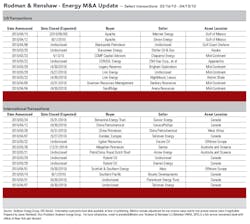

Apache deals increase GoM presence

Houston-based Apache Corp.'s two transactions in mid-April highlight the past month's major M&A deals. On April 15, Apache announced it had agreed to acquire Mariner Energy in a roughly $3.9 billion transaction, which includes $1.2 billion of Mariner debt. The deal is expected to close in the third quarter, subject to Mariner shareholder and regulatory approval. G. Steven Farris, Apache's chairman and CEO, said, "This is a strategic step and a natural extension into the deepwater Gulf for Apache." He added that Mariner provides a new platform for growth in the deepwater and compliments Apache's strength in the Gulf Shelf and the Permian Basin. At year-end 2009, Mariner had interests in nearly 350 federal offshore leases, with more than 110 in development.

Apache also acquired certain assets from Devon Energy in the Gulf of Mexico valued at about $1.05 billion.

In another significant US deal, SandRidge Energy and Arena Resources agreed to merge with the former paying about $1.5 billion to Arena shareholders. Oklahoma City-based SandRidge will be the surviving entity with a combined enterprise value of roughly $6.2 billion. The transaction will make SandRidge one of the largest producers of West Texas conventional oil and gas.

Refining giant China Petroleum & Chemical Corp., or Sinopec, more than doubled China's presence in Alberta's oil sands by paying $4.7 billion for ConocoPhillips' 9% stake in Syncrude Canada Ltd. Last October, Conoco CEO Jim Mulva said the company planned to sell $10 billion in noncore assets by 2011 to pay down debt, right-size the company, and improve its financial position.

The board of directors of Australia's Arrow Energy Ltd. has recommended that stockholders accept an offer from CS CSG (Australia) Pty Ltd., a company jointly owned by PetroChina and Royal Dutch Shell, to purchase Arrow for about $1.9 billion. Arrow would "de-merge" certain assets into a new company called Dart Energy.

Calgary-based Talisman Energy has agreed to sell a number of non-core assets in Canada with total proceeds of approximately $1.9 billion, through five separate transactions. John Manzoni, chairman and CEO, said the sales will help the company focus on its growing North American shale gas business.