Renewable energy key to LNG emissions reduction

Alan Trench

Partners in Performance

Houston

Peter Mann

Partners in Performance

Perth, Australia

Rachel Paulk

Partners in Performance

Houston

LNG producers often focus on reducing venting and flaring as their primary activity in cutting emissions, but using renewable energy to power electrified compressors is just as important. Existing producers can reduce as much as two-thirds of operational emissions through a combination of these two measures. Given the rising demand for LNG for coal replacement and grid reliability, producers should maximize reduction opportunities to better both their emissions intensity and their bottom line. As new LNG projects are advanced, companies aiming to decarbonize by including hybrid renewable energy schemes will secure a competitive advantage.

LNG demand

As the cleanest burning fossil fuel, natural gas can help countries move away from burning higher emitters—specifically coal—without having to overhaul existing power generation or wait for the development of large renewable energy projects.

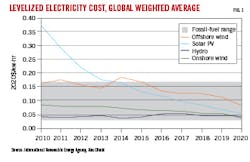

Renewable energy technologies such as onshore and offshore wind turbines, and solar photovoltaics have matured enough to become cost competitive with fossil fuels, becoming a game changer for energy production (Fig. 1). Their cost competitiveness, coupled with the global focus on decarbonization, is driving forecasts for renewable energy to be accountable for almost 95% of the increase in global power capacity through 2026.1

With most of that new generation coming from wind and solar projects, however, intermittency remains a problem. Battery energy storage system (BESS) technology is still maturing, and for many grid operators is prohibitively expensive at the scale required to maintain grid stability during periods of intermittency. Public attitudes towards nuclear energy, which also can mitigate renewable unreliability, remain chilly following high-profile disasters in Fukushima, Japan; Chernobyl, Ukraine; and Three Mile Island, Pa. All of these factors combine to make natural gas—able to provide peaking and flexibility—a highly attractive near-term solution to mitigate the intermittency problems wind and solar pose for grid reliability.

As 2022 began, forecasts on LNG demand already were bullish: LNG demand was forecast to rise 25-50% by 2030,2 and 2022 LNG trade would reach 400 million tons, a 6.6% rise from 2021.3 Regions driving that demand included Asia, where many countries are transitioning from coal, and Europe, which needed to replenish its gas stores after a supply crunch exacerbated by a cold winter season in 2021. Russia’s invasion of Ukraine, however, rendered carefully constructed forecasts moot. European demand for natural gas, typically supplied by Russia, skyrocketed as other supply sources were sought. Unanticipated export opportunities for other producing countries opened up, driving historic demand for LNG.

LNG producers which can demonstrate that they are reducing operational emissions will not only capitalize on this market but will generate positive public sentiment. Further there is very clear business sense in reducing emissions: many reduction initiatives generate positive returns.

Decarbonizing LNG operations

LNG operators have several levers by which to achieve substantial reduction in their emissions, primarily addressing natural gas production and liquefaction processes. Other parts of the value chain, such as shipping and regasification, also present opportunity to reduce emissions.

A comprehensive approach to reducing emissions includes the following steps:

- Establishing an emissions baseline for existing operations and assets, as well as new projects.

- Defining and screening abatement initiatives.

- Developing a business case and roadmap for action.

- Establishing a management framework to monitor performance.

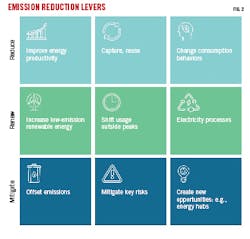

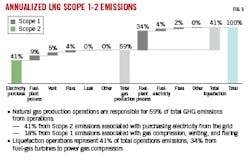

Fig. 2 includes an emissions reduction model based on nine critical levers capturing key areas through which companies can lower energy intensity, renew existing operational models, and mitigate emissions and risks. In a typical LNG production process, gas production accounts for 59% of total annual GHG emissions from operations:

- 41% from Scope 2 emissions associated with purchasing electricity from the grid, which was supplied by coal-fired generation.

