OGJ Newsletter

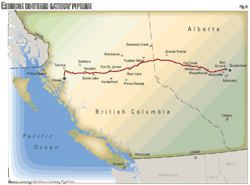

OSHOT: Regulatory delays threaten Keystone XL

Continued regulatory delays could place the proposed 700,000-b/d Keystone XL pipeline in jeopardy, according to Robert Jones, TransCanada vice-president and manager of the Keystone Pipeline project. While speaking to reporters July 20 on the sidelines of the Oil Sands & Heavy Oil Technologies conference in Calgary, Jones said, "US refiners will have to replace the oil they're losing from Mexico and Venezuela and they will do that by whatever means they can."

Jones also noted that TransCanada's Keystone Cushing MarketLink project, delivering 150,000 b/d of oil from Cushing to the US Gulf Coast by 2013, would not proceed without approval of Keystone XL, explaining that the economics do not work for the line as a stand-alone facility.

During his keynote presentation on Keystone XL, Jones described the pipeline as a target for environmental groups who simply oppose oil, noting that building the facilities to export the oil overseas instead, conducting those export activities, and then importing oil by truck, rail, or tanker in the Gulf Coast would have environmental impacts, including greenhouse gas emissions, exceeding those of building and operating Keystone.

Addressing concerns surrounding Keystone XL's crossing of the Ogallala aquifer, Jones noted that there are already 3,500 miles of hazardous liquids pipeline already crossing the aquifer. Keystone XL would cover a 250-mile stretch of Ogallala. Jones cited a University of Nebraska study stating that a leak from the Keystone XL would affect and area "from tens to hundreds of feet around the pipeline" and would not pose a risk to the aquifer. Jones went on to note that the oil transported on Keystone XL would be no different from other heavy oils long-transported through US pipelines and that specifications for the crude were both widely used and broadly disseminated.

Lucian Pugliaresi, president of Energy Policy Research Foundation, emphasized both the potential job creation and the ongoing economic efficiencies Keystone XL would create during his presentation. TransCanada says Keystone XL will create 20,000 direct construction and manufacturing jobs, lead to 118,000 spin-off jobs, and inject more than $20 billion into the US economy. Pugliaresi said savings gained in oil transport and in maximizing the match between Gulf Coast processing capacity and the crudes it could most efficiently process would alone yield $100-600 million/year.

Endeavour to buy Marcellus shale properties

A unit of Endeavour International Corp., Houston, will buy Marcellus shale assets in north-central Pennsylvania from SM Energy Co. for $80 million.

SM Energy is selling its entire noncore leasehold position in the play consisting of 42,000 net acres and pipelines. The acreage has three producing wells that averaged 2 MMcfd of gas equivalent in the quarter ended Mar. 31. Booked reserves were 5.6 bcfe, 50% proved developed, at the end of 2010.

Closing is expected in the last quarter of 2011 retroactive to Apr. 1. SM Energy said the sale brings its 2011 divestitures to more than $1 billion year to date.

ONRR fines Chevron for improper lease deductions

The US Office of Natural Resources Revenue collected a $1.1 million civil penalty from Chevron USA for improper claiming transportation deductions on certain leases it holds in the Gulf of Mexico, the Department of the Interior agency announced.

ONRR cited Chevron for claiming the deductions on certain "Section 6" tracts in the gulf when the leases specifically bar deductions for oil transportation, ONRR Director Gregory J. Gould said on July 20. Section 6 leases originally were issued by the State of Louisiana in the 1940s and retained the terms barring deductions for oil transportation when they were converted to federal leases subsequently, he explained.

ONRR said it denied the deductions Chevron claimed in April 2010. The company did not dispute the order and corrected and repaid the deductions the following month, the agency said. It said that the company claimed such deductions in later months, prompting ONRR to assess the civil penalty. Chevron paid a fine totaling $1,144,500 on July 14 and corrected the inaccurate reports it had submitted, ONRR said.

