Global outlook for upstream and oilfield services is healthy

Jon McCarter

Ernst & Young Houston

Doubtless, 2009 was a year of considerable challenge for many, but opportunity for some, and the fundamental outlook for the oil and gas sector continues to look positive. It's clear that there is light at the end of the tunnel rather than a train coming toward us.

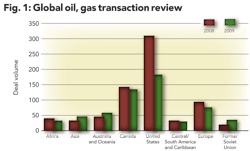

In total, 837 deals were announced in 2009 with upstream accounting for 72% of these. The volume of deals was down 24% compared to the previous year. The total value of oil and gas transactions announced globally stood at US$198 billion, up some 10% compared to the previous year.

This is perhaps surprising given lower than average commodity prices in 2009, although the statistics have been dominated by a few large transactions. If ExxonMobil had not announced its US$41 billion acquisition of XTO Energy in December, the figures would have looked very different. M&A activity was much stronger in the second of half of 2009 (485 deals versus 352 in the first half), reflecting the improving capital market conditions and growing consensus on oil price outlook.

Corporate oil and gas valuations started 2009 at subdued levels, reflecting depressed commodity prices and wider capital markets malaise. This presented opportunities for well-capitalized acquirers, such as Asian reserve-seeking national oil companies (NOCs), but naturally drove sellers toward asset-level transactions. Overall, would-be acquirers had the upper hand and the total value of announced corporate transaction levels were up considerably in 2009, accounting for 66% of total deal value compared to 44% in 2008.

The positive trends that we have seen in recent months are likely to continue, and the outlook for oil and gas transactions remains healthy in upstream and oilfield services. In the downstream world, over-capacity in some regions is likely to drive a longer period of uncertainty and transactional challenges. But as 2009 aptly demonstrated, one person's challenge represents another's opportunity.

The mixed fortunes of the upstream universe in 2009 continue to leave a wide divide between the haves and have-nots. The increased oil price may have generated a flurry of equity investment, but funding constraints continue to affect many, be it equity or debt, and the successes of proposed IPOs this year are being carefully monitored. Companies' increased cost of capital has not necessarily been factored into transaction valuation methodologies as much as might be expected.

Commodity pricing, another key valuation parameter, has not been universally positive either. Oil has spent the second half of 2009 hovering around the anticipated US$70 per barrel mark, a welcome improvement for many from the mid-$30s seen at the start of the year, but there is an ongoing short-term pricing concern given depressed levels of global demand and surplus OPEC capacity. Natural gas pricing has had a tougher year, and possible development projects continue to face delays as companies wait for improved pricing and stability.

Despite the ups and downs, M&A activity has improved, increasing by volume. Improved access to funding and relative economic stability have encouraged those that can to take advantage of reduced valuations and less competition for opportunities. This has largely been to the benefit of well-capitalized organizations with a long-term commodity outlook or need, such as Asian NOCs with growing energy-hungry economies and gas utilities seeking a physical hedge. Deal activity within the independent sector has been lower.

Deal volumes on the up through a period of depressed share prices

Despite the increased M&A activity in the second half of 2009, transaction volumes fell short of 2008 levels with 605 upstream transactions announced in 2009 versus 730 in 2008. Significantly, asset deals showed a 22% drop in volume from 2008 levels while the number of announced corporate transactions was consistent with 2008 levels, accounting for 21% of deals by transaction volume and over 70% by deal volume as acquirers looked to take advantage of depressed market pricing.

The combined value of announced deals in 2009 was US$149 billion according to data from IHS Herold Inc., comparing favorably to the US$112 billion in 2008. However, two transactions made up US$62 billion of the value being ExxonMobil's announced deal with XTO and Suncor's acquisition of Petro-Canada.

North America continues to be the most active market

A little over 50% of global upstream deals announced in 2009 were in North America, down from the 80% bias that we reported last year. While Canadian volumes were consistent, 2009 witnessed a 42% drop in US deal volume. This is a clear demonstration of the market impact of difficult funding conditions and a challenging short-term natural gas outlook in North America.

In terms of deal value, North America accounted for over 65% of announced transaction values according to IHS Herold with five of the 10 largest transactions targeting North American reserves. Exxon Mobil's announced US$41 billion acquisition of XTO in December and Suncor's US$21b acquisition of Petro-Canada in March were the year's largest announced transactions and are reflective of a longer-term outlook being taken on unconventional resources, such as oil sands and shale gas, from the larger independents and international oil companies (IOCs).

