion and amortization (DD&A). Adjusted earnings decreased as higher volumes were more than offset by lower prices, higher DD&A and increased operating costs.

For the fourth quarter, cash provided by operating activities was about $4.5 billion. Excluding a $1.0 billion change in working capital, ConocoPhillips generated cash flow from operations (CFO) of over $5.4 billion.

The company funded $3.3 billion of capital expenditures and investments inclusive of $0.4 billion of spend related to fourth-quarter acquisitions, repurchased $2.0 billion of shares, and paid $0.9 billion in ordinary dividends. In addition, the company completed strategic debt transactions and repaid naturally maturing debt, resulting in net cash proceeds of $1.2 billion.

Full-year review

Production for 2024 was 1.99 MMboe/d, an increase of 161,000 boe/d from the same period a year ago. After adjusting for impacts from closed acquisitions and dispositions, production increased 69 MBOED or 3% from the same period a year ago.

In 2024, cash provided by operating activities was $20.1 billion. Excluding a $0.2 billion change in working capital, ConocoPhillips generated CFO of $20.3 billion and received disposition proceeds of $0.3 billion. The company funded $12.1 billion in capital expenditures and investments.