Large Cris R Massive gas find indicated in Vermilion

A group led by PetroQuest Energy Inc., Lafayette, has made a large indicated gas discovery in the primary Cris R Massive objective in Vermilion Parish, La., just southwest of Tigre Lagoon field.

Due to the projected size of the reservoir, PetroQuest said, it is evaluating a multiwell delineation program to accelerate development of the discovery. The company said it should exhibit a stable production profile analogous to PetroQuest's 2008 Pelican Point gas-condensate discovery farther east.

Petroquest said the well on the La Cantera prospect reached a depth of 18,550 ft and logged 176 ft of highly resistive sand in Cris R. As a result of stuck pipe in the bottom 550 ft of the well, the company was only able to obtain porosity information in the upper part of the logged sands that confirmed 37 ft of net commercial pay.

The company is preparing to sidetrack the well in to evaluate the entire sand package and test other objectives as deep as its proposed true vertical depth of 19,300 ft.

PetroQuest has a 16% net revenue interest, and Stone Energy Corp., Lafayette, has a 33% working interest in the well, also called LaPosada. The companies expect to be able to start production around yearend or in early 2012.

The well is the second discovery Stone has made in the South Louisiana deep gas play following South Erath 5 miles northwest of La Cantera. Stone is participating in another onshore deep gas exploratory test at Lighthouse Bayou in Cameron Parish, La., that is drilling at 20,000 ft enroute to 25,000 ft.

Stone has also identified deep gas prospects on the Gulf of Mexico shelf, where the company is the third-largest lease owner, and is maturing the prospects for its 2012 and 2013 drilling programs.

Danish North Sea has gas-condensate find drilled

A group led by a unit of PA Resources AB, Stockholm, has made a gas discovery at the Broder Tuck 5504/20-4 exploratory well in the Danish North Sea 10 km south of Gorm field.

PA Resources UK Ltd. said the well on License 12/06 went to 3,658 m TVD below mean sea level in Lower Jurassic-Triassic, established a gross hydrocarbon column of at least 230 m, and cut 17 m of net pay in high-quality Middle Jurassic sandstones.

The reservoir was cored, and an extensive wireline log, pressure, and sample suite was taken for future evaluation, with wellsite sample analysis showing the reservoir fluid to be gas with some condensate. A sidetrack will be drilled to assess the potential for additional gas volumes downdip.

Australia western flank multipay oil discovery hit

Drillsearch Energy Ltd., Sydney, has a multipay new oil field discovery at Arno-1 in the Cooper-Eromanga basin western flank oil fairway in PEL 91 in South Australia.

Arno-1 found oil pay zones in the McKinlay, Namur, and Birkhead reservoirs, each well-recognized in the basin. Birkhead is emerging as a leading oil exploration play in the western flank with discoveries just north of Arno-1 at Growler, Wirraway, and Snatcher Fields.

Arno-1 cut a 7.4-m gross oil column in the McKinlay and Namur sandstones at 1,374-81 m and a 6-m gross oil column in Birkhead sands at 1,662-68 m that may be be part of a larger Birkhead channel play fairway. Further tests and evaluation of the three pay zones is required to estimate ultimate recoveries.

A 21-m interval of oil shows at 1,338-59 m was also encountered in the Murta formation which on testing proved tight. With the oil zone now seen in the Murta Formation at Arno-1, this zone may become a focus of future exploratory drilling.

After testing Arno-1, Drillsearch will move the rig to drill the Bauer-1 oil exploratory well 5 km south of Arno-1 and 2.5 km north of Chiton oil field.

Vaalco, Magellan eye Montana Bakken

Magellan Petroleum Corp., Portland, Me., has signed a letter of intent with Vaalco Energy Inc., Houston, to begin developing the Bakken formation and deeper horizons in the East Poplar Unit and Northwest Poplar field in Roosevelt County, Mont.

