CCS pipeline projects face state, local regulatory issues

Summit Carbon Solutions LLC, Navigator CO2 Ventures LLC, and Wolf Carbon Solutions US LLC are developing multistate projects in the Upper Midwest which, collectively, would comprise more than 3,600 miles of new pipeline for carbon capture from ethanol plants. About 5,000 miles of pipeline already carry CO2 in the US, primarily linking natural CO2 sources to oil fields in which CO2 is used for enhanced oil recovery.

A still larger pipeline network than the combination of these likely will be needed, however, to meet national goals for greenhouse gas reduction. Federal incentives for building these projects have grown, even while state and local regulatory headwinds build.

Safety regulation

The Pipelines and Hazardous Materials Safety Administration (PHMSA) within the Department of Transportation has statutory authority over CO2 pipeline safety. PHMSA has long regulated the construction, operation, and maintenance of CO2 pipelines (49 C.F.R. §§190, 195-199). However, a 2020 CO2 pipeline rupture in Satartia, Miss., which required a local evacuation and caused 45 people to be hospitalized, has prompted criticism from pipeline safety advocates that PHMSA’s existing regulations for CO2 pipelines are inadequate.

Safety concerns also have given rise to siting opposition among some affected landowners and advocacy groups. In response to these criticisms, and findings from its own Satartia investigation, PHMSA announced May 26, 2022, that it was initiating a rulemaking to update its CO2 pipeline safety standards. The agency plans to publish a Notice of Proposed Rulemaking in June 2024, but has not set a date for a final rule. Some have expressed concern that developers may begin building new CO2 pipelines before a new rule is finalized.

Financial support

The Infrastructure Investment and Jobs Act (IIJA, P.L. 117-58) Section 40304 established within the Department of Energy (DOE) a Carbon Dioxide Transportation Infrastructure Finance and Innovation (CIFIA) program for CO2 pipelines. The act authorized and appropriated $2.1 billion for low-interest CIFIA loans and grants.

Although CIFIA has not yet funded any pipeline projects, analysts expect that developers such as Summit Carbon Solutions would apply for CIFIA funding. President Biden’s FY2024 budget request for CIFIA includes $308 million in direct loan subsidies and $25 million in grants.

The IIJA (Section 40314) also established a DOE program to support regional clean hydrogen hubs; demonstration projects involving clean hydrogen producers and consumers and the connecting infrastructure. Division J, Title III, appropriated $8 billion to support the program.

In September 2022, DOE made a funding opportunity announcement for a first tranche of up to $7 billion to support 6-10 hub proposals that were due by April 7, 2023 (OGJ Online, Dec. 5, 2022). DOE plans to announce the projects selected for award negotiations in fourth-quarter 2023. Although DOE has not publicly released hub-funding applications, several reportedly include carbon capture (e.g., from methane reforming to produce hydrogen) which could require development of CO2 pipelines.

The IIJA (Section 40303) also amended DOE’s existing carbon capture technology program to include support for front-end engineering and design for CO2 transport infrastructure. Division J, Title III, appropriated a total of $100 million for the period FY2022-FY2026.

On May 17, 2023, DOE announced $9 million in funding for three projects “to perform detailed engineering design studies for regional CO2 pipeline networks.” The three proposed networks would be in Wyoming, and along the Gulf Coasts of Texas and Louisiana.

Siting authority

Currently, states have primary siting jurisdiction for CO2 pipelines, although federal approvals may be required for certain pipeline segments (e.g., across federal lands).

The North Dakota Public Service Commission (PSC) last month denied a siting permit for Summit’s 18-million tonne/year (tpy) Midwest Carbon Express CO2 pipeline project. Summit filed an application in October 2022 to build 320 miles of carbon dioxide pipeline in North Dakota. The proposed route of the pipeline would cross parts of Burleigh, Cass, Dickey, Emmons, Logan, McIntosh, Morton, Oliver, Richland and Sargent Counties. CO2 would then be injected into pore space in North Dakota for permanent sequestration (Fig. 1).

In February 2023 the PSC scheduled four public hearings held in Bismarck, Gwinner, Wahpeton, and Linton, ND. To allow additional time for public testimony, another hearing was scheduled for Bismarck and held in early June. These hearings included many hours of testimony and cross examination from intervenors, including those representing landowners.

Those testifying, according to the PSC, expressed broad concerns regarding eminent domain, safety, the policy of permanent CO2 sequestration and storage, setback distances, irreparable harm to underground drain tile systems, impacts on property values, and the ability to obtain liability insurance due to the project. Landowners and intervenors testified that the project would cause adverse effects on the value of their property and residential development projects.

Summit filed a letter from an appraisal company in response to these concerns. However, the filing was not brought forth during any of the public hearings and therefore the commission and intervenors did not have the opportunity to ask questions about the document or question a witness from Summit, the PSC said.

