UK tight-gas development in southern North Sea offers basin extended life

Tayvis Dunnahoe

Exploration Editor

Despite the region's maturity, a range of companies continue to explore in the UKCS, taking advantage of the low cost of drilling following the oil price downturn. Tight-gas reservoirs in the basin contain an estimated 3.8 tcf of natural gas, according to a recent report from UK Oil & Gas Authority (OGA). Exploration in the legacy region remains attractive as successful discoveries can be developed via existing platforms.

Technological advances including a combination of horizontal drilling and reservoir stimulation also have enabled operators to exploit tight gas reservoirs, many of which were considered non-commercial at the time of discovery. The southern North Sea has tight-gas fields already onstream, existing discoveries, and some yet to find resources.

Tight-gas strategy

The southern North Sea basin has produced 40 tcf of gas since 1967. The basin produces about 1.3 bcfd using associated infrastructure, offshore compression hubs, export pipelines, and onshore terminals.

Oil & Gas UK commissioned a joint industry project in 2015 to better understand the southern North Sea's remaining potential. The volume of tight gas remaining within or near historic producing fields was a key finding of the study.

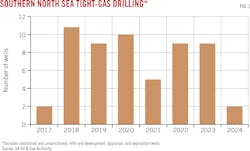

According to the OGA, 60% of undeveloped southern North Sea discoveries and 50% of known prospects in the UKCS are classified as tight-gas accumulations. Based on current gas price projections, OGA expects drilling activity to increase in the short to medium term, including development, exploration, and appraisal wells (Fig. 1).

Southern North Sea

The southern North Sea is one of the more legacy areas in the UK. Many of the basin's older fields are now coming to the end of their life, but tight-gas is prolonging some fields' lives.

"Breagh and Cygnus were not considered commercial at the time of discovery," said Fiona Legate, senior analyst, Wood Mackenzie. Discovered in 1997, Breagh was later developed and started producing in 2013. "There's a second incremental development phase on Breagh which could reach a final investment decision (FID) in 2017, with first production in 2020."

The Cygnus gas field, discovered in 1988, was brought onstream in December 2016. Located in Blocks 44/11 and 44/12, 150 km off the coast of Lincolnshire, Cygnus field was sanctioned in 2012 and has become one of the largest gas developments in the southern North Sea. Cygnus is estimated to contain 650 bcf of recoverable gas.

"Both Cygnus and Breagh fields will continue to provide near-field exploration opportunities in the region as any discoveries could be developed cheaply and quickly via the existing infrastructure," Legate said.

Premier Oil PLC expects to make an FID in first-half 2018 on the Tolmount field, discovered by E.On UK in 2011. Premier gained a 50% stake in the field when it purchased E.On UK's assets in April 2016 for an estimated $120 million. The company also acquired 10 greenfield and six near-field exploration licenses close to Tolmount. The company expects first production in 2020.

"Premier acquiring an interest in Tolmount is a good example of getting assets into the right hands. The new operator has pushed ahead with the development faster than would have happened under the old ownership," Legate said. In May 2017, Premier announced it had awarded Tolmount offshore front-end engineering and development contracts to Wood Group and is looking ahead at two satellite developments, Tolmount East and Tolmount Far East. Tolmount lies 40 miles east of Yorkshire with estimated reserves of 530 bcf.

In October 2016, Independent Oil & Gas (IOG) completed its purchase from Verus Petroleum of the Vulcan satellites, including three fields in Block 49/21a (Licence P039), Block 49/21d (Licence P2122), Block 48/25b (Licence P130), and Block 49/21c (Licence P1915) in the southern North Sea. The fields lie in Permian age Rotliegendes Leman sandstone with reservoir seal provided by the overlying Zechstein evaporates and carbonates.

Vulcan East was discovered in 2006 adjacent to the producing Vulcan field operated by ConocoPhillips. Vulcan North West was discovered in 1987, and Vulcan South in 2000. IOG owns 100% interest and has announced it will submit a field development plan by year-end 2017, make an FID early 2018, and produce first gas in mid-2019.

"Both of these examples represent how new owners can have an appetite to develop existing discoveries which would not have been attractive to the previous owners," Legate said. "The Vulcan satellites have been sitting untouched for years, but in the current cost environment IOG is planning to lock in lower development costs." The development will also create a new hub in the southern North Sea, important given the rate at which mature fields are being decommissioned in the basin.