The LOI contemplates a farmout to Vaalco of an operating working interest in 23,000 net acres of oil, gas, and mineral leases covering the Bakken and deeper formations at Poplar.

Vaalco has agreed to acquire 65% in return for cash and for bearing 100% of the cost to drill three wells by yearend 2012. The parties would then move forward together as 65%-35% owners, respectively, to further develop the prospects.

Magellan will retain its current ownership for all formations above the Bakken, including the currently producing Charles and Tyler formations, where all Poplar 2P reserves are located.

Magellan said the partnership with Vaalco is another step, with a strong and experienced partner, toward monetizing the asset not only from the Bakken but also from the Three Forks, Red River, and associated deeper formations.

Drilling & Production — Quick TakesReport notes Marcellus shale production increase

The Marcellus shale could become the leading supplier of gas in the US within a decade, according to an analysis released July 20 by two researchers from Penn State University and a former Penn State professor now with the University of Wyoming.

The study, commissioned by the Marcellus Shale Coalition (MSC), estimated that Marcellus shale production will average 3.5 bcfd of gas equivalent in 2011 compared with an average 1.3 bcfed in 2010. This includes dry gas and petroleum liquids.

Production at yearend 2010 from the Pennsylvania Marcellus was nearly 2 bcfd, the report said, noting producers are using advanced well stimulation techniques that increased well productivity.

The study, taken in tandem with projections released earlier this year by the US Department of Energy, said the Pennsylvania Marcellus shale has the potential to produce 17.5 bcfd by 2020, which would be about 25% of US gas.

"Just a few years ago, Pennsylvania relied heavily on other states for natural gas to fuel our economy. That dependence is no longer, though, as Pennsylvania is now a net natural gas exporting state," said Kathryn Klaber, president and executive director of the MSC.

The study estimates that by 2020, Marcellus development could support 256,420 jobs and generate $20 billion in added value to Pennsylvania's economy.

Timothy J. Considine, former Penn State professor and now a director of the Center for Energy Economics and Public Policy at the University of Wyoming, wrote the study along with Robert Watson and Seth Blumsack.

Watson is a Penn State petroleum engineer and Blumsack is a Penn State energy economist.

API reports rise in second-quarter well completions

Drilling activity for oil in the US increased in the second quarter, according to the American Petroleum Institute's latest Quarterly Well Completion Report. According to the report, an estimated 6,595 oil wells were drilled during the period.

The report noted that in total, an estimated 10,939 oil wells, natural gas wells, and dry holes were completed, up 14% from second-quarter 2010 and up 46% from second-quarter 2009.

API also reported total estimated footage of 83,093,000 ft drilled in the second quarter.

Lucius field unitization completed in gulf

Anadarko Petroleum Corp. said a unitization agreement was finalized with ExxonMobil Corp. and co-owners for the development of the Lucius field on Keathley Canyon Blocks 874, 875, 918, and 919 in the deepwater Gulf of Mexico.

The Lucius interest owners also entered into an agreement with Hadrian South co-venturers whereby the Lucius facility will process natural gas from Hadrian South field in return for a production handling fee and reimbursement for any required facility upgrades.

"We expect Lucius to be among the most economically efficient projects in our portfolio, while providing important infrastructure in an emerging area of the Gulf of Mexico," said Al Walker, Anadarko president and chief operating officer.

Walker said orders have been placed for long-lead items, including a truss-spar floating production facility with a capacity to process more than 80,000 bo/d and 450 MMscfd of natural gas. He expects the co-owners to sanction the project later this year and production to start in 2014.

A recent extended well test with equipment-constrained rates flowed more than 15,000 b/d of 29° gravity oil, indicating that Lucius can be developed with a minimal number of wells, Anadarko said.