Several landowners testified expressing concerns specific and unique to their properties. According to the PSC, landowners repeatedly testified that they had contacted Summit with requests for reroutes across their properties or other mitigation steps but heard nothing back from the company.

The commission felt that Summit had not taken steps to address outstanding legitimate impacts and concerns expressed by landowners or demonstrated why a reroute is not feasible, and requested additional information on issues that came up during the hearings. PSC said that Summit either did not adequately address these requests or did not tender a witness to answer the questions.

As part of the permitting process, Summit was also required to contact and ask for feedback from 44 different local, state, and federal agencies. A cultural resource report was submitted to the North Dakota State Historical Preservation Office (SHPO). SHPO responded to the report advising that it did not meet their standards and has not received a revised report addressing their concerns. PSC said that SHPO concurrence is commonly required by the commission for issuance of a siting permit.

The US Geological Survey noted 14 areas of potential geological instability within the project corridor. PSC said that Summit had not submitted information to it demonstrating how it has addressed these concerns.

Summit said that it had secured 80% of voluntary easements for its pipeline route in North Dakota, continues to negotiate with additional landowners every day, and is responding to the PSC’s decision. It went on to say that it is looking at its plans again and will address the issues raised, including reroutes, in its reconsidered application. Summit is partnering with 34 Midwest ethanol plants in building its 2,000-mile system.

Another round of meetings occurred in mid-August in Mitchell and Floyd Counties, Iowa, to discuss Midwest Carbon Express. Opponents of the pipeline called on state regulators to delay a final hearing on the project in relation to North Dakota’s rejection of the proposed route.

Summit last year signed an MOU for supply of the project’s compression (OGJ Online, Mar. 31, 2022).

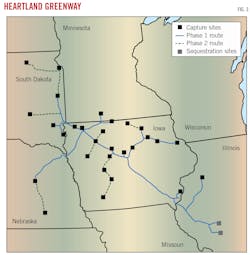

Navigator is developing the 15-million tonne/year Heartland Greenway carbon capture, utilization, and storage (CCUS) system spanning Iowa, Illinois, Minnesota, Nebraska, and South Dakota (Fig. 3). The company earlier this year reached an agreement with Finland-based Puro.earth to validate and certify its carbon dioxide removal credits.

In the meantime, Story County repealed the initial ordinance and changed its rationale for the new action to include maintaining the county’s “rural character” and “historic patterns of development.” Courts have routinely ruled in favor of the primacy of state and federal law in similar cases.

Navigator last year said it plans to begin building Heartland Greenway in second-quarter 2024 for startup in mid-2025 (OGJ Online, Sept. 5, 2022).

The USE IT Act (Section 102 of Division S of P.L. 116-260) clarified CO2 pipeline eligibility for streamlined review of any necessary federal permits which might be required. The law also directed the Council on Environmental Quality to set guidance to expedite CO2 pipeline development. Some analysts have asserted, however, that the absence of overall federal siting authority for CO2 pipelines could be “a significant problem.”

Certain proposals would federalize interstate CO2 pipeline siting, preempting state siting authority, akin to siting for interstate natural gas pipelines under the Federal Energy Regulatory Commission. On May 10, 2023, the Biden Administration urged Congress to “address the siting of...carbon dioxide pipelines and storage infrastructure and provide federal siting authority for such infrastructure.” Some participants may object to federalization of CO2 pipeline siting authority, however, contending that CO2 pipeline development for carbon capture and sequestration (CCS) is relatively new and that there has not been a demonstrated need for federal preemption.

Congressional action

At a March 2023 hearing on pipeline safety of the House Committee on Transportation and Infrastructure, Subcommittee on Railroads, Pipelines, and Hazardous Materials, ranking member Donald M. Payne Jr. (D-NJ) stated, “the safe transmission of carbon dioxide to sequester locations is vital to meeting our carbon reduction goals, and I want to make sure this can be implemented without delay.” In a similar vein, the Senate’s Building American Energy Security Act of 2023 (S. 1399, 118th Congress) would include CO2 transportation projects among those eligible for streamlined regulatory review and would prioritize them as projects of “strategic national importance.”

“In the United States, it often takes between 5 and 10 years—sometimes longer—to get critical energy infrastructure projects approved, putting us years behind allies like Canada, Australia, and more recently the EU, who each have policies designed to complete permitting in 3 years or less,” said Sen. Joe Manchin (D-W. Va.), chairman of the Senate Energy and Natural Resources Committee and sponsor of the legislation. “There is overwhelming bipartisan recognition that our current permitting processes aren’t working, and equally bipartisan support for addressing it through comprehensive permitting reform legislation.”

Given the essential role of CO2 pipelines in CCS systems, economic and regulatory hurdles faced by CO2 pipelines may limit the deployment of CCS. Siting opposition due to safety concerns could prevent CO2 pipeline development in some localities and increase development time and cost in others.

How and when PHMSA will update its CO2 pipeline safety standards might,