Investment considerations in Libya's upstream market

One of the most attractive E&P opportunities in the world today, Libya, is offering new prospects for growth to majors, state oil companies, large independents and service companies alike. There appears to be reasonable investment opportunity as the country moves quickly into a more open E&P marketplace.

Quick summary

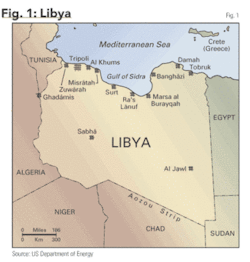

• Slightly larger than Alaska, Libya is the No. 3 oil producer in Africa.

• Libya is Europe’s No. 1 oil supplier.

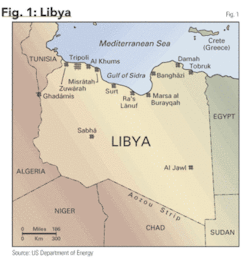

• Oil production is currently 1.5 MMBD or 43 percent of peak production in 1970.

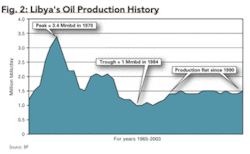

• Proven oil reserves could equate to 39 billion barrels, or three percent of the world’s total.

• Proven gas reserves may be near 52 TCF, almost 90 percent of Canada’s.

• Libya’s goal is in excess of $30 billion in capital investment in the energy sector in the next 10 years to ramp up oil and gas production.

• Strategy: Allow E&P and service companies to infuse modern technology into outdated petroleum infrastructure.

Today's E&P theme: growth

The challenge for today’s E&P operations, whether they are international majors, super independents or in some cases, state oil companies, is to grow their business. What is growth? It means operators must at least replace, but also expand reserves. And then there’s the need to increase production as well.

Today the world’s top international E&P companies are faced with huge reserve replenishment goals that require worldwide search and evaluation. But they must also add to those replenished reserves to satisfy growth goals - very difficult, indeed.

Accordingly, E&P management with responsibility to grow the business must search the globe for reserve opportunities, knowing that, to be successful, they first must have a location with attractive prospects. Then they must be able to validate all risk and economic considerations involved for the sake of their own internal metrics and to justify the undertaking on an investment basis, just as they would for any long-term investment.

We think the global oil and gas sector is now energized - much like it was in the late 1960s and early 1970s with North Sea and, later, West African campaigns - to move aggressively on international opportunities. Therefore, Libya has become a timely target for potential development.

Libyan oil and gas situation

For many years the oil and gas industry has looked longingly at Libya’s underutilized oil and gas reserves. But due to US government sanctions imposed in the late 1980s, US E&P and service companies were prohibited from direct participation. Those sanctions not only affected producers and service companies, they impacted trade and the investment sector as well.

International producers and Libya’s state oil company and affiliates have been heavily involved in hydrocarbon development with focus on both brownfield enhancement and new development. But as time moved on, production languished, falling from a peak of 3.5 MMBD in 1970 when Libya was ranked among the top oil producers in the world to approximately 1.5 MMBD today.

Primary responsibility for development was left to Libya’s National Oil Corporation (NOC), local Arab oil companies such as WAHA, Zuetina, and a few European companies such as Eni/Agip, Wintershall, Total, and Repsol. Petro-Canada also entered Libya with the purchase of 25 percent of Lundin Petroleum AB, Stockholm assets and 49 percent of the assets of German-based Veba Oil & Gas GMBH, a joint venture with NOC. A majority of brownfield operations have been managed by NOC and affiliates while international players have tended to focus on new development.

Unfolding opportunity

In the spring of 2004 Libya’s leader, Col. Muammar Gaddafi (as a point of interest, there is a book published that lists over 200 different ways to spell Col. Gaddafi’s name), finally concluded it was time to reenter the international community. He was helped by US initiatives that had been underway for some time.

The decision sparked immediate interest and plans for new economic activity for Libya, a good share of which is in the oil industry. As a result, Libya may now be one of the hottest E&P opportunities in the world and in a sense is becoming another long-term play similar to the North Sea or West Africa.

As one would then expect in these busy times, if you visited the Corinthia Group’s Bab Al-Africa luxury hotel in Tripoli in the past year, you would surely be rubbing elbows with senior management from ChevronTexaco, Oxy, Marathon, ConocoPhillips, and energy service companies as well. You also would likely bump into the recently posted staff from the US Departments of State and Commerce.

With all of this time, effort and expense, what questions are new entrants hoping to answer? The majority has spent time in other areas of the world where the business climate was just as challenging. But it is a bit different in Libya. Certainly there is E&P history; there is some (but limited) infrastructure; there is a welcoming attitude for international oil companies to be sure; and there is one important condition that helps underscore the bigger development opportunity: the implementation of technology into an upstream environment where the clock stopped in 1987.