More generally, however, the relative weakness of natural gas prices in the US shifted acquisition activity back to conventional reserves. Oil represented about 50% of acquired US proved reserves for the year until Exxon's announcement swung the bias back to natural gas.

US private equity activity in the upstream sector showed strong signs of improvement during the second half of the year. We anticipate a renewed interest in the sector from private equity through 2010. There is, however, a backlog of businesses to exit that may affect the quantity and timing of new investments.

Asian NOCs funding rapid expansion

National oil companies were the focus for much of the M&A speculation in 2009, targeting reserves and production to support continued domestic economic growth. Being government-sponsored, such entities typically rely less on external financing, which is a key advantage in a funding constrained market.

Sinopec's US$9 billion acquisition of Swiss oil explorer Addax Petroleum, announced midway through the year, and KNOC's US$4 billion acquisition of Harvest Energy Trust in October are among the top five transactions by value this year. Both transactions are representative of Asian NOCs, recent international expansion, and deep pockets.

IOC-NOC JVs are indicative of future trends

We anticipated at the start of the year an increasing likelihood of additional strategic partnerships between NOCs and IOCs. These arrangements offer reserve-hungry NOCs access to reserves and experienced international partners, while the IOCs benefit from access to capital and potentially service or infrastructure capabilities. Many of the recent license awards in Iraq exemplify this theme.

Looking forward, things may be less positive for IOCs in these arrangements as Ernst & Young predicts that reserve-seeking NOCs in certain areas may partner directly with other reserve-holding NOCs, leveraging political ties to access opportunities and expand operations.

"Funding constraints continue to affect many…Companies' increased cost of capital has not necessarily been factored into transaction valuation methodologies as much as might be expected."

CNPC and KMG's US$3.3 billion acquisition of MangistauMunaiGas (MMG) from Central Asia Petroleum and China National Offshore Oil Corporation (CNOOC) and Qatar Petroleum's E&P sharing agreement are examples of the adoption of more international NOC partnering. With Sinopec's acquisition of Addax resulting in its exclusion from the second Iraq licensing round, NOCs may look to be more selective in their targeting.

Outlook for the remainder of the year

With stability comes market confidence, and we have seen equity investment returning to the sector. A number of IPOs are planned for 2010, and if successful, we can expect to see increasing investor interest in the sector. Lessons have been learned regarding the risks of investing in single-asset, pure exploration companies, so we anticipate that companies successfully coming to market will have larger portfolios, probably spread from exploration into production operations.

Further commodity pricing volatility is likely in the short term as global demand is predicted to remain below supply capacity into 2010. As economic recovery drives demand growth, greater pricing stability is expected in the medium term, although the precise timing and shape of recovery remains a subject of much speculation. This strong medium term consensus will be a key enabler in upstream transactions in 2010 as buyers and sellers share the outlook for a critical component of pricing.

NOCs have arguably been more active than the majors in 2009, but ExxonMobil's announced acquisition of XTO may be the trigger for a wave of acquisitions as the majors emerge from a year of restructuring and internal reorganization.

Service costs have fallen in 2009, and 2010 may see a return to investment in longer-term capital projects, often in unconventional resources, such as shale gas, oil sands, and coal bed methane. The heavy investment requirements of these projects has left a number of IOCs without financing options to meet required development costs, and these continue to be targets for those with liquidity.

A large proportion of the junior universe continues to face financial difficulties. Although investors have demonstrated an appetite for secondary financing, much of this is aimed at the larger entities with current or near-term production opportunities. There has been less consolidation activity at the smaller end of the market than expected, but because financing remains hard to come by and asset inactivity continues, many of these entities will be forced to take action or face asset relinquishment.

In closing

The outlook is positive. Funding conditions, both on the debt and equity sides, are improving as private equity begins to refocus on external opportunities rather than managing existing portfolios.

As valuation expectations of sellers adjust from the heady days of 2007, trade buyers are back in the game. The public markets are recovering and a number of privately held oilfield services (OFS) companies are being positioned for possible flotation. As operators plan new capital expenditure in a healthier oil price environment, pricing pressure reduces and order backlogs build up, it seems unlikely that 2010 will be as quiet for OFS transactions as 2009.

About the author

Jon McCarter is oil and gas transactions leader with Ernst & Young's Transaction Advisory Services team in Houston and works with some of the world's largest organizations, fastest-growing companies, and private equity firms on some of the biggest and most complex cross-border deals in the global market.

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com