CGES: Baltic exports of Russian crude threaten dominance of Black Sea routes

Development and rapid expansion of new export terminal on the Baltic Sea threaten the traditional dominance of Black Sea ports in the seaborne trade of Russian oil, according to an analysis by the Centre for Global Energy Studies, London.

The drive to build new export terminals in the north in part results from mounting competition faced by Russian crude in Mediterranean markets, said the report, where lengthening delays in transiting the Turkish Straits have driven up delivery costs. These delays are the result of more-stringent conditions imposed by Turkey on large oil tankers transiting the Bosporus and Dardanelles straits.

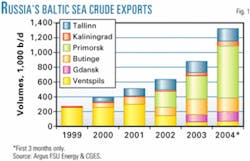

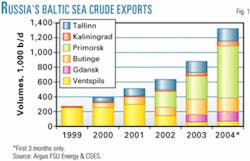

Figs. 1 and 2 present historical exports through the Baltic and the Black seas, respectively.

BPS opening

The first new Baltic Sea export terminal opened at Butinge, Lithuania, in August 1999 and handled 11,000 b/d of Russian crude in that half year. Throughput rose through 2002 to more than 200,000 b/d in 2003.

In 2000, large volumes of oil started to move through terminals in the Russian enclave of Kaliningrad and terminals in and near Tallinn in Estonia. "Although the volumes of oil exported from Kaliningrad have remained relatively small, throughputs at Tallinn rose to more than 150,000 b/d in 2003," said the Center's report.

The largest increase in Russian crude oil exports through the Baltic Sea, however, has resulted from the December 2001 opening of the Baltic Pipeline System (OGJ, Mar. 25, 2002, p. 62) and the associated export terminal at Primorsk and the rapid expansion in the capacity of this route since July 2003.

The system has been operating at capacity from the beginning and in 2003 carried 320,000 b/d (16 million tonnes) of Russian crude, said the report. The route's capacity, initially 240,000 b/d, was hiked to 360,000 b/d in July 2003, raised again to 600,000 b/d by yearend 2003, and increased by an additional 240,000 b/d in March of this year.

Plans call for additional boosting to 1.2 million b/d next year, "making it Russia's single most important crude oil export outlet, supplanting Novorossiysk," said the Center.

Development of the Baltic Pipeline System was prompted by a Russian desire for a northern oil export route entirely in Russian territory following the independence of the Baltic republics where all the Soviet-era Baltic Sea oil export terminals had been located.

The report said the Latvian port of Ventspils suffered directly from the opening of the Baltic Pipeline System with throughputs falling dramatically in 2002. "Pipeline deliveries to Ventspils ceased altogether at the start of 2003, when the port had to rely solely on deliveries by rail, which averaged just 66,000 b/d in 2003, little more than a fifth of the volume handled by the port in 2001," said the Center.

Gdansk, others

In 2003, it said, Russian crude oil exporters also increased their use of spare capacity along the northern branch of the Druzhba pipeline into Eastern Europe, delivering oil to the Polish port of Gdansk for re-export. Although this route had been used in the past, deliveries had been intermittent, said the Center, and it was only when "the capacity of pipelines to the traditional export terminals was fully utilized that Gdansk began to be used regularly by Russian oil producers."

In 2003, Gdansk handled nearly 90,000 b/d of Russian oil.

With the new export terminals operating, Russian crude oil exports through the Baltic rose to more than 880,000 b/d in 2003 from about 270,000 b/d in 1999. In first-quarter 2004, Baltic Sea exports rose even further, the Center's figures show, with Primorsk handling more than 700,000 b/d of Russian crude and throughputs at Gdansk rising to more than 120,000 b/d.

New Baltic Sea export terminals under construction by Russian oil companies and conversion of some of the storage tanks at the Lithuanian port of Klaipeda to allow transfer of crude oil as well as refined products, all being supplied by rail, "will ensure that Russian oil exports through the Baltic Sea continue to rise in the coming months." Lukoil, for example, was to have begun exports from its Vysotsk terminal, near Primorsk, early in second-quarter 2004.

Exports of crude oil through Russia's own ports and Ukraine's Black Sea terminals have also grown in recent years, said the report, but not as dramatically as on the northern routes (Fig. 3). Deliveries through the Russian port of Novorossiysk Black Sea have dominated exports: The port had seen throughputs rise to almost 940,000 b/d in 2003 from about 600,000 b/d in 1999.

Such other ports as Tuapse and Odessa have continued to handle around 100,000 b/d each of Russian crude, although throughputs at both have slipped slightly in recent years. Deliveries to Tuapse have been limited by the availability of the higher-quality Siberian Light crude that the port handles, while Odessa has faced increasing competition from other ports, said the report, and has tended to handle increasing volumes of Kazakhstani rather than Russian oil.

The Center said Russian crude oil exports through Black Sea ports rose to more than 1.3 million b/d in 2003 from slightly more than 800,000 b/d in 1999.

Dramatic effect

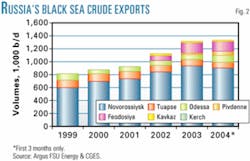

The rapid rise in Russia's crude oil exports through Baltic Sea terminals has dramatically affected the north-south split in the country's crude oil exports (Fig. 4). On average in 1999, 75% of Russia's seaborne crude oil exports moved through terminals on the Black Sea, with 25% shipped through the Baltic Sea; volumes exported from terminals on Russia's northern and eastern coasts were minimal, while exports from Caspian Sea ports were nonexistent.

By 2003, however, Baltic Sea ports accounted for 40% of Russia's seaborne crude oil exports. Those ports, said the Center will almost certainly handle more than half of the country's seaborne crude oil exports in 2004, following the 720,000-b/d increase in the capacity of the Baltic Pipeline System that took place in the 9 months between June 2003 and March 2004.

The Center's report concludes that the rapid rise in the volume of Russian crude oil transiting the Baltic Sea has raised concerns among the other countries bordering that body of water over the quality of the vessels used and the potential impact of an oil spill on the delicate ecosystem of the Baltic Sea.

"Like Turkey in the Black Sea to the south, countries bordering the Baltic Sea are seeking to impose more stringent conditions on tankers carrying Russian oil out of northwestern ports— conditions that Russia has, so far, opposed," said the report.