Propane prices experience strong third-quarter growth, petchem demand tempering

Michael Horvath Jr.

In third-quarter 2004, energy and propane prices were extremely strong while petrochemical demand for propane lessened compared to previous quarters. North American spot propane prices surged to more than 80 ¢/gal; Mont Belvieu and Conway, Tex., hit 84.5-85.0¢/gal. West Texas Intermediate (WTI) crude also surged back above $49/bbl.

Propane inventories in September increased to more than 67 million bbl. Petrochemical demand moderated at the end of the third quarter to less than 350,000 b/d.

Third quarter extraction rates were normal at 525,000 b/d. October natural gas bid week prices will average $5.21/MMbtu on the Texas Gulf Coast.

Refinery production experienced continued weakness during the quarter and averaged less than 340,000 b/d. Imports averaged an exceptionally strong 212,000 b/d.

Pricing

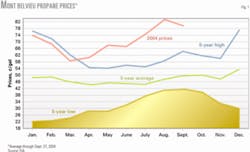

Energy markets were extremely strong in the third quarter, with current propane prices of 84-85¢/gal at Mont Belvieu (Fig. 1) and Conway. Even though there is a widespread consensus that speculators are a major factor in the markets, especially for WTI, there have been only brief price downturns during the past several weeks.

There will be more short-term corrections, but they will be minimal for now. Fundamental forces that began moving the propane market several months ago (i.e., tight supply-demand balances) have not changed. New tightness has arisen due to hurricane Ivan, which has had an unexpected, lasting effect on Gulf of Mexico production.

Price volatility will continue and probably get worse because worldwide demand is not expected to slow to any significant degree. Saudi Arabia's pledges to increase crude production will have no effect on the US because the crude has a low quality.

Propane prices are at record levels for this time of year even though the monthly averages have decreased from earlier in the quarter (decreases of 4.3¢ /gal and 5.3¢/gal to prices of 79.3¢/gal and 81.1¢/gal at Mont Belvieu and Conway, respectively). The full extent of the softening, however, has already occurred and prices are more likely to increase from these levels, especially with natural gas prices now escalating.

Crude oil prices will decrease only slightly, and not until early spring 2005. By late spring, crude prices could strengthen to about $54-56/bbl due to motor gasoline demand. Consequently, propane prices will remain high and could possibly surpass 90¢/gal through January, when natural gas prices typically exceed $7.00/MMbtu.

The propane-to-No. 2-fuel-oil ratio declined to 1.13:1, on a ¢/btu basis. The average WTI ratio fell to 75.8% (spot C3 cash prices vs. cash crude).

Propane supply

Extraction rates at gas processing plants continued at normal levels of 530-540,000 b/d during third quarter 2004, according to the US Department of Energy's Energy Information Administration (EIA). Extraction rates will continue at normal to above-normal rates through yearend 2004. This is because exceptionally strong NGL prices will keep processing margins above average despite rising natural gas prices.

High crude oil prices have been, and will continue to be, the driving force for strong processing margins. Processing margins in September averaged 18-20¢/gal on the US Gulf Coast and Midcontinent (Fig. 2). This is based on bid-week average natural gas prices of $5-5.25/MMbtu.

Even though natural gas prices will escalate to $7.00/MMbtu by yearend, margins should continue at greater than 10¢/gal because strong WTI prices will support equally strong NGL prices.

Natural gas prices in January 2005 will increase to $7.25-7.50/MMbtu; however, processing cash margins will still remain positive. As of October 1, the latest natural gas build of 81 bcf increased the working gas in storage to 3.092 tcf, or 200 bcf above the 5-year average.

Refinery production averaged 340,000 b/d and imports surged to 212,000 b/d in the third quarter.

Marine propane imports, exports

Nearly 6 million bbl of waterborne imports were scheduled for September delivery with another 1 million bbl expected in October.1 All of the September cargoes were destined for the US Gulf Coast and about 50% of the October cargoes are scheduled for delivery to the US East Coast.

Spot-price netbacks for the western Mediterranean Sea and the Atlantic North Sea moved strongly negative at –$14/tonne and –$80/tonne into the US East Coast and Gulf Coast, respectively. Due to these conditions, only contract cargoes are likely to move into the US.

Waterborne exports in September continued to be insignificant at less than 10,000 b/d. Total exports averaged about 20-25,000 b/d.

