World oil production capacity model suggests output peak by 2006-07

Simulations of the World Oil Production Capacity (Wocap) model suggest that global oil production will peak at a point near 81 million b/d well before the end of the decade, likely by 2006-07

Wocap was developed mainly during 1997-2000. The model's cornerstone consisted of the conventional oil reserves estimates developed by Colin J. Campbell that added to a global total of 1.9 trillion bbl.1

After the first successful simulation runs in 2001, Wocap was modified in 2002 to introduce political intangibles in most countries belonging to the Organization of Petroleum Exporting Countries. In 2003, an attempt was made to usher in global geopolitics within the model (Fig. 1).

Wocap simulations

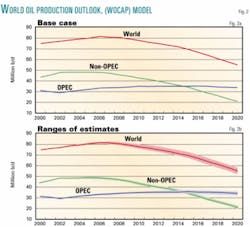

The latest Wocap simulation predicts that worldwide crude oil production (inclusive of all other hydrocarbon liquids, such as NGLs, etc.) will peak during 2006-07 at about 81 million b/d, give or take 1 million b/d or so (Fig. 2).

Thereafter, declining production will prove irreversible, and global oil output is expected to fall to about 55 million b/d by 2020 (give or take 3 million b/d).

As can be seen in Fig. 2, non-OPEC output will continue in its current long plateau (just below 50 million b/d) for some years to come, before eventually beginning to dwindle in 2006 or 2007.

On the other hand, OPEC's production peak is likely to occur sometime in the middle of the next decade, well below 40 million b/d—in stark contradiction with all those who wishfully predict an OPEC output well above 50 million b/d and even over 60 million b/d for 2020.

Under no scenario (even the most exotic ones) could the Wocap model be simulated to peak after 2008—a date that really seems to be the ultimate terminus ad quem.

Non-OPEC's new champion

The North Sea—non-OPEC's champion of the 1980s and 1990s—is in full decline at an average rate of around 6%/year. Its total output soon will sink below 5 million b/d and likely will fall to about 3.5 million b/d by 2010.2

In the 21st century, Russia has taken over from the North Sea as non-OPEC's new champion. Unlike the North Sea, however, Russia is not a new province but a very mature one. Moreover, it is a region over which the defunct Soviet Union had ridden roughshod, especially during the 1980s (with the battering of the supergiant Samotlor field a case in point).3

During 2003, Russia achieved an average output of 8,460,000 b/d. The latest Wocap base-case scenario for Russia forecasts an oil production plateau of just under 8.5 million b/d during 2004-06.4 Under no Wocap scenario could Russian output edge over the 9 million b/d mark.

This is in stark contrast with many other forecasts, especially those issued by Edinburgh-based consultants Wood Mackenzie (WoodMac), which sees Russia's crude output going from strength to strength before reaching 10.4 million b/d in 2010.5 WoodMac Director Tim Lambert summarized his consultancy's findings on Russia's future oil production: "Russian production has been growing rapidly in recent years, and many observers consider that it should exceed 10 million b/d in 2010. On an unconstrained basis—assuming that all required investment was put in place—we believe that production could reach 12 million b/d in 2010 and 2011."6

Both Wocap and WoodMac cannot be right, and undoubtedly one is totally wrong. The question remains which one is wrong.

But the Wocap-WoodMac discrepancy is not the only gap on Russian forecasts. Even in the short term, there is an abyss between the prediction of 2.2% growth in 2004 by Russian experts and the 8.6-10% rise forecasted by international analysts, translating into a difference of 550,000-670,000 b/d by yearend.

However, there is little doubt that Russia will be the oil industry's ultimate supply-side litmust test. And this year's output results might settle the short-term (and maybe even long-term) differences once and for all. And it goes without saying that as fares non-OPEC champion Russia, so will fare the whole of non-OPEC in 2004.

OPEC's main pillar

Most of OPEC's stars (e.g., Iran, Kuwait) are not faring well: They clearly have reached the end of their oil capacity tether (a fact readily confirmed by the respective Wocap simulations).7 OPEC's brightest hope, Iraq, is now still in the grip of vicious terrorist attacks—with the development of the supergiant fields of Majnoon, West Qurna II, and Nahr Umar having to wait for calmer days.

But, far more ominous than all these developments, is that OPEC's main pillar, Saudi Arabia, has been the subject of serious doubts.

Saudi Arabia always has stood as the oil industry's symbol: "a supplier for all seasons" and the "producer of last resort," which produced an average of 8,672,000 b/d in 2003 (32.3% of OPEC's total output.)8 Naturally, the Saudi oil miracle was expected to last forever. No one ever dared think the unthinkable.