- 18% from Scope 1 emissions associated with gas compression, venting, and flaring

Liquefaction accounts for the remaining 41% of total emissions, with the bulk derived from powering gas compressors. Fig. 3 includes a breakdown of these totals, organized by upstream-downstream and delineated by the source responsible for contributing Scope 1 and 2 emissions.

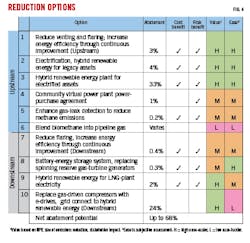

In the example depicted, several opportunities to abate emissions are identified, each of which should be evaluated based on abatement potential and cost and risk benefit, and scored according to overall value and ease of implementation.

Production opportunities

For production assets, the two largest drivers of emissions typically include venting and flaring, and electricity consumption. Continuous-improvement programs help promote sustained measurement and prioritization of asset-integrity issues that lead to fugitive emissions, like degradation of flange joints, valve glands, seals, and trips.

Many existing LNG operators can have a mix of older, legacy sites using fuel gas for compression, and newer sites using electrified compressors. Despite the capital expenditure (capex) required, replacing the legacy gas compressors with electrical compressors, coupled with establishing a hybrid renewable energy plant (gas-wind-solar + battery), often offers an opportunity to reduce operating expenditures for sites not capable of grid connectivity and can lead to a 33% abatement in CO2 emissions (Fig. 4).

Electrification, coupled with renewable energy generation, also can reduce the cost of energy and improve power reliability. One client’s legacy sites had advantageous locations for using wind and solar generation, with gas offsetting any intermittency issues. We estimated these sources could generate enough power to displace 80% of existing gas consumption, allowing for a cost savings and reduction in associated emissions.

For newer upstream assets which are already electrified, grid power supplied from coal-fired generation represents the single largest driver of emissions. In one instance, a behind-the-meter hybrid renewable energy solution, targeting an 80% supply ratio of renewable energy to natural gas, reduced annual emissions by 33% and hedged the risk associated with fluctuating electricity prices. Excess energy can also be sold back to the grid during peak pricing windows, helping further offset any capex.

In addition to implementing changes in operational equipment, LNG producers can leverage three emerging industry trends to stay competitive. The first worth tracking is virtual power plants (VPP). Many industrial customers are well-positioned to leverage a community VPP power-purchase agreement with local stakeholders to supply, offtake, or sell excess power.

VPPs aggregate the capacities of various power generators, flexible consumers, and storage systems. Startups like OhmConnect Energy, Enbala Power Networks, Sunrun Inc., and Tesla Inc. have piloted demand response products competitive with already established offerings from companies such as ABB Group, Siemens AG, and General Electric Co. Utilities in many US states have hosted VPP pilots or introduced incentives to promote greater distributed energy resources from local households. Countries including Australia, Dubai, Finland, Germany, and Japan are piloting VPP programs to improve grid resiliency and quality of distributed power.

Second, a growing wave of private, methane-detecting satellites have been placed in orbit by organizations such as GHGSat, the Environmental Defense Fund (EDF), and a number of startups including Bluefield Technologies, LongPath Technologies, Arolytics, and MIRICO Ltd. GHGSat in 2016 launched the first high-resolution satellite capable of measuring greenhouse gas (CO2 & CH4) emissions from any industrial site in the world, and currently provides leak detection services for supermajors including TotalEnergies SE, Shell PLC, and Chevron Corp.

Oil and gas companies need a proactive strategy to identify and mitigate methane leaks and utilizing this type of capability will be critical for staying out of the crosshairs of environmental activists—who are already using this data to target companies—and governments, many of which signed the COP26 Global Methane Pledge.