Petrochemical demand

Total feedstock demand improved in the third quarter, averaging nearly 1.9 million b/d.2 Propane demand, however, fell at the end of the quarter to less than 340,000 b/d due to poor cracking economics. Cash margins for propane were near breakeven levels after a weak August that included record-high summer prices. Heavier feedstocks, such as natural gasolines/naphthas and heavier, were exceptionally strong with cash margins of 8-10¢/lb of ethylene due to strong coproduct credits for pyrolysis gasolines (aromatics). Pure ethane and 80/20 ethane/ propane mix also had solid margins because of favorable pricing.

September cracking margins improved across the board, except for butane, which remained negative. Declines in average September prices (4+¢/gal for pure ethane and propane) pushed propane margins into positive territory and made ethane and ethane/propane mix much more competitive feedstocks.

Ethane stocks, which were at 5-year lows at the end of the second quarter, improved dramatically near the end of the third quarter (to nearly 20 million bbl) due to strong gains in gas-plant extraction levels.

The fourth quarter outlook remains mixed because of strong crude and natural gas prices, which tend to make the heavier feedstocks more competitive. Demand for propane will decrease to 314,000 b/d, and ethane consumption will remain relatively unchanged at 682,000 b/d.

US propane inventories

During the third quarter, US propane stocks increased 25 million bbl to 68 million bbl total, according to the latest EIA data. This pushed stocks above the average inventory level of 64.1 million bbl.

This surge in stocks was mainly due to exceptionally strong imports, both overland and waterborne, which accelerated dramatically during the last 5-6 weeks of the quarter. The overwhelming majority of the increase in August and September occurred on the US Gulf Coast due to waterborne imports and cutbacks in petrochemical consumption.

We were bullish on imports but underestimated the actual volume imported. Even if the US Midcontinent experiences record crop-drying demand, there is now enough propane in storage to move supplies there via pipeline or tank car.

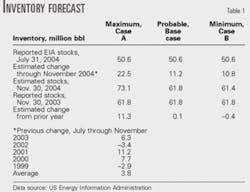

Table 1 shows our inventory forecast.

Regional inventories

PADD I stocks increased to more than 5 million bbl at the end of the quarter as waterborne imports continued to help the build. The increase is right on the 5-year average. Stocks will peak in the 5.5-6 million bbl range by November, helped by continued waterborne imports.

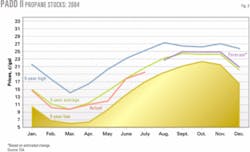

PADD II stocks were at normal levels in September with total primary storage of 25 million bbl (Fig. 3). While there remains the possibility of record crop-drying demand, strong Canadian imports will push the inventory to normal levels in the fourth quarter. Stocks will peak at 24.5-25.5 million bbl.

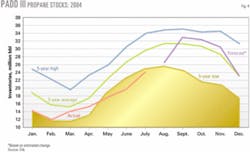

PADD III stocks increased to 35 million bbl at the end of the third quarter, which was above normal levels (Fig. 4). Significant waterborne imports and a decline in petrochemical consumption were the cause of the increase. Stocks are now likely to peak near or just above 35 million bbl.

Canadian inventories

Stocks increased at normal rates during the third quarter and will likely peak at 10.5-11 million bbl, according to Canada's National Energy Board. This would put stocks about 500,000 bbl above normal.

The split between Eastern and Western Canada should continue slightly in favor of the East at 51:49, but flow rates from the West can easily expand if there is increased demand.

Extraction rates continue to be strong, and there is no reason why stocks should not peak at comfortable pre-winter levels. Even relatively strong exports to the US Midcontinent, at this stage of the build, should not be a significant factor.

References

- "Waterborne LPG Report," Commercial Services Inc., Sept. 23, 2004.

- "Hodson Report," Jacobs Consultancy, September 2004.

The author

Michael Horvath Jr. (mhorvath @propaneletter.com) is president of M. Horvath & Associates, Houston, and author of The Propane Market Strategy Letter. He served as director of business development at Tauber Oil Co. until retiring earlier this year. Horvath has more than 35 years' experience in the NGL, petrochemical, and consulting businesses. He holds a BS (1972) in chemistry and mathematics from the University of Houston and has taken postgraduate courses in business law and economics. Horvath is a member and past chairman of the Houston Chapter of the Gas Processors Association and the Gas Processors Suppliers Association.