IHS Markit: Conventional oil, gas discoveries at 70-year low

Conventional oil and gas discoveries during the past 3 years are at the lowest levels in 7 decades and a substantial rebound is not expected, said IHS Markit in a recent report.

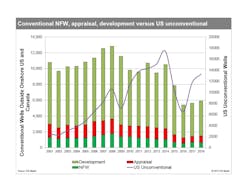

The low levels in discoveries come as a result of a pullback during the past 10 years in the wildcat drilling that targets conventional oil and gas plays—most drastically after oil prices collapsed in 2014. The trends have far-reaching implications that could limit future conventional reserves additions, the report said.

The decline in conventional discoveries was not only driven by low oil prices, but by competition from short cycle-time unconventional projects and by financial investors who question long-term, high-cost frontier projects, the report said. These factors shifted drilling away from areas where potential discoveries could be larger and reduced upstream exploration investment due to concerns about long-term oil demand.

“One of the main drivers here is the shift of investment by US independents from international exploration to shale opportunities in the United States—shorter cycle-time projects—with greater flexibility to respond to changing market conditions,” said Keith King, senior advisor at IHS Markit and a lead author of the analysis. “These operators can quickly turn an unconventional project off and stop or postpone drilling next month if oil prices fall.”

In addition to the overall reduction in conventional drilling, the report identified additional reasons for the modest exploration results in recent years. One of the most telling is that the average discovery size of conventional fields varies greatly with the maturity of the basins being explored.

Basins that are early in their life cycle—the frontier and emerging phases—have average discovery sizes 10 times greater than average discovery sizes made in the later, more mature basins. The average discovery size of these early life-cycle basins is 210 million bbl vs. 25 million bbl from mature basins discovered during the last 10 years.

The analysis also showed differences between average discovery sizes in deep and ultradeep water areas compared with shallow water and onshore discoveries—the former being five or more times greater on average.

Despite the larger discovery size associated with these deeper water and frontier/emerging basins, operators are drilling fewer wells in these areas. In 2014, 161 new field wildcats (NFW, exploratory oil wells drilled in unproven fields) were drilled in deep and ultradeep water; by 2018 that number dropped to 68 wells, IHS Markit said. Drilling in frontier/emerging-phase basins declined by a similar amount.

In the current risk-averse environment, the industry prefers drilling in mature basins near existing infrastructure where operators can bring a project online in 2 to 3 years, IHS Markit said.

“The industry will likely continue to invest more in less costly, less risky, quicker cycle time projects in the onshore and shelf, with deepwater investment remaining constrained,” King said. “There will be areas of intense activity in the deeper water depths and in frontier and emerging-phase basins as well, but overall, these areas will only see incremental gains.”

While some of the larger E&P companies and a few independents with better track records continue to pursue selective deepwater exploration, IHS Markit said, this does not offset the industry trend in the aggregate.

There are other confounding issues that could continue to suppress the discovery of conventional resources, IHS Markit said. First, there are fewer conventional NFW wells being drilled globally—in the US alone, they have declined by 60% since 2009. Second, the percentage and absolute number of these wells drilled in areas with the largest discoveries has declined relative to areas with smaller discovery sizes.

Despite these challenges for conventional activity, there is always some chance that these trends could be reversed, IHS said.

“Lackluster financial returns from unconventional production onshore in North America may drive more operators back to conventional exploration in the longer term,” King said. “Offshore companies have been able to substantially reduce the costs of building and operating offshore facilities necessary to develop resources in deeper waters. This renewed competitiveness could rekindle interest in conventional exploration where larger discoveries are made.”