BP: Oil prices have support level of $30/bbl for Brent

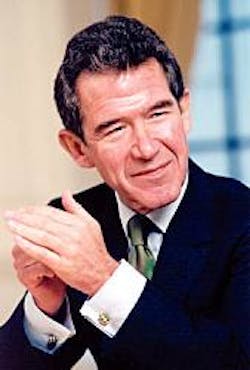

Oil prices apparently have a support level of $30/bbl for North Sea Brent crude, based upon their recent record and the world supply-demand balance, BP PLC Chief Executive John Browne told reporters Oct. 26 in London.

He sees the $30/bbl support level "for at least the medium term" in discipline by the Organization of Petroleum Exporting Countries and in the needs of members for revenue.

"The recent surge in the oil price above $50/bbl has raised many questions about future prospects and whether or not there has been some fundamental change in the oil market," Browne said.

In the 1990s, the Brent oil price averaged $18.50/bbl, with temporary spikes above $20/bbl. The price was closer to $10/bbl toward the end of that decade, he noted.

"The price only began to diverge from that $18 average after April 2000 when OPEC established a target price band of $25/bbl—plus or minus $3/bbl—for the OPEC basket," Browne said.

"From then until the end of 2003, the OPEC basket price averaged $26/bbl, with Brent prices about $1/bbl higher than that," he said. OPEC adjusted production to keep the basket price within its target band.

2004 prices

Browne called 2004 "an exceptional year for the oil price," which has set records in nominal but not in inflation-adjusted terms. The reason is demand growth.

During the late 1990s and early 2000s, global oil consumption has risen at about half the rate of economic growth. In 2004, the growth rates will be much closer, Browne said: 3.4% for oil consumption and 4% for worldwide gross domestic product.

"The most important driving factor behind this shift appears to have been the demand for energy-intensive products in China in particular," he said. "Oil production has responded to this demand, and despite disruptions in one location or another, supplies have been maintained."

Worldwide crude oil production is expected to grow by 3.4 million b/d in 2004, which would be the fourth largest annual rise in history.

OPEC production is close to an all-time high, and non-OPEC oil production continues to expand. During 2000-03, non-OPEC production increased by 1 million b/d/year, outpacing demand growth by 100,000 b/d each year.

Browne said: "In spite of this large rise in supplies, oil prices have risen. To some degree this is because the rapid recent rise in demand has eaten into global spare oil production capacity, now estimated to be 1 million b/d, compared with an average over the last decade of 3 million b/d.

"As spare capacity has reduced, prices have responded to demand in a more sensitive way. Prices also appear to contain a risk premium stemming from concerns over a variety of security issues, which might affect production."

Oil price prospects also depend on the future strength of supply, demand growth, OPEC politics, and perceptions of risks to political stability in the key producing areas.

Production rates

Outside OPEC, Russian production growth is expected to continue but probably more slowly than in the past few years. Elsewhere, output probably will increase in Azerbaijan, Angola, and the Gulf of Mexico. Those increases will be partially offset by declines in the North Sea and other parts of the US.

"For the next 3 years, this net growth is estimated to be around 1 million b/d each year—broadly similar to the average increase over the last 5 years," Browne said.

OPEC's crude oil production capacity is expected to grow and to be supplemented by increased output of natural gas liquids. Robust oil prices have stimulated exploration and production investment worldwide.

"For the top 30 publicly traded companies, investment levels have risen from a low point of $62 billion in 2000 (following the period of very weak prices) to $98 billion in 2003, a growth rate of more than 15%/year," Browne said. "We are likely to see further growth in 2004. All of this supports the expected expansion of non-OPEC production."

Demand will determine spare capacity levels. If demand growth were to return to the historic average of 1.3 million b/d/year, global spare capacity could return to 3 million b/d by 2008—assuming no further geopolitical or other disruptions.

If demand continued to grow at this year's rate, the world would have no spare capacity, Browne said.

"These numbers appear rather precise, but of course there are still uncertainties as to the growth in supplies from both OPEC and non-OPEC producers," he added.

Prices could spike above the $30/bbl support level if demand strength outpaces the rate at which additional production capacity comes on stream each year.

"As far as BP is concerned, we will continue to use a Brent oil price of $20/bbl for the purposes of planning our activity levels in the E&P sector. This allows us to maintain a portfolio of activities with strong returns," he said.