Eight fields started production in the southern North Sea over the last 5 years. "There is only one proposed exploration well in the southern North Sea this year, near the Sean Area hub operated by Oranje Nassau Energie," Legate said.

Infrastructure, cost constraints

The southern North Sea will undergo more decommissioning as mature fields and infrastructure cease operations. The new hub created by Breagh has pipeline capacity for additional production. "Despite maturing fields and decommissioning, companies are planning to invest in the southern North Sea in the near term," said Legate.

The average size of most pre-FID fields in the southern North Sea is 140 bcf according to Legate. Older discoveries such as Cygnus are larger, at 650 bcf. This range demonstrates the value of smaller-sized, near-field developments in the region. Smaller discoveries can be developed cheaply as tie-backs whereas larger developments create more value and warrant standalone development.

Funding is the biggest risk to southern North Sea developments. Many of the companies in the pre-FID projects are small to mid-size exploration and development firms. Appropriating development funds on schedule can be difficult in a down market.

"Cost structures seen during the downturn are favorable if companies can take investment decisions now to take advantage of lower costs," Legate said. FID delays can in turn delay first-production schedules.

"Smaller companies are looking at using more innovative structures in terms contracting rigs, supply vessels, pipe laying vessels, and service suppliers," Legate said. Tying these expenses to first gas can alleviate some of the upfront cost of getting a field through the development phase, but service and supply companies have been hit hard during the down turn. "Operators may struggle to find companies willing to take on the risk with little or no cash up front." The service sector is stretched now, and has experienced layoffs and in some cases fulfilling contracts on a breakeven basis. "There may be a limited pool of service companies willing to opt for a cost-deferred contract strategy," Legate said.

Northern North Sea

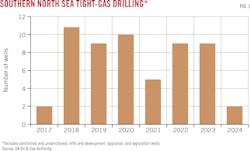

UK OGA is gearing up for its 30th Offshore Licensing Round later in 2017, and East Shetland has garnered attention as being an area with several large discoveries despite being underexplored. The 30th round will focus on mature areas of the UKCS, some of which haven't been offered for licensing in more than 40 years (OGJ Online, June 20, 2017) (Fig. 3). To increase interest, OGA has shot new seismic for several regions including the East Shetland basin.

Kraken field started production in June 2017. EnQuest PLC confirmed the heavy oil field was completed with seven production wells and six injection wells. The production wells are being brought online in phases (OGJ Online, June 23, 2017). "That is one of the first more technically challenging heavy oil fields to come onstream in the northern North Sea," Legate said.

Statoil will bring its heavy oil Mariner field onstream in 2018. These developments combined open up the East Shetland basin for existing discoveries that could be developed through the new hubs and potentially open the region to increased frontier exploration.

"Heavy oil fields are costly to develop and typically have longer lead times," Legate said. "With Kraken on production and Mariner on the way next year, this is a positive time for the East Shetland basin."

Unlike the southern North Sea, majors dominate the northern North Sea and this group has access to more capital. "Near-field exploration wells are cheap to drill in the current environment and discoveries can be tied in to a company's own facilities," Remarked Legate.

EnQuest PLC has drilled the Tyrone and Tiree discoveries from its Kraken hub and there are additional prospects in the area, but no frontier drilling has yet occurred in the East Shetland. "The northern North Sea is a mature area, but we have seen an increase in near-field exploration over the past couple of years," Legate said.

Apache has been drilling near its core Beryl hub, 335 km northeast of Aberdeen. The Beryl field and associated Alpha and Bravo platforms include the Ness, Nevis, Buckland, and Skene fields. The operator has made three discoveries in the last 2 years and is expected to continue near-field exploration.

Four discoveries in the northern North Sea in 2015-16 equaled 100 MMboe. There are three exploration and two appraisal wells planned for 2017 in the northern North Sea. All but one of these are near-field wells-Statoil's Jock Scott-is a frontier well.

Major operators are allocating funds to explore the UKCS, especially in the northern North Sea. "But we feel that it could be a last look around to boost throughput at their existing platforms," Legate said.