That is to say that most fields, equipment and operating practices are vintage 1980s by today’s exploration-drilling-completion-production standards. We think a major theme in Libya’s potential for success will be the infusion of new oilfield technologies to allow a faster upramp in E&P results.

Libyan oil and gas reserves are well documented. According to figures released by NOC, Libya has proven oil reserves accounting for 42 percent of Africa’s total and three percent of the world. There appears to be great enthusiasm for all of the onshore and offshore blocks that are currently included in EPSA-IV, Libya’s now-ongoing round of open-bid licensing.

Last September EPSA-IV was launched in London. The offering covers 58 blocks in all the major oil and gas basins: Sirte, Ghadames, Murzuq, Cyreneica-Batnan, Kufra, and Offshore.

In the beginning approximately 125 companies registered but only about 70 were ultimately qualified to bid. As of press time for this publication, NOC was holding to a 29th January deadline for final submittal of proposals even though there have been reports of possible delay.

World-scale investment

Libya has upside plans for reserve and production growth. NOC’s published current capacity figure is at 1.5 MMBD. They want very much to increase it to three MMBD between 2010 and 2015 and anticipate the investment required will be near $30 billion, a figure that would probably include some midstream and downstream improvements.

That’s a huge expenditure but it is considered feasible with the opening of the country’s E&P opportunities to international companies, enhancement of oil infrastructure, and new technology implementation.

This ambitious program will require major study and evaluation of new and existing fields. For example, there will undoubtedly be assessment of exploratory opportunities utilizing current-state seismic and petrophysical technologies. Then there is brownfield production that provides logical candidates for enhanced recovery programs. In the area of completion and recompletion, we know that at the present there is limited fracturing taking place.

These and other instances point out a long list of opportunistic situations for improvement. This being the case, companies that call for or provide downhole data, completion or production-enhancement services can change the face of the industry and its practices as they exist today in Libya. Those companies must be prepared to address the long term in their programs to invest in the equipment and personnel required for profitability in a Libyan “campaign.”

In spite of these promising numbers, the answers to any of an executive’s questions must be tempered with the following conditions:

• Over 15 years of isolation from state-of-the-art oil exploration and recovery technology.

• Libya is an authoritarian state replete with complex bureaucracy.

• Need for enhanced international banking services.

• Problems in importation and logistics.

Operators should give significant attention, as always, to risk issues that will be a significant part of investment metrics in any E&P campaign. A brief summary of risk in Libya:

• Subsurface/geological - The opportunities are attractive, a must for even considering Libyan E&P potential. But more sophisticated seismic and geological assessment must come forward in order to evaluate effectively country-wide prospects.

• Market - Important to be able to move and sell produced product into global markets. Fortunately, Libya has long-established supply relationships with Europe and especially with the tiny island nation of Malta, located just 60 miles offshore from the Libyan mainland and a stepping stone into Italy and the rest of Europe. Malta, the newest member of the European Union, has significant infrastructure in the form of a deepwater harbor for loading and unloading crude oil and refined products and a European-style banking and legal system, which is attractive to Western investors.

• Political - A must to be able to deal adroitly with regulations, taxes, government, and in-country operational issues. Even though there is entrenched bureaucracy within this authoritarian regime, there is a welcoming environment on the part of the government and the Libyan people.

• Infrastructure - Adequate at this time to meet current demand but will need to expand.

• Commercial - Tied to infrastructure and political considerations, but it’s important to have a good feel for doing business in Libya, knowing the “right” partners and service providers and handling day-to-day problems and opportunities with a focus that extends two to three years out.

Six business areas of focus

Notwithstanding the negatives, we do know that international oil companies over time have traveled farther and spent more to explore in areas with far less potential. Our investigation of the Libyan oil industry gives us confidence that Libya offers viable and potentially profitable opportunities to committed upstream E&P, oilfield equipment, or service entities willing to deal with the challenge of bureaucracy and early-stage conditions of global E&P opportunities.

We’ve sorted through the Libyan upstream sector and considered six logical areas that are important to E&P and service company growth:

1) Exploration

2) Development

3) Improved maintenance

4) Enhancement of existing fields

5) HSE implementation

6) Training

Exploration - The Middle East is home to the majority of the world’s crude oil reserves, but most of its countries are largely closed to foreign E&P and investor entry. Libya is different - the door is opening to a broad prospect portfolio that will be attractive to investors, E&P initiatives, and application of appropriate technologies.

The type of improved exploration technology used in global markets today is taken for granted. Advances in 3D seismic, enhanced seismic processing, logging, coring, and related services are available to be employed quickly.

That’s not to say those capabilities are not present, but there is room for expansion. That applies to new and exploratory opportunities and also for existing fields where there is undoubtedly significant infill drilling potential.

Development - The same positive environment for exploratory initiatives is certainly going to be applicable to oil and gas development as well. Recent Libyan startups in development have been relatively successful with operators like Eni, Repsol, Total, Wintershall, and Petro-Canada leading the way.

