ConocoPhillips to acquire Marathon Oil in $22.5-billion deal

ConocoPhillips has agreed to acquire Marathon Oil Corp. in an all-stock transaction with an enterprise value of $22.5 billion, inclusive of $5.4 billion of net debt.

The deal would add complementary acreage to ConocoPhillips’s existing US onshore portfolio, adding over 2 billion bbl of resource with an estimated average point forward cost of supply of less than $30/bbl WTI, the companies said in a joint press release May 29.

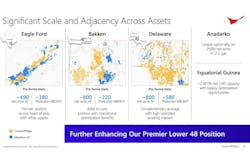

Marathon is focused on four US resource plays—Eagle Ford, Bakken, Permian, and SCOOP/STACK—with an integrated gas business in Equatorial Guinea.

“This acquisition of Marathon Oil further deepens our portfolio and fits within our financial framework, adding high-quality, low cost of supply inventory adjacent to our leading US unconventional position,” said Ryan Lance, ConocoPhillips chairman and chief executive officer.

Multi-basin deals, additional drilling locations

Commenting on the deal, to Andrew Dittmar, principal analyst at Enverus Intelligence Research, said the deal “represents a pivot in US shale M&A from deals focused on increasing exposure in a single key basin or play to acquiring a multi-basin operator,” which could work in Conoco’s favor during Federal Trade Commission (FTC) review “given the increased regulatory scrutiny for oil and gas deals,” he continued (OGJ Online, May 3, 2024).

“The largest area of concentration, and potential FTC concern, will be the Eagle Ford where Conoco will jump EOG [Resources] to become the largest operator with 400,000 boe/d of gross operated production compared to EOG’s 300,000 boe/d gross operated production,” Dittmar said. Marathon’s Eagle Ford operations produced 127,000 net boe/d in this year’s first quarter. Overall, the deal would boost ConocoPhillips's Eagle Ford position through an 85% increase in net location count, he detailed.

Dittmar said the deal also “adds 2,600 net remaining drilling locations to Conoco’s portfolio, giving it about 13,000 net remaining untapped locations across its US shale resource plus the Montney in Canada.”

ConocoPhillips expects to achieve at least $500 million of run rate cost and capital savings within the first full year following the deal’s closing through reduced general and administrative costs, lower operating costs, and improved capital efficiencies.

The transaction, subject to the approval of Marathon Oil stockholders, regulatory clearance, and other customary closing conditions, is expected to close in fourth-quarter 2024.