EQT to buy Rice Energy in $8.2-billion deal

EQT Corp., Pittsburgh, has agreed to acquire fellow Marcellus and Utica operator Rice Energy Inc., Canonsburg, Pa., for $6.7 billion, including $1.5 billion in net debt and preferred equity.

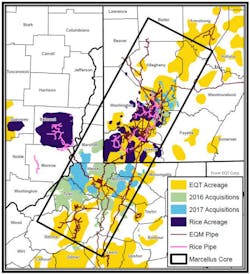

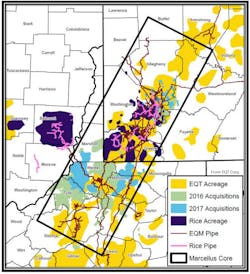

The deal includes estimated average sales volumes for 2017 of 1.3 bcfd. EQT says the vast majority of the acquired acreage is contiguous with its existing acreage position. At close, the firm will hold some 1 million total net acres in the Marcellus.

In terms of core net acres, the purchase will expand EQT’s position in the Marcellus by 187,000 to 670,000, in the Pennsylvania and West Virginia Utica by 105,000 to 616,000, and in the Upper Devonian by 64,000 to 149,000. The firm also will enter the Ohio Utica with 65,000 core net acres. Including its newly acquired acreage, EQT’s total estimated 2017 sales volumes from those regions are expected to be 3.6 bcfd.

EQT’s total number of undeveloped locations in the Marcellus will grow by 980 to 3,700, in the Pennsylvania and West Virginia Utica by 630 to 3,680, and in the Upper Devonian by 430 to 955. The firm is taking 280 locations in the Ohio Utica.

EQT also will obtain Rice’s midstream assets, including 92% interest in Rice Midstream GP Holdings LP, which owns 100% of the general partner incentive distribution rights and 28% of the limited partner interests in Rice Midstream Partners LP.

The firm expects the acquisition to result in a 50% increase in average lateral lengths for its future wells in Greene and Washington counties of Pennsylvania. The deal complements the footprint of EQT Midstream Partners LP, where the firm expects growth opportunities through dropdowns and additional organic projects.

EQT will pay 0.37 shares of EQT common stock and $5.30/share in cash of Rice common stock. EQT shareholders will own 65% of the combined company. The deal is expected to close in the fourth quarter.

Marcellus, Utica giant

"This transaction brings together two of the top Marcellus and Utica producers to form a natural gas operating position that will be unmatched in the industry,” commented Steve Schlotterbeck, EQT president and chief executive officer. “Since the beginning of 2016, we have added more than 485,000 acres to our development portfolio and have achieved significant scale in the core of the Marcellus.”

EQT earlier this year won a bankruptcy auction to acquire 53,400 net Marcellus acres, including drilling rights on 44,100 net acres in the Utica, from Stone Energy Corp. for $527 million (OGJ Online, Feb. 9, 2017). Also in the Marcellus, the firm in 2016 bought 42,600 net acres from Trans Energy Inc. and entities affiliated with Republic Energy for $513 million, and 62,500 net acres from Statoil ASA for $407 million (OGJ Online, May 2, 2016).

Rice late last year acquired Englewood, Colo.-based Vantage Energy LLC and Vantage Energy II LLC for $2.7 billion including debt (OGJ Online, Sept. 26, 2016).

“We will now shift our focus from acquisitions to integration as we work to drive higher capital efficiency through longer laterals, reduce per unit operating costs through operational and [general and administrative expense] synergies, improve our sales portfolio by expanding access to premium markets, and deliver increased value to our shareholders,” Schlotterbeck said.

Contact Matt Zborowski at [email protected].