There will be requirements for drilling, completion, EPC and turnkey projects for all associated services. That could call for downhole technology and services such as MWD, horizontal drilling, multilateral completion, downhole pumps, etc.

There is also the related need for consulting engineers in such disciplines as civil, mechanical, and petroleum. As an example of spending requirements in development, NOC officials point out they have 10 to 15 major field developments ongoing or in the planning stages with beginning-to-end expenditures in the $9 billion dollar range.

Improved maintenance - Oil companies with long histories of successfully operating aging production could do well here. Experience in managing in areas like the Permian Basin in Texas could go far in, say, the Sirte Basin where a majority of producing fields are at least 45 years old.

Considering that most of the existing fields are being operated with pre-sanction equipment and that spare parts and replacements having been difficult to procure, upgrading overall maintenance can have an immediate impact in existing fields.

For example, we’re told that many aging electric submersible pumps in service require too-frequent maintenance and that spares and replacements are rare. The same is true on other subsurface and surface equipment. Readily available parts and service will be a plus for future maintenance.

Enhancement of existing fields - Upgrading existing fields and enhanced recovery technologies to be implemented in producing fields is a high priority of NOC. A significant number of Libyan oil fields today are considered mature. Many wells are experiencing declining oil production accompanied by more sand and water production, so there is opportunity to enhance many of these vintage fields.

A logical first step by operators could be the execution of field-wide production enhancement studies (one of NOC’s several top priorities) with results supplying much-needed data describing reservoir and field conditions.

Improving individual well production could then be executed on selective bases. One can smartly employ remedial stimulation, EOR techniques using production chemicals, or installing waterflood programs using data from downhole monitoring systems, consider multilateral completions (similar, say, to ML campaigns in Canada and Venezuela), and so on. There are still more techniques and technologies available, most of which have been successfully deployed worldwide.

Health, safety, and environmental implementation - The Libyan oilfield has operated for many years with some attention to health, safety, and environmental issues. International E&P companies operate within very stringent HSE protocols that could raise the scale of practice in Libya once they enter and begin to extend their operations. NOC has placed strong emphasis on the implementation of HSE programs for any foreign operating company.

This is especially true with the environmental services. NOC is aware of environmental issues or potential problems and is making efforts to address the situation involving new companies that will enter the upstream market.

One example is the reduction of emissions, so they are targeting the flaring of gas. Another is their Law No. 7 that addresses water and wastewater treatment, land contamination, air pollution, waste management, and systems monitoring. All these areas offer prospects for services specializing in health, safety, and environmental services.

Training - The area of training is a major concern for NOC and they are making it a focus issue for any oil and gas company or service company that plans to operate in Libya.

NOC goes through its affiliate, Umm Al Jawaby, in its planning and arranging for training. But there will be new requirements for any foreign companies working in Libya to hire and train certain shares of the local workforce. Training then becomes part of the cost and the reward in doing business in Libya, so it is certainly an important component of E&P strategy as well as being a medium to long-term opportunity for companies experienced in all phases of oil field training.

Summary

There is no question that Libya now offers very attractive opportunities for international E&P and service companies alike. There is reward to those with capital, commitment to the long term, and patience in dealing with delay and bureaucracy. There is risk as well, along with investment concerns associated with any international market in an early-opportunity stage.

We suggest that one should look at Libya through the prism of technology implementation, probably on two levels: The high-end applications that pay off in the long term, typically on new development; and lower-cost technology that would focus on brownfields, typically operated by NOC and affiliate companies that seek short-medium term results.

In that sense, one should think back to other global oil and gas developments that were brought forward quickly, and in most cases, successfully, when appropriate technologies and smart practices were employed.

Recall the North Sea, West Africa, and other regions that began to flourish with proper deployment (and good management) of drilling, completion and production systems and technologies. That can happen in Libya soon - not this year, maybe not next year, but the impact and early successes should begin to evolve thereafter.

Those conditions and the general situation described above should be taken into account in all investment issues that one will be addressing in the now-improving Libyan oil and gas market.OGFJ

The author

Don Warlick [[email protected]] is president of Houston-based Warlick International, a market and business consultancy that specializes in global energy business. Established in 1977, the firm is developing a new annual market report covering all aspects of the Libyan upstream oil and gas sector. Previously, Warlick served in marketing and corporate development roles with Getty Oil Company; PepsiCo, Inc.; and The Williams Companies. He has BS and MS degrees in engineering from The University of Tulsa.

Libya report released

A comprehensive new report on Libya’s upstream and midstream oil and gas markets and the oil service sector is now available from Warlick International and Oil & Gas Journal. The report includes information about legal and regulatory issues, security concerns, and other relevant details of interest to the potential market participant. An annual subscription to the report includes quarterly updates. A prospectus and table of contents is available at www.ogjresearch.com.