An appraisal well 3,200 ft south of the December 2009 Lucius oil and gas discovery cut nearly three times the pay thickness of the discovery well. The updip appraisal well, drilled to about 20,000 ft in 7,100 ft of water on Keathley Canyon Block 875 encountered almost 600 net ft of light oil pay with additional gas-condensate pay in thick subsalt Pliocene and Miocene sands, Anadarko said (OGJ, Feb. 1, 2010, Newsletter).

On Hadrian South in Keathley Canyon 964, ExxonMobil encountered 200 ft of gas pay in Pliocene sandstone reservoirs while drilling in 2009 (OGJ Online, June 8, 2011).

Oklahoma Springer play yields 60 bcf gas well

The Buffalo Creek 1-17 well in Beckham County, Okla., has produced more than 60 bcf of gas since being turned to sales in December 2002, one of only six wells in the state to have yielded that much gas, said Chesapeake Energy Corp., Oklahoma City.

The well was drilled to 21,000 ft and produces from the Cunningham sand of the Pennsylvanian Springer formation. It averaged 41 MMcfd the first 2 years and still makes 8 MMcfd.

Chesapeake said it is running three rigs drilling for deep Springer gas in the Anadarko basin and believes that its 75,000 acres will accommodate at least 185 more wells.

The Buffalo Creek 1-17 well cost $8.5 million to drill and complete and $1.4 million in operating expenses since then. Gross revenue of $320 million includes $65 million paid to royalty owners and $15 million paid in state severance tax. Net cash flow to the working interest owners totals $230 million or $5.35/Mcfe, or 27 times the drilling/completion cost.

Chesapeake noted that it has been a pioneer deep driller in conventional formations using 3D seismic in the Anadarko Basin.

"The success of the Buffalo Creek 1-17 well initiated a process almost 10 years ago that has now led to Chesapeake owning the largest leasehold position in the Anadarko basin. This industry-leading leasehold position has proved to be exceedingly valuable as unconventional plays such as the Granite Wash, Cleveland, and Tonkawa plays have emerged in areas in and around our traditional strongholds of conventional Anadarko basin production."

Chesapeake said it operates four of the six most productive gas wells ever drilled in Oklahoma.

PROCESSING — Quick TakesIsrael takes emergency measures to shore up supplies

Israel Electric Corp. (IEC), strapped for supplies of natural gas following the recent attack on a pipeline from Egypt, will be allowed to use 500 million new Israeli shekels (NIS) ($145 million) for the purchase of emergency supplies of diesel fuel instead of power lines.

IEC Chief Executive Officer Eli Glickman asked Minister of National Infrastructures Uzi Landau for permission to divert the money to diesel purchases as the utility's own reserves will be used up by end-July. Without additional funding, IEC will reach the limit of its ability to meet electrical demand in August.

Landau originally budgeted the money for the construction of power lines, but he agreed to divert the funding to the purchase of diesel after Gluckman advised that construction of the new power lines could be postponed until 2012.

IEC also wants a similar redirection of NIS 880 million that is currently held by Israel's Public Utilities Authority (Electricity) for the construction of power stations. Additionally, IEC believes it can raise a further NIS 400 million on the capital market. Altogether, IEC will require NIS 3.7 billion in 2011 to purchase enough diesel to replace the shortfall in gas caused by disruptions in deliveries along the line from Al Arish in Egypt to Ashqelon in Israel.

The most recent bombing was the fourth in 6 months, cutting off badly needed supplies during the hot summer months when Israelis' increased use of air conditioning sends electricity demand off the charts (OGJ Online, July 18, 2011).

Shell in biological desulfurization venture

Royal Dutch Shell PLC has agreed to form a 50-50 joint venture with Paques Holding BV, a Dutch water and air purification firm, to market biological desulfurization technology for use in oil and gas operations.

The venture, Paquell BV, is adapting proprietary technology Paques has used since the early 1990s in the water business for atmospheric biogas desulfurization.

The companies said the technology, which uses natural bacteria, can remove hydrogen sulfide from produced gas and refinery gases.