Lastly, if the quality of natural gas is high enough, opportunities can exist to produce renewable natural gas by blending in biomethane. This offers dual benefits: first, increasing the gas supply below market price, and second, reducing Scope 3 emissions from fuel usage. Biomethane represents a global, growing opportunity; the US has more than 2,200 sites producing biogas, and Europe has in excess of 10,000 operating digesters.4

Liquefaction opportunities

Simply improving existing business processes across sites can help capture sizeable abatement potential, without requiring capital expenditure towards new equipment or assets. Oil and gas companies have achieved a ~15% reduction in emissions through focused continuous improvement, which generally is paid for by gas saved.

For one of our clients, reducing fuel-gas consumption by replacing spinning reserve gas-turbine generators with battery storage represents an abatement potential of 0.3%/year. While implementation costs for the BESS would be millions of dollars, overall net present value for the project would breakeven, while also allowing for a reduction in emissions.

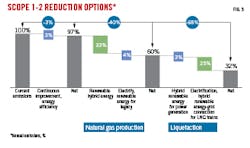

Replacing part of gas-fired power production with a hybrid gas-wind-solar plant represents a 3% abatement opportunity and also leaves more gas available for sale (Fig. 5). Hybrid renewable energy plants may require financing using low-cost third-party funding rather than upfront capex.

With most emissions in LNG plants generated by gas combustion to power refrigeration compressors, use of electric drive (e-drive) train technology both frees up gas and significantly reduces emissions, if coupled with renewable-sourced power. Given the scale of load, however, grid connection is still typically advised to mitigate outages.

Equinor ASA’s 7.6 billion cu m/year (bcmy) Hammerfest LNG plant on Melkoya Island, Norway, commissioned in 2007, was one of the first to feature e-drives. Freeport LNG Development LP followed in 2014, installing the first e-drive in the US (and largest globally) at its 20-bcmy plant on Quintana Island, Tex. Freeport LNG credits the e-drives with reducing emissions, allowing shorter restarts, increasing operational flexibility, and improving year-round efficiency and production.5

References

- International Energy Agency, “Renewables 2021,” Dec. 1, 2021.

- Morgan Stanley, “LNG as the world transitions to Net Zero,” Oct. 24, 2021.

- BloombergNEF, “Gas & LNG – 10 Predictions for 2022,” Jan. 27, 2022.

- World Biogas Association, “American Biogas Council Announces the Eight Fastest Growing Biogas Businesses,” Mar. 15, 2021.

- Vara, R.R., Goodwin, L., Schmidt, W.P., and Saunderson, R.P., “Freeport LNG’s Lessons Learned from All-Electric LNG Liquefaction Trains Start Ups,” Gastech Exhibition & Conference, Dubai, Sept. 21-23, 2021.

The authors

Alan Trench is a director with Partners in Performance with 30 years of experience in the oil and gas industry. He has held executive positions at TotalEnergies SE and Schlumberger Ltd, and worked at McKinsey & Co. serving global oil and gas clients. His experience includes working onshore and offshore in Azerbaijan, Argentina, Brazil, Malaysia, UK, and the US, serving clients such as bp PLC, Shell PLC, Petronas, ConocoPhillips Co., TotalEnergies, and Petrobras. He has an MBA from the University of Texas at Austin’s McCombs School of Business and a BBA from Pontificia Universidad Católica Argentina.

Peter Mann is a director with Partners in Performance with 25 years’ experience across a wide range of industries including mining, oil and gas, energy, transport, financial services, agribusiness, the Australian Football League, and Cricket Australia. He has conducted energy and GHG strategy reviews for oil and gas majors, power utilities, large miners, and renewable energy companies. He holds an MBA from Melbourne Business School and a BE from the University of Western Australia.

Rachel Paulk is a manager with Partners in Performance and has more than 10 years of experience in energy consulting. Her experience includes supporting oil and gas clients in the Permian basin, as well as extended assignments promoting energy-sector resilience in Jamaica, Nigeria, and Hawaii. Before Partners in Performance, she held roles with Deloitte and Booz Allen Hamilton. Rachel holds a master’s degree from Columbia University’s School of International and Public Affairs, New York, NY, and an Honors BA from Rollins College, Winter Park, Fla. She is also a certified business energy professional with the Association of Energy Engineers (AEE).