US producers continue comeback as revenues, income rise in 4Q09

Don Stowers,Editor, OGFJ

Laura Bell,Statistics Editor, Oil & Gas Journal

Fourth-quarter 2009 financial results for the OGJ150 group of publicly traded oil and gas producers are dramatically different from the same period in 2008 when the United States and indeed most of the world seemed to have fallen into an economic abyss. Revenue and net income had plummeted in the last quarter of that year as the world floundered in the midst of the worst financial crisis since the Great Depression. Now it appears the nation is slowly climbing out of the hole, and the energy industry is leading the way.

The petroleum industry, particularly the upstream sector, has proved remarkably resilient. Since those gloomy days, US producers as a group have posted three consecutive quarters of growth in both total revenues and net income.

For the 4Q09, total revenues grew by $20 billion (roughly 9%) to more than $241 billion over the third quarter and by nearly $13 billion (5.6%) over the 4Q08.

Net income for 4Q09 rose by about $609 million (4%) to almost $16 billion over the third quarter. The biggest turnaround is in net income from 4Q08 to 4Q09. The former showed a loss of $41.9 billion, whereas the latest figures showed a positive return of $16 billion in net earnings – a difference of approximately $57.9 billion comparing quarter to quarter.

The only disappointment is that year-to-date capital and exploration spending was down about 11.6%. Part of this is a result of greater efficiencies, but it is also partly due to continuing credit restrictions and a failure of some producers to ramp up exploration spending. In the fourth quarter of 2008, the OGJ150 group of companies spent roughly $161 billion compared to the same period in 2009 when they spent just $122 billion.

This quarterly report covers 142 companies, although only 122 of them reported results as of press time.

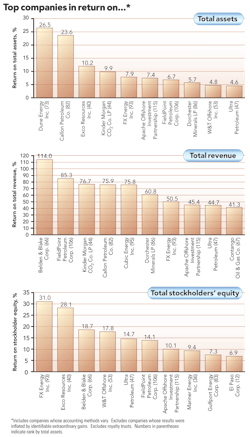

Among these companies, total assets grew by about $7.5 billion from 4Q08 – an increase of about 0.7%. Total assets as of Dec. 31, 2009, are estimated to be $1.075 trillion for these 122 companies.

Stockholder equity grew by 3.8% to more than $501.3 billion year on year. It was up 2.1% from the previous quarter.

Largest in net income

Among the top 20 companies in net income, 15 showed increases over the prior quarter. ExxonMobil remains the largest producer by far with more than $6 billion in earnings, almost twice as much as the second-ranked company, Chevron Corp., with about $3.1 billion in net income.

Chevron, third-ranked ConocoPhillips ($1.2 billion), fourth-ranked Occidental Petroleum ($938 million), 10th-ranked Marathon Oil Corp. ($355 million), and 14th-ranked Exco Resources ($241 million) all showed income declines over the prior quarter.

Five new companies joined the top 20 in net income, including EOG Resources ($400 million), El Paso Corp. ($274 million), Miller Petroleum ($272 million), Dominion Energy ($146 million), and Newfield Exploration Co. ($113 million).

The five companies that dropped off the list are: Chesapeake Energy ($524 million loss), Forest Oil ($45.2 million profit), Noble Energy ($8 million profit), Williams Cos. ($109 million profit), and Energen Corp. ($83.4 million profit).

As a group, the top 20 in net income earned about $1 billion more than in the previous quarter, an increase of nearly 6.9%.

Largest in total revenues

Among the top 20 companies in total revenues, all showed increases in revenue over the prior quarter. As a group, total revenues were up about $16 billion (about 7.4%) to $233 billion for the quarter.

ExxonMobil again led the group in total revenues with $87.1 billion, followed by (in order): Chevron ($48.7 billion); ConocoPhillips ($43 billion); Marathon Oil ($15.9 billion); Hess Corp. ($8.7 billion); Murphy Oil ($5.8 billion); Occidental Petroleum ($4.5 billion); Apache Corp. ($2.6 billion); Devon Energy ($2.4 billion); and Anadarko Petroleum ($2.4 billion).

To illustrate how much the domestic oil and gas industry continues to be dominated by the largest companies, the total revenues for the top 20 companies for the 4Q09 was $233 billion compared with $241.6 billion for the entire 122 companies covered in this report. So the largest 20 companies in revenue had 96.5% of the total, with the remaining 120 companies bringing in 3.5% of the total.

The picture is even more dramatic with respect to net income. The top 20 companies had $16.3 billion in net income among them, while the OGJ150 group as a whole had just $16 billion in net income. So the largest 20 companies had more than 100% of the total because the remaining 120 companies as a group had a net loss of $368 million.

Fastest-growing company

Austin-based Brigham Exploration Co. tops the list of fastest-growing companies for the quarter with a 187.7% increase in stockholders' equity over the preceding quarter. The company also had a 418.9% increase in net income over the same period.

Beginning in late 2005, Brigham began acquiring acreage in the Williston Basin in North Dakota and Montana and has invested about $170 million in drilling and seismic in the region. As a result, the company has shifted most of its drilling capital expenditures from its traditional base in the onshore Gulf Coast, the Anadarko Basin, and West Texas to the Williston Basin, where they are currently targeting the Bakken, Three Forks, and Red River objectives.

The company anticipates increasing its operated rigs running in the Williston Basin from four to eight by May 2011 and drilling a total of roughly 76 net Bakken and Three Forks wells during 2010 and 2011.

Click here to download the pdf of the OGJ150 Quarterly "Quarter ending Dec. 31, 2009"

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com