World energy consumption is projected to rise to 736 quadrillion btu (quads) in 2040 from 575 quads in 2015, an increase of 28%, according to the latest International Energy Outlook 2017 (IEO2017) from the US Energy Information Administration.

Most of this growth is expected to come from countries that are not in the Organization for Economic Cooperation and Development and especially in countries where demand is driven by strong economic growth, particularly in Asia. Non-OECD Asia, which includes China and India, accounts for more than 60% of the world’s total increase in energy consumption from 2015 through 2040.

By 2040, energy use in non-OECD Asia exceeds that of the entire OECD by 41 quads in the outlook’s reference case.

“Economic growth—as measured by gross domestic product—is a key determinant in the growth of energy demand. The world’s GDP (expressed in purchasing power parity terms) rises 3%/year from 2015 to 2040. The fastest rates of growth are projected for the emerging, non-OECD regions, where combined GDP increases 3.8%/year, driving the fast-paced growth in future energy consumption among those nations,” EIA said.

Fuel type

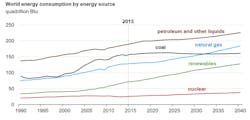

Through 2040, the outlook’s reference case projects increased world consumption of marketed energy from all fuel sources, except for coal, demand for which is projected to remain essentially flat. Renewables are expected to be the fastest-growing energy source, with consumption increasing by an average 2.3%/year between 2015 and 2040. The world’s second fastest-growing source of energy is projected to be nuclear power, with consumption increasing 1.5%/year over that period.

Even though IEO2017 expects the nonfossil fuels—renewables and nuclear—to grow faster than fossil fuels, fossil fuels still account for more than three quarters of world energy consumption through 2040.

Natural gas, which has a lower carbon intensity than coal and petroleum, is the fastest-growing fossil fuel in the outlook, with global gas consumption increasing 1.4%/year. The relatively high rate of gas consumption growth is attributed to abundant gas resources and rising production—including supplies of tight gas, shale gas, and coalbed methane.

Although liquid fuels—mostly petroleum-based—remain the largest energy source throughout the IEO2017 projections, the liquids share of world marketed energy consumption is projected to fall slightly, from 33% in 2015 to 31% in 2040. As oil prices rise, energy consumers are expected to turn to more energy-efficient technologies and switch away from liquid fuels where possible.

Compared with the strong growth in coal use in the 2000s, global coal use remains flat in EIA’s international projection. Coal is increasingly replaced by gas, renewables, and—in China and a few other countries—nuclear power for electricity generation. Demand for coal in industrial processes is also expected to slow.

China is the world’s largest coal consumer, but coal use is projected to decline in China by 0.6%/year from 2015 to 2040. In OECD countries, coal’s expected decline is similar, falling by 0.6%/year. The coal share of total world energy consumption declines over the projection period, from 27% in 2015 to 22% in 2040. World coal consumption would be even lower in 2040 were it not for the projected increases in its use by non-OECD Asian nations outside of China.