But, then, on Feb. 24, in a presentation at a conference held by Washington, DC-based Center for Strategic & International Studies, Matthew Simmons, chairman and CEO of Houston-based Simmons & Co. International, predicted that the Saudi oil miracle "would soon come to an end."

And his arguments were built around an ironclad thesis based upon extensive scientific research (and, among many others, some 200 Society of Petroleum Engineers technical papers).

Simmons even questioned the potential of the world's largest oil field and the Saudis' major producer, the awesome Ghawar: "Aramco [the original Arabian American Oil Co.] estimated Ghawar's reserves to be 60 billion bbl in 1975 on the basis of 400 wells and a very clear mapping of the oil-water contact...and with 55 billion bbl now produced, Ghawar is about to become another Brent, Prudhoe Bay, Samotlor, or Yibal.U"9

Now, the terminal decline of Ghawar would signal the beginning of the end for Saudi Arabia's oil. This should trigger alarm bells all over the petroleum industry and even in the general public (who should realize that global oil supplies are not "forever," not even in Saudi Arabia).

It is worth mentioning that Wocap model predictions for Saudi Arabia (up to 2020) are in full consonance with the potential consequences of Simmons's highly rational thesis.

As for Saudi Aramco's defense of its future oil potential, it simply cannot be taken seriously, as it is now highly doubtful that their oil fields can hold their own during the present decade. Some Saudi Aramco officers, such as Mahmoud Abdul-Baqi, vice-president, exploration, and Nansen Saleri, manager, reservoir management, are still sanguine about future potential, as the latter declared: "Saudi Arabia could easily achieve and sustain a production of 10 million b/d through to 2054."10

If Saleri is correct, then Simmons's thesis and the Wocap scenarios are good for history's dustbin; there is an unbridgeable gap between his half a century and a mere decade (at best). But, fortunately, some Saudi officers are much more prudent than their above- mentioned colleagues.

One of them is Saudi Aramco's senior vice-president for exploration, Abdullah Al-Seif, who reportedly told an interviewer in December 2003: "There is a need for 800,000 b/d [of] new capacity to maintain [the] current level of 10 million b/d...[as] the decline in [Saudi] oil fields ranges between 5% and 12%.U"11

Outlook

Wocap's predictions for a global oil production peak of about 81 million b/d in 2006 or 2007 lately have been reinforced by the clouded predicament for the world's two largest producers, Saudi Arabia and Russia.

Should non-OPEC champion Russia stumble, or OPEC pillar Saudi Arabia show signs of falling in step with Simmons's thesis, then Wocap's credibility would be further enhanced.

Already, 2003 (with its myriad of highly favorable signs) proved very propitious for Wocap; 2004 could prove even more so. Wait and see. F

References

1. The latest Campbell estimates for ultimate recoverable reserves can be found at www.peakoil.net.

2. Samsam Bakhtiari, A.M., "North Sea oil reserves: half full or half empty?" OGJ, Aug. 25, 2003, p. 25.

3. See the dramatic Samotlor decline from 3.4 million b/d to 0.4 million b/d in Laherrère, J., "Forecasting future production from past discovery," presented at the OPEC and the Global Energy Balance: Towards a Sustainable Energy Future conference, Vienna, Sept. 28-29, 2001, p. 9.

4. Bakhtiari, "Expectations of sustained Russian oil production boom unjustified," OGJ, Apr. 29, 2002, p. 24.

5. Wood Mackenzie, "Russian Oil: Where are the Real Opportunities?" (2003), summary available at www.woodmac.com.

6. Petroleum Review, November 2003, p. 7.

7. Bakhtiari, "Middle East oil production to peak within next decade," OGJ, July 7, 2003, p. 20.

8. Middle East Economic Digest, Apr. 2, 2004, p. 25.

9. "US Critic Predicts End of Saudi Arabia's 'Oil Miracle,'" Petroleum Intelligence Weekly, Mar. 1, 2004, p. 6.

10. "Saudi Aramco Dismisses Alarm, Highlights Potential," ibid., p. 7.

11. Shirkhani, N., "Saudi drive on to stem oil decline," Upstream, Dec. 12, 2003, p. 19.

The author

Ali Morteza Samsam Bakhtiari (www.samsambakhtiari.com) is a senior expert in the corporate planning division of National Iranian Oil Co., Tehran. He specializes in questions related to the global oil, gas, and petrochemical industries, with special emphasis on the Persian Gulf and the Organization of Petroleum Exporting Countries. Formerly, he lectured on design and economics at the chemical engineering department of Tehran University's Technical Faculty. He holds a PhD in chemical engineering from the Swiss Federal Institute of Technology at Zurich.