ROV operators to earn $9 billion over next 5 years

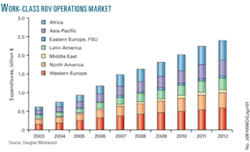

Oil and gas industry expenditure on work-class remotely operated underwater vehicle (ROV) operations is likely to total $1.6 billion in 2008, and the market is set to reach $2.4 billion by 2012, reports energy analysts Douglas-Westwood in a new market study, The World ROV Report 2008-12.

“Both offshore utilization and ROV day rates have increased dramatically over the past 5 years and stand at an all-time high,” said lead analyst Lucy Miller. “In the past year, ROV day rates for Africa, Middle East, and the Caspian have increased by 42%, overtaking Norway, which was, until recently, the most expensive region. Also shortages of skilled operators have caused personnel day rates to grow by 47-50% in those regions.”

The report is based on analyzing underlying demand drivers and ROV operators’ day rates, said Miller. “Although oil prices have fallen of late, this is likely to be a short-lived phenomena as oil companies take a much longer-term view.

“High levels of drilling activity and increased installations of subsea wells, pipelines, control cables, and other hardware are to continue apace as shallow water oil reserves deplete worldwide and deep water increasingly becomes one of the few remaining places where major oil finds can be made,” Miller said. Petrobras’s recent deepwater discoveries off Brazil are evidence of this, she added.

In deep water, ROVs are a key enabling technology for drilling and field development, and increasingly service thousands of existing underwater installations worldwide, she said.

The analysts conclude that over the next 5 years a total of 655 new work- class ROVs must be built to satisfy the dual demands of market growth and attrition within the existing fleet. This compares with 411 over the past 5 years.