TRANSPORTATION — Quick TakesBP reports pipeline leak in Alaska's Lisburne field

BP Exploration Alaska reported a spill of methanol and produced fluids at the Lisburne oil field on July 16. About 50-100 bbl of a methanol/produced fluid blend was spilled onto a gravel pad and a freshwater tundra pond, according to the company's initial estimates. Lisburne field is part of Prudhoe Bay Unit.

The spilled fluid includes some crude oil although the volume of spilled crude was not immediately available, the Alaska Department of Environmental Conservation (ADEC) said.

"During the Lisburne Production Center annual shut-in, an 8-in. test-header pipeline, with a 100-bbl potential capacity, released in an underground section at a roadway crossing at the L-1 drill site, the ADEC said. "The pipeline is sleeved within a larger pipe structural casing through which the spilled fluids were released at each end. The failure of the pipeline occurred during a leak test intended to check newly install valves."

Pressure in the pipeline reached 949 psi before the leak, ADEC said. Spill responders put absorbent material and boom on the tundra. Vacuum trucks recovered 15 bbl of spilled liquids. There was no ongoing production activity when the leak happened.

Tesoro to move Bakken crude oil via rail

Tesoro Corp. plans to transport crude oil via a dedicated unit train from the Bakken shale formation in North Dakota to its 120,000-b/cd refinery in Anacortes, Wash. Once permits are received, construction of unloading terminals at the refinery could take a year to complete.

Tesoro expects to spend $50 million on this project. Currently, Tesoro's refinery takes delivery of 1,000-2,000 b/d of Bakken crude. Upon completion of the Anacortes rail project, Tesoro expects to deliver as much as 30,000 b/d of Bakken oil to the refinery.

"The high-quality, cost-advantaged crude oil will allow the company to decrease dependence on foreign waterborne feedstocks and declining Alaska North Slope production," Tesoro said in a July 15 news release.

Tesoro executed a long-term agreement with Rangeland Energy LLC for access to Rangeland's crude loading terminal and pipeline facility in Williams County, ND. It will have a direct connection to Tesoro Logistics' High Plains crude oil gathering system, is expected to be in service by the first quarter of 2012.

PTTEP unit confirms plans for floating LNG scheme

PTTEP Australasia confirmed plans to station a floating LNG (FLNG) vessel in the Timor Sea to develop its gas assets. PTTEP AA, a unit of Thailand's PTTEP PCL, also has signed a partnership agreement with SBM Offshore and the Linde Group for the project.

PTTEP AA has submitted documents to the federal government's Department of Environment proposing to develop the gas reserves in Cash-Maple, Montara, and Oliver fields using the FLNG scheme.

Front-end engineering and design work is expected to begin during this year's fourth quarter. The vessel will be able to process 2 million tonnes/year of LNG. A final investment decision is currently timed for fourth-quarter 2012. All going to plan, the vessel would be on station to come on stream in late-2016.

PTTEP AA is considering two options. One would be to relocate the FLNG vessel to each field in turn. The other is to station the vessel at Cash-Maple and connect the other fields to it by subsea lines.

The company says that 11-21 production wells will be needed across the three field areas: 5 wells in permit AC/L7, which contains the Montara group of fields including Swift and Swallow; 3 wells at Oliver in AC/P33; and as many as 13 wells in Cash-Maple in retention lease AC/RL7.

The FLNG vessel will be 400 m long and 65 m wide, designed to withstand severe cyclones. It will be designed for a field operational life of 20 years with the hull structure designed for a life of 30 years.

In the partnership agreement, the Netherlands-based SBM Offshore will contribute its mooring system technology and marine expertise. It also will be involved in the gas processing for the FLNG topsides.

Germany's Linde Group will build the topsides for the floating production, storage, and offloading vessels.

When the project's final investment decision is reached, SBM and Linde will incorporate a special purpose company to jointly construct, finance, own, and operate the FLNG facility. It will then be contracted to PTTEP AA on a lease-and-operate basis.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com